[ad_1]

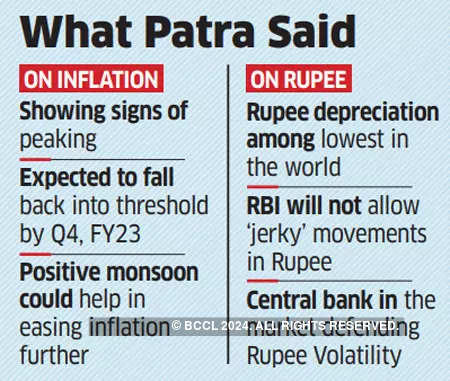

India’s retail inflation is exhibiting indicators of peaking and the coverage wanted to include costs gained’t be as harsh as elsewhere, stated Reserve Financial institution of India (RBI) deputy governor Michael Patra, additionally part of the six-member Financial Coverage Committee (MPC). The depreciation within the rupee is among the many slowest on this planet and the RBI will defend it in opposition to volatility within the foreign money markets, Patra stated on Friday on the PHD Chamber of Commerce.

India’s retail inflation is exhibiting indicators of peaking and the coverage wanted to include costs gained’t be as harsh as elsewhere, stated Reserve Financial institution of India (RBI) deputy governor Michael Patra, additionally part of the six-member Financial Coverage Committee (MPC). The depreciation within the rupee is among the many slowest on this planet and the RBI will defend it in opposition to volatility within the foreign money markets, Patra stated on Friday on the PHD Chamber of Commerce.

“Our hope is the required financial coverage actions shall be extra reasonable than in the remainder of world and we can deliver again the inflation to focus on inside a two-year time span,” Patra stated in feedback that ought to mood issues about aggressive charge will increase by the RBI to maintain costs in verify.

He stated the MPC will talk about and draft the report back to be despatched to the federal government to clarify the deviation from the inflation goal, weighing in on the scenario if the determine is just not met for 3 successive quarters. The RBI is remitted to maintain shopper inflation at 4% with a tolerance band of two share factors on both facet of that.

Inflation based mostly on the Shopper Worth Index (CPI) eased to 7.04% in Could from an eight-year excessive of seven.79% in April. The following assembly of the MPC is scheduled for August 2-4.

“It might be a untimely prognosis, however there are indications that inflation could also be peaking,” Patra stated. “In another simulation, which contains the coverage actions undertaken to date, the easing of inflation might be even sooner and quicker… If the monsoon brings with it a extra benign outlook of meals costs, India can have tamed the inflation disaster even earlier.” Excessive crude oil and meals costs have been a problem, he stated in his keynote tackle on Geopolitical Spillovers and the Indian Financial system.

The RBI raised the coverage charge by acumulative 90 foundation factors in two steps—on Could 4 and June 8–raising its inflation forecast for FY23 by a share level to six.7%.

Different central banks, together with the US Federal Reserve, have been extra hawkish in attempting to handle inflation that has hit a multi-decade excessive.

Elevated gasoline, meals and commodity costs, stemming largely from the Russia-Ukraine battle, are conserving costs up. “Indubitably, the influence of geopolitical dangers will trigger a really grudging decline in inflation and a potential breach of the accountability standards, however India would achieve bending down the long run trajectory of inflation, profitable the battle despite dropping the battle,” Patra stated.

Retail inflation averaged 6.3% within the fourth quarter of FY22 and is projected at 7.5% within the first quarter of FY23 and seven.4% within the second quarter.

The deputy governor stated analysis by the RBI and others clearly demonstrates that progress is impaired when inflation crosses 6%. “Therefore, breaching the suitable higher tolerance restrict of 6% for India’s inflation goal ought to set off accountability if financial coverage has to stay credible,” he stated.

RUPEE TARGET

The Indian foreign money hit an alltime low of 78.32 in opposition to the greenback on Thursday amid issues of additional capital outflows after the US Federal Reserve chairman Jerome Powell stated it was “strongly dedicated” to reducing inflation. The rupee recovered marginally to 78.20 per greenback on Friday. Patra stated the RBI didn’t have a goal for the rupee however would cushion any sharp actions.

“We have now no stage in our thoughts, however we is not going to permit jerky movements–that is for certain–and let it’s broadly identified that we’re available in the market defending the rupee in opposition to volatility,” he stated.

GROWTH PROSPECTS

Financial coverage motion will take its toll on spending and demand, Patra stated. “What the RBI is attempting to do is to stabilise the worth scenario when the economic system is ready to bear it as a result of within the longer run, worth stability is useful for progress,” he stated. The central financial institution expects India’s economic system to develop 7.2% in FY23, down from 8.7% in FY22.

“Within the first quarter of 2022-23, out there indicators of financial exercise have improved. Not like the remainder of the world, India is recovering and getting resilient and stronger,” Patra stated.

“That is the most effective time to place the stabilising results of financial coverage into motion in order that the prices to the economic system are minimised.”

[ad_2]

Source link