[ad_1]

Information launched on Friday confirmed that top UK inflation is hitting retail gross sales, enterprise exercise and client confidence, strengthening predictions of an financial recession this 12 months.

The quantity of retail gross sales in Nice Britain fell for the second consecutive month in June as excessive inflation pushed shoppers to tighten their belts.

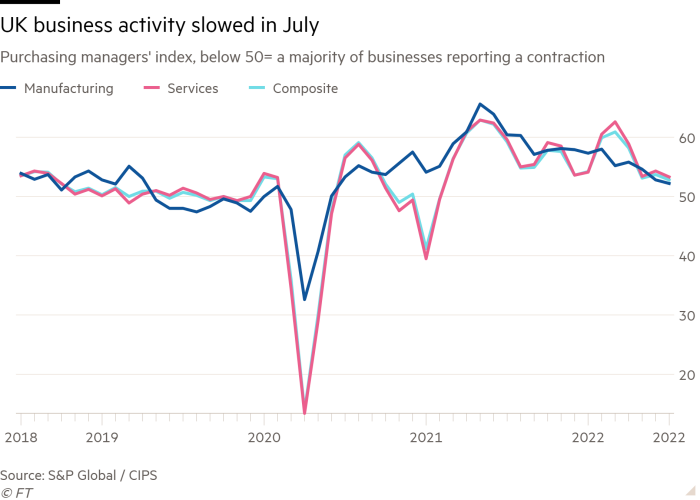

A carefully watched survey confirmed that enterprise exercise slowed in July to its weakest tempo for the reason that Covid pandemic lockdown of early 2021 as excessive inflation hit demand.

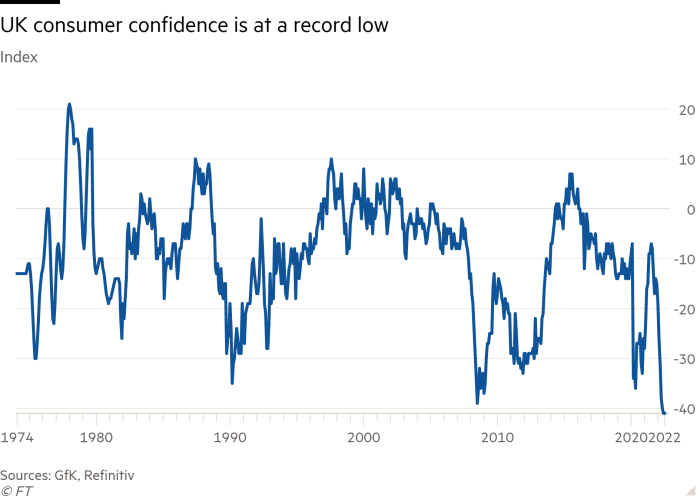

Furthermore, analysis firm GfK revealed that UK client confidence remained at minus 41 in July, the bottom since data started in 1974.

The info underscored the impression of surging inflation — which hit a 40-year excessive of 9.4 per cent in June — on family funds and enterprise exercise.

Joe Staton, shopper technique director at GfK, mentioned confidence was “severely depressed this month because the impression of hovering meals and gasoline costs and rising rates of interest continues to darken the monetary temper of the nation”.

The amount of products purchased in Nice Britain fell 0.1 per cent from the earlier month — the second consecutive decline — however shoppers spent 1.3 per cent greater than in Might attributable to rising costs, based on information from the Workplace for Nationwide Statistics.

Beforehand, progress within the quantity and worth of retail gross sales has been related, however since February the distinction between the 2 has been greater than 1 share level as inflation has lowered what individuals should buy with their cash.

Recorded purchases have been declining or stalling since October final 12 months, as gross sales progress volumes have been revised down in current months. The figures don’t embody spending in bars and eating places.

Heather Bovill, ONS deputy director for surveys and financial indicators, mentioned the pattern for retail gross sales “is considered one of decline”.

Meals gross sales ticked up 3.1 per cent as a result of Queen’s jubilee celebrations in early June — the one sector to report a rise. In distinction, gross sales of fuels, clothes and family items fell sharply with retailers suggesting shoppers had been reducing again on spending attributable to greater costs.

This comes as an ONS survey, printed on Friday, revealed that half of the inhabitants reported shopping for much less meals within the first half of July on account of hovering costs.

The survey discovered that almost half of the inhabitants discovered it tough to pay for his or her vitality payments and a couple of in 5 have needed to borrow cash or take out credit score prior to now month in contrast with final 12 months.

The hit to households was mirrored within the month-to-month S&P International/CIPS buying supervisor survey which confirmed the flash composite output index dropping to 52.8 in July from 53.7 in June and the bottom studying since February 2021.

Chris Williamson, chief enterprise economist at S&P International Market Intelligence, mentioned: “UK financial progress slowed to a crawl in July.” He added that forward-looking indicators prompt that “worse is to return”.

Manufacturing order books deteriorated for the primary time in a single and a half years. Output was dragged down by capability constraints arising from shortages of supplies and workers.

Nonetheless, the survey additionally pointed to some softening in enter price stress. Paul Dales, economist at Capital Economics, predicted inflation would result in a 3 per cent fall in actual family disposable incomes this 12 months and one other 2 per cent decline subsequent 12 months. “In consequence, a recession now feels inevitable,” he mentioned.

Regardless of faltering demand and early indicators of easing prices, James Smith, economist at ING, expects the Financial institution of England to lift charges by 50 foundation factors at its August assembly, after 5 consecutive 25 foundation factors will increase.

GfK’s Staton mentioned the following prime minister might want to ship “a much-needed shot within the financial arm of the nation if they’re to assist enhance client confidence”.

[ad_2]

Source link