[ad_1]

Final week, Indian rupee weakened by 47 paise as importers rushed to cowl their greenback payables. It opened across the 73 mark, and step by step misplaced floor in opposition to the US greenback to the touch a low of 73.87 earlier than bucking the pattern on Thursday to finish at 73.50. Together with the demand from the importers, short-covering by merchants on the key psychological stage of 73.00 pulled the native foreign money decrease. The open curiosity of USD-INR 28 Sept futures contracts has diminished to 16,46,460 contracts on 09 Sept from 20,02,799 on 31 August, in keeping with the information from NSE.

Persistent power within the US greenback in opposition to developed and rising currencies had additionally constructed strain on the Rupee. The US greenback index which tracks the buck in opposition to a basket of its friends, bounced again from 92.10 to 92.86 earlier than retreating to round 92.64 stage on Friday in per week by which the European Central Financial institution (ECB) determined to decelerate its Pandemic Emergency Buy Programme (PEPP) valued at 1.85 trillion euros whereas retaining the rates of interest unchanged.

The 25 member ECB Governing Council took this determination, retaining in thoughts the decade-high inflation price and the reasonable restoration in progress. Though it offered no numerical steering for the subsequent quarter, the market’s expectation ranges from web purchases of 60 to 70 billion euros as in opposition to the present tempo of 80 billion euros a month with flexibility to regulate the quantity relying on market situations.

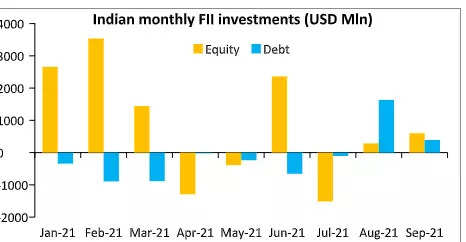

The rupee is additional anticipated to take advantage of Greenback inflows into the home market however they will not be as sturdy as seen within the latest previous. The cautious tone adopted by FPI as a result of lofty valuations and an overstretched rally within the international and Indian fairness markets that are buying and selling close to all occasions highs additionally led to the slowdown in greenback inflows to India.

Regardless of diminished inflows into the fairness markets, the native debt markets have acquired a sizeable quantity of funding. This could be due to the carry commerce play because the buyers are elevating the cash from low-interest charges markets (developed) and investing within the high-interest charges (rising) markets like India. By the way, fund managers are additionally getting ready for a good credit score market within the coming days as the worldwide central banks making floor for bond buy tapering.

FII knowledge additionally means that a big a part of latest rupee beneficial properties over the past week of August was because of the mammoth of inflows seen within the Indian Debt Market.

In the course of the coming week, the inflation and retail gross sales numbers from the US can be carefully watched. The month-on-month inflation numbers from the US has shocked the market contributors in 4 out of 5 earlier months however the retail gross sales knowledge missed the expectations in August, which could be largely attributed to the rising variety of delta variant instances.

Nevertheless, the important thing spotlight of the month would be the FOMC assembly scheduled on 21-22 September because the market will likely be on the lookout for additional cues on the timing and quantum of Fed tapering.

Thus, the varied components supporting the rupee could be attributed to the sturdy influx pipeline on account of IPOs, sturdy vaccination drive together with the continuation of the FOMO rally and exporter promoting at greater ranges. However, components comparable to slowing FPI flows in secondary markets, rising likelihood of a 3rd wave and a rally in US treasury yields will work in opposition to rising market currencies just like the rupee.

Additionally, the persistent build up of FX reserves by RBI will forestall vital rupee appreciation from the present stage. This can be witnessed by the rise in FX reserves by $8.895 billion in the course of the week ended on 03 Sept 2021 to a document excessive of $642.45 billion.

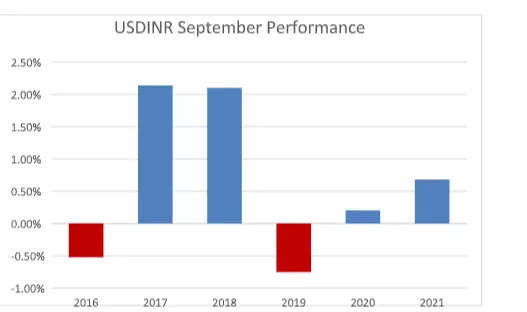

As evidenced within the above chart, within the month of September rupee has depreciated thrice within the final 5 years, whereas it has appreciated solely twice over the identical interval. Apparently, the common rupee depreciation is roughly 1.5% (2017, 2018, and 2020) whereas the common rupee appreciation is comparatively lesser at 0.60% (2016, 2019). The best way issues are stacked up, it shouldn’t be shocking if the rupee ends round 1,5% decrease this yr too in the course of the month.

For the approaching week, a muted begin could be anticipated in USDINR and it’s prone to transfer within the vary of 73.30 – 74.20 ranges with an upward bias. Final however not least anticipate the USD-INR pair to embrace extra volatility within the days forward.

(The authors, Ritesh Bhansali and Imran Kazi are each V-Ps in Mecklai Monetary. The views are their very own)

[ad_2]

Source link