[ad_1]

A looming recession, runaway inflation, an power disaster in Europe and a euro that is sunk to close parity with the greenback: company earnings worldwide face a laundry checklist of challenges this season that might create one more reason to dump shares.

After a tumultuous first half for international equities, with $18 trillion in worth worn out, traders are anxious to see if earnings are holding up or if firms will lower steerage amid the intensifying threats to demand. Companies could use the dour financial image to be much more conservative than in any other case concerning the future.

In an uncommon divergence of opinions, Wall Road analysts seem to imagine firms are largely in a robust place to move on increased prices to shoppers, however strategists — extra cautious after getting their forecasts for 2022 fallacious to this point — aren’t satisfied. They’ve loads motive for doubts, with the macroeconomic backdrop deteriorating amid surging costs, increased rates of interest and decrease shopper confidence.

“It is weird that when everyone seems to be speaking of a possible recession, analysts’ earnings forecasts have been going up in the previous few months as a substitute of down,” stated Anneka Treon, managing director at Van Lanschot Kempen. “It simply would not add up and that is why this earnings season is so vital when it comes to revenue margins and administration commentary on the most recent demand developments they’re seeing.”

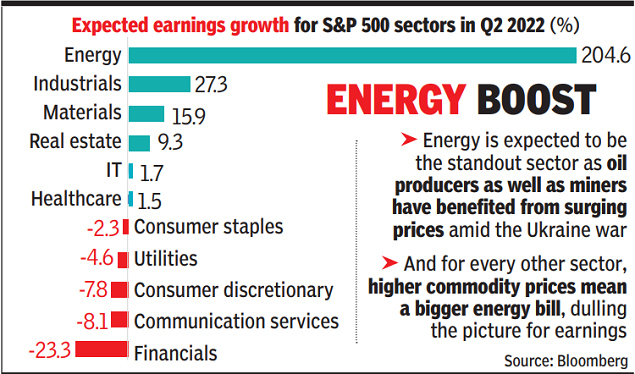

Power is anticipated to be the standout sector as oil producers in addition to miners have benefited from surging costs amid the struggle in Ukraine. Nonetheless, steerage from giants resembling Exxon Mobil Corp. and Shell Plc can be important after oil costs dropped again to round $100 a barrel. And for each different sector, increased commodity costs imply a much bigger power invoice, dulling the image for earnings total.

And whereas web margin estimates are nonetheless hovering close to all-time highs, there are cracks showing. A Citigroup Inc. index exhibits international earnings downgrades at the moment are outnumbering upgrades at an rising tempo.

With sentiment amongst inventory merchants already gloomy, listed below are 5 issues traders are watching within the second quarter-earnings season that will decide whether or not there is a rebound or a drop to new lows.

Inflation Harm

In relation to pricing energy, luxurious items corporations are in a great place because of strong demand, in keeping with Morgan Stanley, which says that Gucci-owner Kering SA hiked some costs final month by 7% versus February. However that might come below stress if administration commentary suggests a stoop in sentiment is translating into decrease demand, strategists stated.

That is a fear throughout the patron sector. The drumbeat of recession warnings could finally drive a change in family habits, limiting pricing energy and the capability to guard margins. Some traders wager that megacap expertise firms with their large scale are higher positioned to keep up development and soak up pressures.

As shoppers lower prices by choosing cheaper staples, which have decrease margins to start with, firms that promote to the mass market are prone to wrestle probably the most, stated Marija Veitmane, senior strategist at State Road International Markets.

Even banks, which typically profit from rising actual yields, will discover it laborious, Veitmane stated, as “the flatness of the yield curve may negate the advantages of rising rates of interest and maintain web curiosity margins low.” Not everyone seems to be bearish on the sector, nevertheless, with prime fund managers at Amundi SA and BlackRock Inc. saying final month that European banks particularly have been enticing.

The `R’ Phrase

With the stoop in shares coinciding with a current decline in Treasury yields and weaker oil costs, traders have already positioned for a “recession commerce.”

They could be eager to listen to what firms must say about the remainder of the 12 months, however they’re already hoarding money and hiding in bonds. Practically $63 billion flowed into money within the week by means of July 6 alone, whereas international fairness funds had redemptions of $4.6 billion.

Ken Langone, the pinnacle of House Depot Inc., stated Wednesday that the US is already in a recession, including his voice to the litany of such views already on the market.

“Some firms may use the final gloom as cowl for any dangerous information that is been lurking within the shadows,” stated Danni Hewson, monetary analyst at AJ Bell.

Thomas Hayes, chairman at Nice Hill Capital LLC, says {that a} “kitchen sink quarter is actually potential,” although he famous that extra firms would have lower steerage going into the season if that have been going to be the case.

China Crunch

In China, the steerage from dozens of preliminary earnings studies — primarily supplies and power corporations — has been optimistic, however scrutiny over the areas worst hit by virus-related curbs can be key this season. Earnings estimates for mainland-listed firms have been lower in the course of the first 5 months of the 12 months, which reduces the implied revenue development for 2022 to 22% from 31%, in keeping with Haitong Securities analysts together with Xun Yugen.

Development supplies and metal are anticipated to be among the many laggards as a result of sluggish property gross sales and delays in building, in keeping with Northeast Securities analysts, whereas shopper corporations may additionally see a huge impact from Covid restrictions.

These measures are additionally affecting US corporations together with Starbucks Corp. and Canada Goose Holdings Inc. In late June, Nike Inc. gave a downbeat full-year forecast, citing the China closures. Measures that have an effect on factories in China even have ripple results elsewhere, hitting provide chains and the provision of parts and uncooked supplies.Â

Europe’s Power Drawback

Earnings at S&P 500 power firms are anticipated to have greater than tripled within the second quarter, in keeping with information from Bloomberg Intelligence. That compares with a mean of 4% for all S&P corporations.

Though oil costs have lately weakened once more, strategists at JPMorgan Chase & Co. and UBS International Wealth Administration stay bullish on the sector.

However as Europe spirals into an power disaster amid declining provides of pure fuel from Russia, companies, notably in Germany, are fearful about energy shortages as winter approaches. Pictet Asset Administration this month downgraded euro-area shares because of the power squeeze.

The outlook for the area’s utilities can also be grim, and governments are taking drastic measures. France is nationalizing nuclear large Electricite de France SA, and Germany is in talks with fuel agency Uniper SE a couple of rescue package deal.

Disappearing Euro

The stoop within the euro may additionally upend earnings for each European import-heavy firms and US corporations who depend on the bloc for components. Europe’s firms that might be harm embody utilities and journey and leisure, however export-oriented sectors resembling automakers, industrials and chemical compounds would profit, in keeping with Joachim Klement, head of technique, accounting and sustainability at Liberum Capital.

For Germany’s export-heavy financial system, although, the tailwind might not be as pronounced due to its publicity to China’s provide chain in addition to its cyclical nature. “I concern that the advantages of a weaker euro are going to be overshadowed by the deterioration within the macroeconomic outlook,” stated James Athey, funding director at Abrdn.

The opposite facet of the commerce is the US greenback. It is gained towards all main friends this 12 months, and the Bloomberg greenback index is up 9%. Worries about forex strikes have weighed on Massive Tech firms within the US, together with Microsoft Corp., which warned final month {that a} robust buck would harm its profitability within the second quarter.

[ad_2]

Source link