[ad_1]

Part 80C of the Earnings Tax Act lets you avail a deduction of as much as Rs 1.5 lakh out of your taxable revenue on guaranteeing investments and bills. Funding in tax-saving funds or Fairness Linked Saving Schemes (ELSS) is one in all them. Because of this one can straight-away save as much as Rs 46,800 on the tax outgo by investing Rs 1.5 lakh in ELSS, assuming that you’re within the highest tax bracket of 30 per cent. It is a very tangible profit and shouldn’t be compromised.

Small-cap funds have undoubtedly returned greater than ELSS. As of June 7, 2022, their 10-year SIP return stands at 16.78 per cent whereas tax-saving funds have returned 12.89 per cent. However it is very important perceive that small-cap funds are usually not meant for everybody. Although they’ve the potential to offer extraordinary returns over the long-term, they’re extremely unstable and vulnerable to sharp ups and downs. This could be a motive for anxiousness for a lot of buyers throughout powerful phases of the market and ultimately driving them out of equities completely which could be a larger downside. Know the promise and perils of small-cap funds.

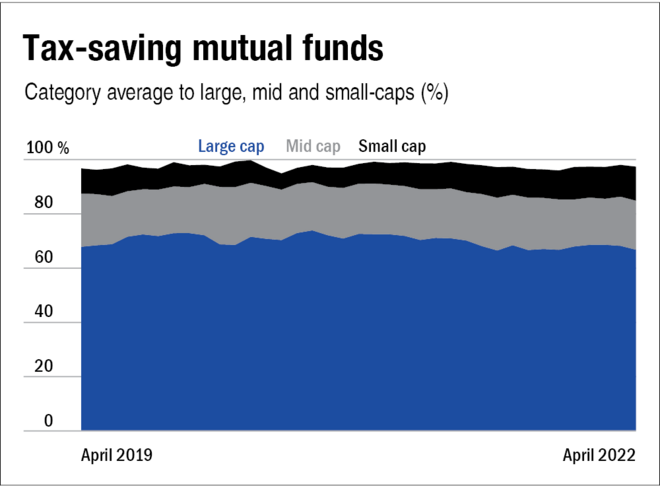

Furthermore, it’s not suggested to make small-caps because the core of your portfolio due to their inherent nature. Solely a small portion of your portfolio must be allotted to small-cap funds. Ideally, one ought to have round 60-70 per cent in large-cap funds to maintain their portfolio secure and the remaining in mid-cap funds and small-cap funds for offering progress and better returns. And that’s precisely what tax-saving funds and flexi-cap funds do. So whereas investing in ELSS, you mechanically get publicity to small-caps as effectively.

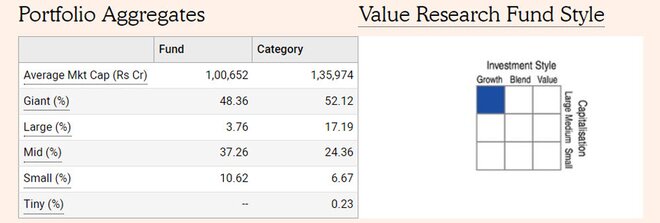

Nevertheless, in the event you nonetheless want to have the next allocation in the direction of mid- and small-caps, we do have tax-saving funds within the ELSS class which observe an aggressive method and make investments extra in mid- and small-caps. It may be simply checked underneath the ‘Portfolio’ part of any fund web page on Worth Analysis On-line.

Prompt watch:

How does an enormous AUM have an effect on the efficiency of a small-cap fund?

Ought to I exit from small-cap funds on a loss?

[ad_2]

Source link