[ad_1]

Lately I received a name from an insurance coverage firm gross sales executives they usually tried to promote me an insurance coverage coverage which they mentioned had Assured 11% returns.

The coverage was Reliance Nippon Life Assured Cash Again Plan

I knew that there’s absolutely some catch and they’re form of misselling me, I didn’t know what precisely it was. So I made a decision to dive deeper and discover out extra.

After I requested them robust questions, and as soon as they realized that my information about this stuff is way more than a mean uninformed investor, they had been able to mail me from their official e mail id about what I’ll get. Lastly, I solved the thriller like CID and instructed them the coverage has only a 4.6% return and never 11%.

Do watch the video under to rapidly perceive the entire sport.

Assured 11% returns

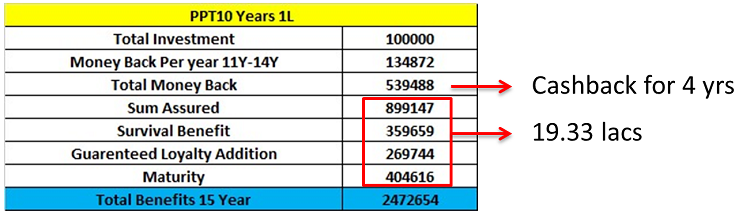

So after I received this gross sales name, a woman instructed me that this was a 15 yrs plan, for which the premium cost time period is simply 10 yrs. I must pay Rs 1 lac for 10 yrs and I’ll get a complete cost of Rs 24.72 lacs in direction of the top and the return seems to be 11% IRR

This sounds fairly engaging and anybody who will not be proud of the FD returns today will get attracted fairly quick.

Right here is the breakup of the quantities she instructed me I’ll get in 15 yrs

I instructed her to ship me an illustration and she or he did that after a while (here’s a PDF Copy)

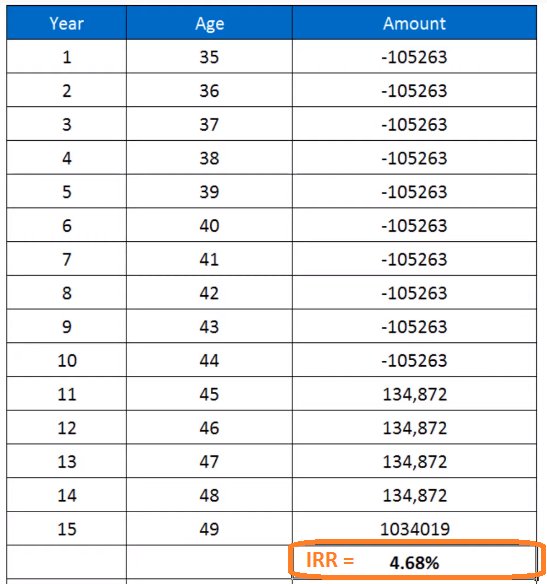

Once I noticed the illustration, I noticed that the premium was not Rs 1 lac, however it was Rs 1,05,263. That is the very first thing that she by no means knowledgeable me of. So as an alternative of 1 lac, the outgo from traders pocket is Rs. 1,05,263!

Once I appeared deeper, I discovered that few numbers she instructed me over the telephone are seen within the illustration, however the quantity of Rs 8,99,147 was lacking from the illustration. This was the SUM ASSURED quantity.

She had talked about to me on name that we are going to get this sum assured quantity additionally, however the illustration had no details about it.

This was the Catch

So after I requested them – “Why is the sum assured not within the cost part?, you instructed me that I’ll get that additionally”

To this one of many seniors instructed me that it’s not within the illustration, however I’ll get it as a result of “Sum Assured is all the time paid within the coverage”. I instructed him that it’s paid when an individual dies, however the place is it written that I’ll get the sum assured quantity other than the opposite numbers he had talked about” for which he didn’t have a transparent reply.

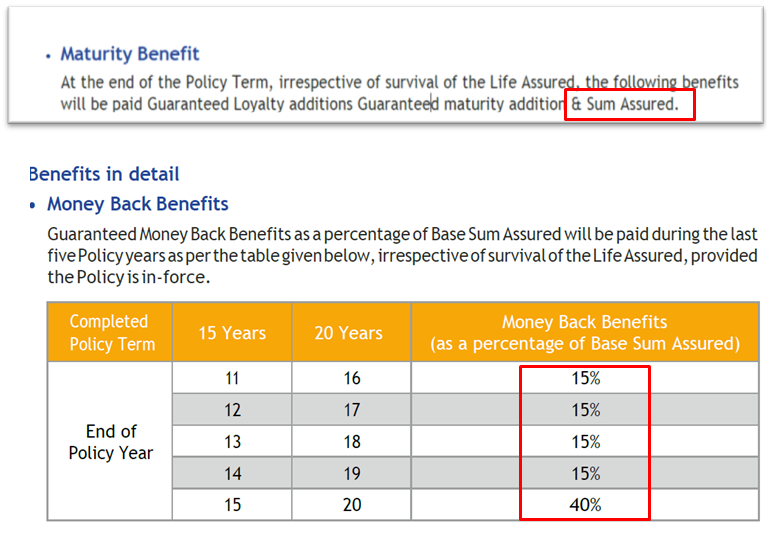

The gross sales man stored telling me I’ll get it and eventually, he instructed me that it’s talked about within the coverage brochure. Once I appeared on the coverage brochure, it was talked about that it paid

however… however …however it paid in installments and THAT WAS THE CATCH

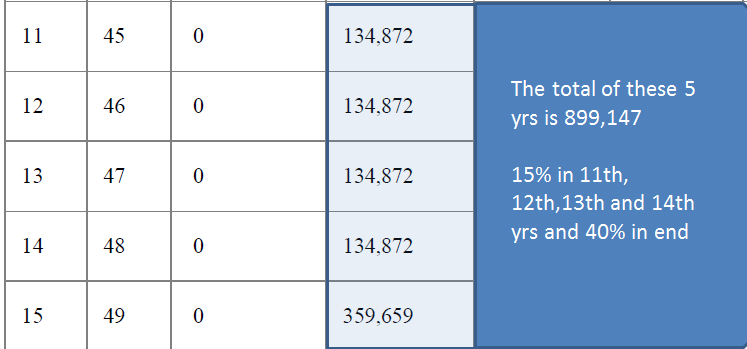

The sum assured is given to you in small elements in 12 months eleventh, twelfth, thirteenth, 14th, and eventually in fifteenth 12 months. So it’s already paid to you which you’ll be able to see within the picture under.

Nevertheless these guys had been counting the sum assured once more after they instructed me concerning the plan over the telephone and that’s the explanation they let you know that you’re going to get a really large quantity, which you’ll NOT!

They’re simply counting the identical factor twice within the profit and they aren’t even mendacity after they say that they’ll mail you that you’re going to get “sum assured” on this coverage since you are GETTING IT!

Are you getting the entire sport? They’re simply saying the factor in an incomplete approach and twisted format.

To correctly perceive the small print, do watch the video above

This was a catch which many of the traders usually are not capable of catch and consider the gross sales name.

In addition they don’t discover any mistake or bluff and although they’ve heard that a number of misselling occur within the insurance coverage sector, they nonetheless go along with these insurance policies.

IRR returns of simply 4.65% as an alternative of promised 11%

Once I calculated the IRR of the coverage with the proper numbers, the IRR turned out to be simply 4.65% reasonably than the 11% they claimed over the decision.

Conclusion

Don’t fall for this type of insurance policies which doesn’t clearly give full data on the returns and is just too difficult to grasp. They’ll attempt to persuade you by saying issues like they are going to e mail you from their official e mail id as a result of they’ve discovered that individuals have discovered from earlier missellings of ULIPS and so forth the place nothing was given in writing and if they are saying one thing like that, it is going to look very belief worthy!

Simply keep away from it.

To your insurance coverage wants, take a plain vanilla time period plan and in your investments do put money into pure investments merchandise like shares, PPF, mutual funds, financial institution FD’s, NPS, and so forth, and hold issues easy.

[ad_2]

Source link