[ad_1]

Dynamic bond funds have the flexibleness to dynamically handle their common maturities by switching to longer or shorter maturity bonds based mostly on their interest-rate outlook. Whereas, on paper, this class has the flexibleness to maneuver across the maturity curve, information suggests that almost all of those funds normally stay on the medium to the lengthy aspect of the period curve. Thus, these funds do get impacted when rates of interest rise. That can be contributing to the drop of their NAVs because the yields have risen and are anticipated to solely rise from right here on.

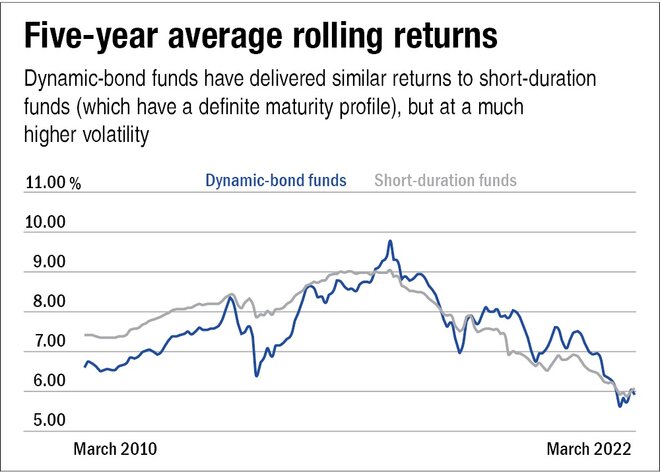

In our opinion, it’s fairly exhausting to foretell rates of interest on a regular basis precisely. Additional, one ought to make investments relying on the aim of investing, however right here it’s extra depending on exterior components. So, these funds are means too energetic for our consolation. On the fixed-income aspect, we err on the aspect of warning. We favor funds which take interest-rate calls in a comparatively narrower vary, rely extra on accrual revenue somewhat than attempting to derive beneficial properties by actively rotating round bonds of various maturity and normally preserve high-quality portfolios. Fastened-income buyers usually count on regular returns with restricted volatility. And on nearly all of events, short-duration funds with a predictable maturity construction outscore dynamic bond funds on this metric. A comparability of five-year rolling returns since 2010 (see the graph ‘5-year common rolling returns’) of dynamic bond funds vis-à-vis short-duration funds highlights the identical.

When you go for dynamic bond funds, do not forget that whereas they are often rewarding, they are going to be unstable relying on how skilfully a fund supervisor can manoeuvre them via an interest-rate cycle. However as talked about above, these funds have some frills hooked up, which you’ll have to settle for. In any other case, if you need comparatively steadier returns with much less volatility, go for short-duration funds with a extra predictable maturity construction.

Advised learn: Are dynamic bond funds a great choice for buyers over a five-year horizon?

[ad_2]

Source link