[ad_1]

What’s Public Provident Fund?

The Public Provident Fund (PPF) is a long-term financial savings instrument established by the central authorities. It provides tax advantages on contributions in addition to withdrawals after the lock-in interval. This scheme got here into drive on July 1, 1968, and is backed by the federal government with the target to supply old- age earnings safety to the self-employed and people working within the unorganised sector. Although the scheme is voluntary, assured returns and income-tax advantages have fuelled its recognition.

Options of PPF

- Eligibility: You should be a resident Indian.

- Entry age: No age is specified for account opening.

- Investments: Minimal: Rs 500 every year. Most: Rs 1.5 lakh every year. Funding may be made in lump sum or instalments in a number of of Rs 50. No restrict on the variety of instalments in a monetary yr (earlier it was 12).

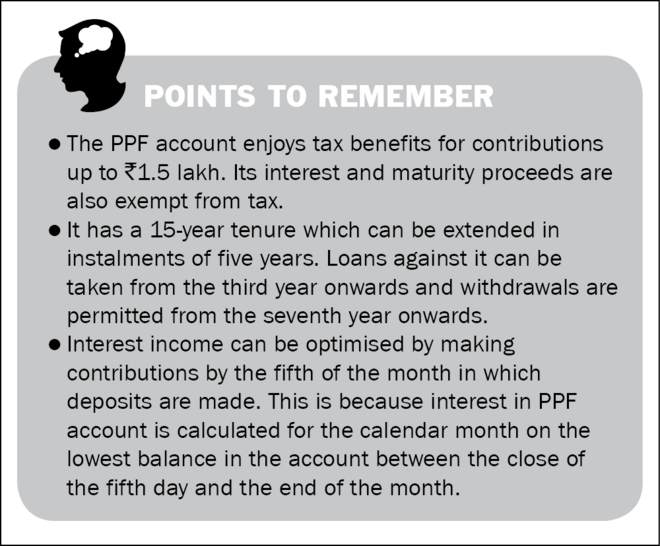

- Curiosity: 7.10 per cent compounded yearly. The curiosity shall be calculated for the calendar month on the bottom stability within the account between the shut of the fifth day and the tip of the month.

- Tenure: 15 years. On completion of 15 years, the account may be prolonged with or with out deposit in a block of 5 years at a time. There is no such thing as a restrict on the variety of extensions. Nonetheless, as soon as the PPF account is sustained with out deposits for greater than a yr publish maturity, then the account holder can’t make deposits within the subsequent years. The PPF account matures after 15 years however the contribution needs to be made for 16 years in all. It is because the 15-year interval is calculated from the tip of the monetary yr through which the account is opened. Successfully, the PPF account matures on the primary day of the seventeenth yr. Nonetheless, it may be prolonged indefinitely for 5 years at a time.

- Account-holding classes: Particular person and minor (by the guardian).

- Nomination: Facility is on the market.

- Exit possibility: Untimely closure of a PPF account just isn’t permissible besides within the case of the demise of the account holder or after completion of 5 years from the tip of the monetary yr through which the account is opened if the cash is required for the therapy of a essential sickness or to fund larger schooling.

Funding goal and dangers

The first goal of saving within the PPF account is to avail tax deductions on deposits, assured returns on funding and tax-free withdrawal on the maturity. Financial savings on this product are fully risk-free due to the federal government backing.

Suitability and alternate options

- Appropriate for risk-averse buyers in search of assured returns by investing repeatedly for long-term objectives, that are 15 or extra years away.

- Not appropriate for buyers who can assume some threat by investing in equity-linked investments, which may generate a lot larger returns in a 15 yr interval.

- Alternate options may be NPS (for retirement financial savings) and Tax saver fairness mutual funds (ELSS)/ Direct inventory investing (for many who can assume threat).

Capital safety and inflation safety

The capital in a PPF account is totally protected, because the scheme is backed by the Authorities of India, making it totally risk-free with assured returns. The PPF account just isn’t inflation protected, which suggests every time inflation is above the most recent assured rate of interest, the deposit earns no actual returns. Nonetheless, when the inflation fee is beneath the assured fee, it does handle a constructive actual fee of return.

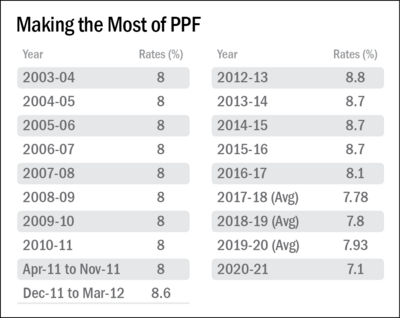

Ensures

Rates of interest are aligned with G-sec charges of the same maturity, with a variety of 0.25 per cent. The federal government has determined to evaluate the PPF charges quarterly. For the second quarter of FY21-22, the speed has been set as 7.10 per cent compounded yearly.

Liquidity

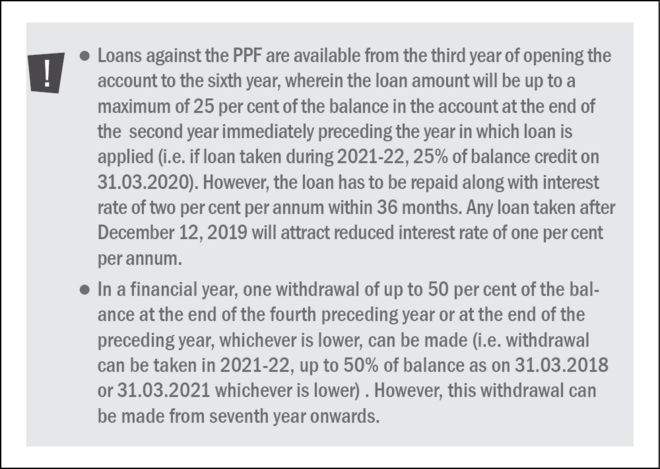

The PPF is liquid, regardless of the 15-year lock-in stipulated with this account. Liquidity is obtainable within the type of loans in opposition to the PPF from the third yr and withdrawals are topic to situations from the seventh yr.

Additionally, it’s now potential to shut your PPF account pre-maturely at a penalty of 1 per cent on the curiosity. Nonetheless, it may be achieved solely after 5 years from the tip of the monetary yr through which the account is opened, offered the cash is required for the therapy of significant illnesses of the account holder, partner or dependent kids, for the upper schooling of the account holder or dependent kids or change in residency standing to NRI.

Tax implications

The scheme has the exempt-exempt-exempt (EEE) standing, the place the deposits, the curiosity earned in addition to the maturity quantity are tax-free.

The sum invested within the PPF account is eligible for tax deduction below Part 80C, topic to a most of Rs 1.5 lakh in a monetary yr. On maturity, all the quantity, together with the curiosity, is tax-free.

The place to open an account

You’ll be able to open the account at numerous locations resembling:

- Any head publish workplace or normal publish workplace.

- Branches of nationalised banks: State Financial institution of India, Financial institution of Maharashtra, and so forth.

- Personal-sector banks: ICICI Financial institution, Axis Financial institution, and so forth.

The way to open Public Provident Fund

Location to open an account, you’ll need the next paperwork:

- An account-opening type.

- Two passport measurement images.

- Aadhaar card. Within the absence of the identical, you’ll want to present a duplicate of the acknowledgement of your Aadhaar software.

- Tackle and identification proof, such because the Aadhaar card, passport, PAN (everlasting account quantity) card or declaration in Type 60 or 61 as per the Revenue-Tax Act, 1961, driving licence, voter’s identification card or ration card.

- Carry the unique identification proof for verification on the time of account opening.

- Select a nominee.

The way to function a PPF deposit

- You want a pay-in slip with the preliminary account-opening sum to be credited to your account.

- You get a PPF passbook together with your picture affixed, stating the nominee’s title.

- You can even handle your PPF account on-line through web banking.

To view the present charges on the schemes, go to vro.in/s34211

[ad_2]

Source link