[ad_1]

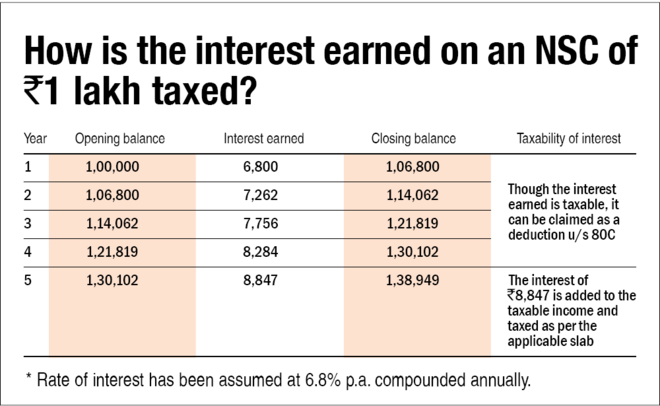

The curiosity earned or accrued on a Nationwide Financial savings Certificates (NSC) is taxable. For taxation functions, it needs to be added to the taxable revenue of the investor yearly (not simply on the time of maturity) and taxed as per the relevant slab. One should present it underneath the pinnacle, ‘Revenue from different sources’ whereas submitting their tax return.

Nevertheless, the curiosity accrued on NSC is mechanically reinvested and added to the principal (authentic funding) yearly. And the identical might be claimed as a deduction from taxable revenue underneath part 80C of the income-tax act. However one should do not forget that the advantage of part 80C is restricted solely as much as a most of Rs 1.5 lakh.

Additional, for the reason that NSC has a tenure of 5 years, whereas the curiosity accrued on the primary 4 years can be reinvested mechanically and might be claimed as a deduction, the curiosity for the fifth yr can be paid-out to the investor together with the maturity quantity. This can stay taxable because it does not get reinvested.

Let’s perceive this with the assistance of an instance. Suppose you make investments Rs 1 lakh in an NSC with an annual return of 6.8 per cent. On the finish of the first yr, the accrued curiosity can be Rs 6,800 which is able to get reinvested mechanically. Now, your principal firstly of the 2nd yr would enhance from Rs 1 lakh to Rs 1.7 lakh. Although this curiosity of Rs 6,800 is taxable, it may be claimed as a deduction u/s 80C as it’s reinvested in NSC. The identical might be executed for the 2nd, third and the 4th yr. However on the finish of the fifth yr, when the NSC matures, the curiosity accrued (Rs 8,847) for the fifth yr can’t be reinvested and is quite paid out. This stays taxable and can’t be claimed as a deduction.

Advised learn: An summary of 6 in style tax-saving choices

[ad_2]

Source link