[ad_1]

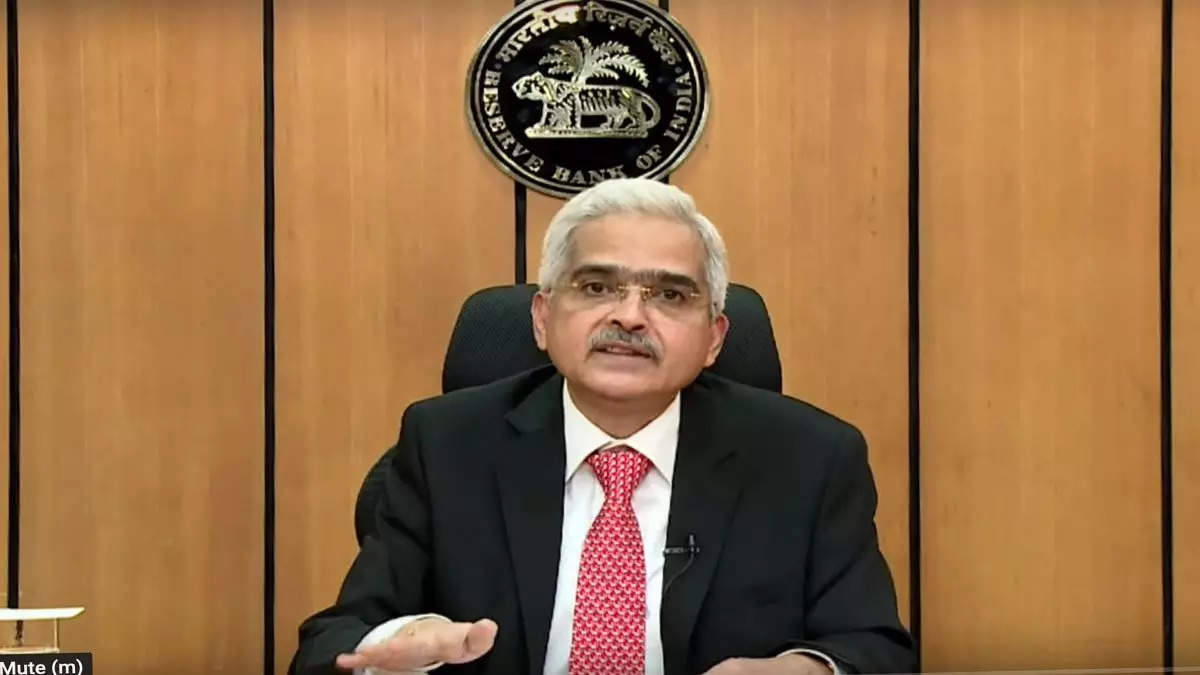

The Reserve Financial institution of India is dedicated to containing inflation whereas protecting development in thoughts, governor Shaktikanta Das instructed MC Govardhana Rangan and Bodhisatva Ganguli in an interview, throughout which he additionally spoke about borrowing, crypto and the reform agenda. Edited excerpts:

You had mentioned that the Could 4 rate of interest hike was the start of reversal of the cuts. The subsequent assembly of the financial coverage committee (MPC) is due on June 6-8. Is there a temptation to do the remaining 75 foundation factors in a single shot?

I am unable to say what the subsequent MPC will resolve. After dialogue we take choices. We’ve got mentioned that no matter we do shall be in a phased and a calibrated method. To the extent doable, we’ll keep away from shocks to the market and to the monetary sector. The off-cycle assembly (was) handled as a shock. It ought to be seen as a continuation of the April MPC. In April, aside from altering the sequence of inflation and altering inflation projection, we made the LAF (liquidity adjustment facility) hall symmetrical and normalised to 50 foundation factors and a change in stance. One vital factor was we launched the SDF (standing deposit facility) and glued it increased than the reverse repo charge. The weighted common name charge, the working goal of financial coverage, was nearer or decrease than the reverse repo charge. The second we did that, the decision charge went up by 40 foundation factors. There was a charge motion. I had mentioned the scenario is quick altering and dynamic and our actions shall be tailor-made accordingly.

The market is obsessive about the repo charge being raised to five.15%. How correct is that?

You may’t exactly pinpoint that it is going to be 5.15%. What we’ve got mentioned is we want to return to the pre-Covid scenario – by way of development, repo charge, and liquidity. It isn’t doable to be exact. It may be decrease or increased.

Central banks are grappling with the best way to deal with inflation. How excessive ought to rates of interest go?

We’re dedicated to containing inflation. On the similar time, we’ve got to bear in mind the necessities of development. It will probably’t be a scenario the place the operation is profitable and the affected person is useless. We should carry down inflation and we won’t afford such an enormous development shock which is able to adversely have an effect on inflation. It needs to be a balanced name with inflation management as precedence.

Virtually all central banks are targeted solely on inflation. However you might be having development additionally as your concern. What sort of imbalance might that trigger within the economic system, markets?

Our focus is on inflation containment. Whereas doing so, we won’t push out development from the desk. All of the central banks are additionally attempting to take the same stance with their home scenario. All of them are additionally conscious of the expansion facet. In the end, it’s the economic system. It’s the welfare of the individuals that’s vital. Excessive inflation is unquestionably towards the welfare of the individuals. When you find yourself bringing down inflation, you might be contributing to public welfare. It’s a tough, delicate balancing act that every central financial institution has to do primarily based on their evaluation of their economies. In RBI, we’ll take a balanced name.

The federal government has taken some fiscal measures corresponding to cuts in gas taxes and that ought to average inflation. Can that result in much less aggressive coverage actions by the RBI?

We’re assessing the inflation street map. The steps can be factored in. We’ll give out a revised forecast within the subsequent MPC. Relying on the forecast which we come out with, the MPC will take a choice on additional charge motion.

The US Federal Reserve minutes counsel sharper and extra 50-basis-point will increase. What’s the sort of magnitude of improve that India would require?

After I’m speaking about development, (it) is that I am unable to overlook in regards to the necessities of development. However our major focus for the time being is to carry down inflation nearer to the goal.

Why is there such a divergence between the wholesale worth index (WPI) and the buyer worth index (CPI)?

The passthrough relies on producers’ costs. In sure sectors, full passthrough hasn’t occurred. Going ahead it might occur. There are indicators that in lots of sectors, the passthrough to retail costs is happening.

The off-cycle charge hike got here as a shock after there was no motion in April, regardless of a better inflation forecast. Additionally, you had mentioned that actions can be well-telegraphed.

I mentioned it might be ‘well-telegraphed’ earlier than April. Yet one more month of inaction would have resulted in an extra spike in inflation with none motion from the central financial institution. And in addition, it might have ended up in a a lot stronger motion within the June coverage. That may have been an actual shock. It is not good to do such a robust motion in a single assembly. There could also be a scenario the place it might be required, however within the present scenario, it was not fascinating.

Within the newest MPC minutes, JR Varma had urged a 100-basis-point improve quickly. How rapidly can we anticipate that?

Particular person members give their views. In the end, it’s mentioned on the subsequent assembly. Every member takes his place after which if there may be unanimity, effectively and good. If there isn’t a unanimity, it’s put to vote. You may see the considering of people, however you’ll be able to’t resolve what the MPC choice could possibly be.The federal government has taken some supply-side actions. There have been actions internationally – be it crude or some commodities. The subsequent coverage motion shall be depending on what inflation forecast we make, primarily based on the developments of the previous month and how much outlook it offers us for the long run.

There seems to be a disconnect between the inflation forecasts and MPC actions. Once you raised the inflation forecast by 120 foundation factors, there was no charge motion? How effectively can motion be tailor-made to forecasts?

I might not agree with that. I had listed many factors – we modified the inflation projection. We modified the stance to specializing in withdrawal of lodging. We made the LAF hall symmetrical, prioritised inflation. We launched SDF, which was a charge motion. On prime of that, an extra repo charge motion would have been an excessive amount of of a shock to the market. Having taken so many measures, it might have meant an 80 basis-point improve. It is not as if in April we decided for an additional 40 foundation factors improve. The developments thereafter, the forecast given by the FAO (Meals and Agriculture Organisation) and the World Financial institution confirmed that it (inflation) is turning into extra sticky, and protracted.

And it’s spreading to broader segments of the economic system?

Core inflation is turning into sticky. There have been will increase in electrical energy tariff and the costs of important medicines, reset in April, additionally went off. The warfare is right here to remain and last more. Due to this fact, the developments throughout April additionally necessitated that we act early. It was evident {that a} charge motion can be essential. We had given indicators there could possibly be off-cycle conferences with (the) scenario fast-changing. We did give a ahead steerage – April, we began the speed motion. The developments throughout April necessitated a charge motion. We wished to keep away from a stronger motion. Placing all these collectively, an off-cycle assembly turned essential.

Does that imply in future too there will not be large will increase even when there are extreme worth pressures?

I might not prefer to prejudge the MPC’s choice. To the extent doable, we’d keep away from any shocks to the market.

You dropped the phrase transitory to explain inflation. There was an argument that supply-side inflation cannot be managed by charge hikes. Now all of the central banks are doing it. What has modified?

Inflation everywhere in the world has change into generalised and protracted. Even now, the inflation is because of the provide facet and never attributable to financial coverage. The present warfare in Europe has made inflation far more generalised, far more persistent. There are specific world elements which aren’t beneath the management of any single nation. When it got here to Covid, there was co-operation. Right this moment, we do not know which path nations are pulling. Due to this fact, inflation has change into persistent. The warfare is prone to last more, due to this fact the central banks need to act. Additionally, development has made a considerable restoration. In India, we’ve got returned to pre-Covid ranges. There are clear indicators of demand revival and personal consumption. There are additionally indications of a pickup in non-public funding. Our development situation seems to be way more comfy and higher than different nations. Anchoring inflation is extra vital, in any other case it should go uncontrolled.

Now that the speed upcycle is a actuality, what’s the risk to development?

Allow us to not assume that the speed will increase would proceed endlessly. There could also be constructive developments on the geopolitical facet, I do not know. Even Covid seems to be in management, however some nations are nonetheless going through a extreme unfold. There are such a lot of uncertainties. The scenario can transfer in both path. It seems that inflation will keep for some extra time. Every central financial institution has to take its personal name primarily based on the native scenario … (in) superior nations, the (inflation) goal is 2% and it (present inflation) is at 6 or 7 or 8%. For them, it’s a greater fear. In India, 7.8% towards our higher tolerance band of 6%. India is best off. On the expansion entrance additionally, India remains to be projected prone to be the quickest rising economic system.

The federal government has minimize taxes on gas. Its subsidy invoice can be climbing which can result in increased borrowings. How do you handle bond yields?

The actions, whether or not they are going to result in further borrowing … we won’t assume there shall be further borrowing. Beneath sure heads, expenditure goes up and beneath sure heads, it comes down. We’re at first of the yr. The income numbers are good. The disinvestment goal seems to be achievable. There could possibly be extra influx of sources, tax and from different sources. There’s extra demand for subsidy, there could possibly be financial savings elsewhere. The federal government can be conscious of the truth that the fiscal deficit needs to be maintained. Debt-to-GDP additionally needs to be saved in thoughts. The RBI is the debt supervisor. It’s our endeavour to make sure non-disruptive completion of the borrowing programme. I’ve mentioned the evolution of the yield curve is a public good. Thereafter, each the RBI and market members have a superb understanding. There was convergence of ideas.

The RBI intervenes in markets actively. However there appears to be a divergence in your strategy to the foreign money and bond markets. Whereas in foreign money you do not have a stage, in relation to yield, you appear to be specific about ranges?

Each within the foreign money and bond markets, we do not like runaway costs. Within the foreign money market, we do not like runaway depreciation and within the bond market, we’d not like a runaway improve in yields in G-Secs.

Coming to the banking system, their financials are trying higher and also you had taken many steps. Can we are saying there will not be a repeat of an IL&FS or a Sure Financial institution?

That’s our endeavour. We’ve got taken many reform measures – governance tips, scale-based regulation for NBFCs (nonbank finance corporations), for MFIs (microfinance establishments) activity-based regulation, quickly for ARCs (asset reconstruction corporations) and concrete cooperative banks and digital lending. We’ve got mandated appointments of danger and compliance officers. Even NBFCs are in a stronger place. Banks’ CRAR (capital-to-risk weighted property ratio) is greater than 16%, GNPAs (gross nonperforming property) is lower than 6% and PCR (provision protection ratio) is 69%. The banking sector stays fairly strong. The monetary well being of all banks is secure. All of the banks are in a wholesome place.

Is it truthful to say that the proposal to let industrial homes personal banks is in chilly storage?

There was an inside working group report. We examined it. We reached a conclusion that for the time being we’d preserve it for additional examination.

Given the state of crypto values, will or not it’s truthful to say that you’ve got received the argument?

It isn’t a query of successful or dropping. There’s lots of dialogue. The federal government will consider all viewpoints and resolve whether or not to control or ban. Crypto has no underlying. You can not regulate nothingness. There needs to be one thing to control. The costs could be unstable. Actually, it’s a purely speculative exercise. I’m not utilizing a stronger phrase, to name it playing, however it’s a speculative exercise. It will probably create a scenario the place small and retail traders would lose cash and will lose confidence within the monetary system. In share costs, there may be an underlying firm which is regulated by the corporate regulation. Have a look at their costs, they’ve crashed.

On the fintech house, there’s a demand for credit score via the UPI (Unified Funds Interface) platform… What’s your view?

Let the UPI do what it’s meant for – a fee and settlement system. Let it do an increasing number of effectively, which it’s doing for the time being. Let the UPI go worldwide, which is our focus space and NPCI’s. Let there be linkage between the UPI and different nations’ fee programs. Let it even penetrate additional within the nation. The banks should undertake digital lending. We’ve got provide you with digital lending plans.

Non-public banks have nearly stopped issuing Rupay playing cards due to the zero MDR expenses. It’s not directly serving to opponents. What’s RBI’s stance?

The federal government has determined to subsidise. We’re engaged with banks on this situation, about issuance of Rupay playing cards, notably within the context of the geopolitical growth and up to date experiences. It’s fascinating that we even have a home card Rupay which can be transacted outdoors the nation. We’re working with different central banks (for it) to be acceptable. We’re engaged with the NPCI and banks.

The place are we by way of sanctions towards Russia?

India has not violated any sanctions. We on the RBI will adhere to sanctions. The funds are occurring. Importers and exporters have discovered a method for settlements.

[ad_2]

Source link