[ad_1]

How did it come into being?

LIC was fashioned on January 19, 1956, when the federal government determined to take over all of the 245 life insurers (together with overseas ones) working in India. So, LIC was created with an goal to nationalise life insurance coverage in India, unfold insurance coverage extensively and successfully mobilise public financial savings. Listed below are the important thing milestones in its journey.

What’s embedded worth?

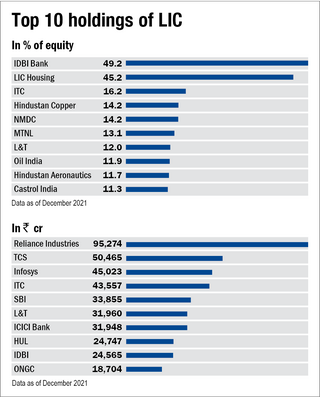

Embedded worth is an estimate of the current worth of shareholders’ pursuits within the distributable income from the property of a life insurance coverage firm after paying all life-insurance claims. In different phrases, it captures the income that accrue to shareholders from the insurance policies which have already been bought. The valuation of a life insurer is usually quoted as a a number of of the embedded worth. Presently, listed friends of LIC are buying and selling at a market-cap-to-embedded-value vary of two to 4 occasions. LIC’s market cap, primarily based on its higher band worth Rs 949 per share, is simply above Rs 6 lakh crore, which is 1.1 occasions its embedded worth. Going by this, LIC might turn out to be the fifth largest listed entity in India behind Reliance Industries, TCS, HDFC Financial institution, and Infosys. Though it have to be remembered that the gray market premium could improve or lower the market capitalisation of LIC on the itemizing day.

[ad_2]

Source link