[ad_1]

Multibaggers, excessive compounders, superior wealth creators – you need to use no matter phrase you want, however the seek for a set of corporations which have the potential to make an investor vastly rich (and even reasonably) is a standard theme throughout all types of buyers. However the place does one look? We all know that small-cap and mid-cap corporations develop sooner than large-cap corporations. Nonetheless, large-cap corporations are extra resilient to altering environments. Small-cap and mid-cap corporations are extra liable to succumbing to exterior in addition to inner shocks. So, how does one stability it out?

On this story, we wish to current a place to begin for potential wealth creators. We ran via the numbers and located some attention-grabbing tidbits. Earlier than we delve into the main points, let’s perceive the method undertaken.

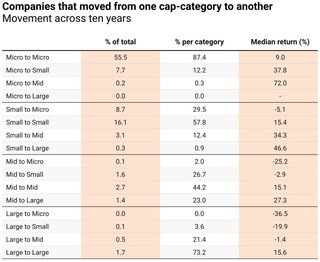

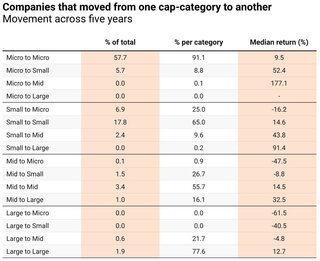

- We categorised all corporations below the assorted capitalisation classes (Micro, Small, Mid and Massive) for annually since 2000 (March-end).

- Then we calculated the returns over a 10Y and a 5Y horizon ranging from March 2000. Thus, we had 13 information factors for the 10Y horizon (e.g., March 2000 to March 2010, March 2001 to March 2011, and so forth until March 2012 to March 2022) and equally, 18 information factors for the 5Y horizon (e.g., March 2000 to March 2005 until March 2017 to March 2022).

- We additionally stored observe of the motion throughout capitalisation classes.

The next tables current the median results of this for each the 10Y horizon and the 5Y horizon.

Heads:

- % of complete – represents the median share of shares (from all shares) shifting from one cap class to a different.

- % per class – represents the median share of shares (inside a cap class) shifting from one cap class to a different.

Insights:

- Whereas the best return has been supplied by Micro to Mid, the variety of corporations on this class is abysmally low. Thus, the chance of success could be very low right here.

- Wanting on the ‘% per class’ column, we discover that, over each 5 and 10 years, Mid to Massive has been fertile floor. That’s, mid-cap corporations usually current a better chance of discovering multibaggers.

- The subsequent finest different is the Small to Mid class. Nonetheless, the small variety of corporations that go on to develop into mid-cap presents a slew of risks.

- Over 10 years, the Massive to Massive class has generated a reasonably first rate return with a better chance of success.

What you should not take away from this evaluation

- Simply because Mid to Massive presents a better chance of success with nice returns, it isn’t the case that you need to shun small-cap or large-cap corporations.

- Wealth creation potential just isn’t judged by the corporate turning into a large-cap firm in some unspecified time in the future sooner or later. It’s primarily based on enterprise fundamentals, scalability, sturdy working and capital allocation expertise of the administration and different issues.

- A portfolio of fully small-cap or fully mid-cap corporations is unwise. Diversification is required to make sure you do not lose what you have got for what you do not want.

Steered learn: Solely two sectors gave constructive returns within the final three months!

[ad_2]

Source link