[ad_1]

New Delhi: This 12 months’s gross sales efficiency will likely be much like final fiscal with regional efficiency anticipated to indicate sharp variations, based on the most recent vendor survey by the rankings company CRISIL.

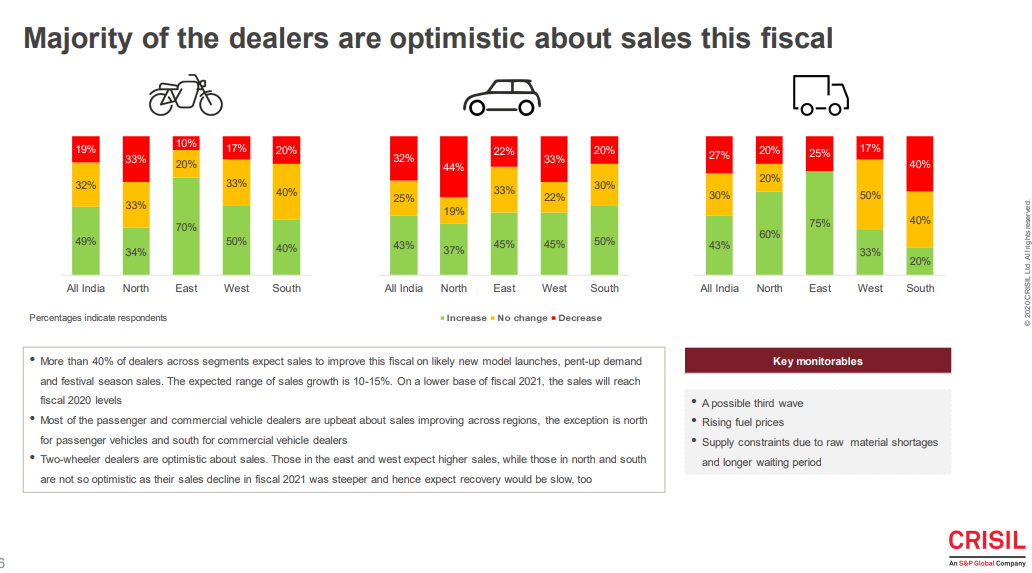

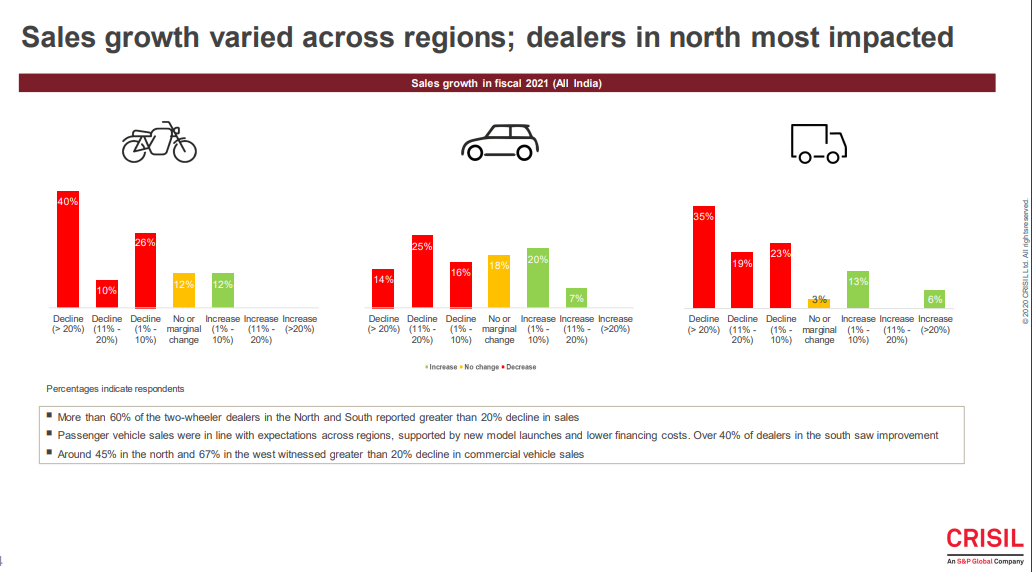

“Whereas most passenger and business car sellers anticipate gross sales to enhance throughout areas, 44% of passenger car sellers within the north and 40% of business car sellers within the south anticipate a decline. Final fiscal, 45% of the business car sellers surveyed within the north and 67% within the west witnessed over 20% year-on-year decline in gross sales,” the rankings company mentioned on Monday.

Total, the two-wheeler sellers are optimistic about gross sales this fiscal. Sellers within the east and west anticipate increased gross sales, whereas 33% within the north and 20% within the south are usually not as hopeful. Final fiscal, ~60% of the two-wheeler sellers surveyed within the north and south reported over 20% year-on-year decline in gross sales, it added.

Bhushan Parekh, director, CRISIL mentioned, “Final fiscal we did see a requirement uptick through the competition season, but it surely didn’t maintain. Two-wheeler sellers had been probably the most impacted. This fiscal, too, gross sales throughout segments are but to succeed in pre-pandemic ranges. Additionally, the deal conversion cycle has doubled, with prospects deferring buy selections. Whereas sentiment is constructive amongst sellers, the chance of a 3rd wave through the upcoming festive season is a key concern.”

Mubasshir Bakir, affiliate director, CRISIL, “Low stock ranges will assist in faster restoration and in addition cut back holding prices. About 75% of the surveyed sellers reported car stock of lower than 45 days because of higher administration. Certainly, whereas lockdowns began in April this fiscal, that they had liquidated stock in March. Added to this, workers rationalisation and price management measures initiated final fiscal have softened the influence on sellers’ financials. Majority of the survey respondents don’t anticipate any materials retrenchment or attrition of workers, or dealership exits this fiscal.”

As per CRISIL, the survey was geared toward gauging vendor sentiments and expectations and drawing a comparability with earlier 12 months’s ballot . It lined 123 sellers of two-wheelers, and passenger and business autos with a good combine throughout areas and OEMs.

Sellers of two-wheelers, passenger autos and business autos anticipate gross sales to extend 10%-15% this fiscal on a low base of final fiscal, pushed by new mannequin launches, pent-up demand, and festive season gross sales. On the flipside, a attainable third wave, spurt in gas costs and provide constraints of authentic tools producers (OEMs) are seen amongst elements that might sluggish the sector down, mentioned the rankings company.

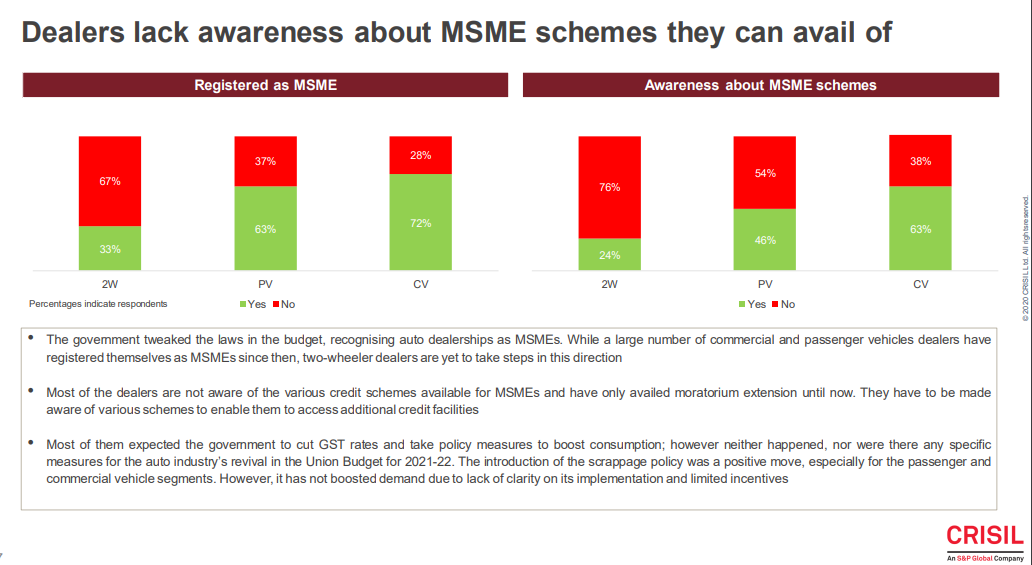

Although the federal government didn’t introduce particular measures for the auto trade’s revival in Union Finances 2021-22, it recognised auto dealerships as micro, small and medium enterprises (MSMEs). Since then, numerous business and passenger car sellers surveyed have registered themselves as MSMEs, although two-wheeler sellers are but to take action.

This may very well be as a result of many sellers are usually not absolutely conscious of the credit score schemes out there for MSMEs and have solely availed of moratorium extension till now, CRISIL mentioned.

Additionally Learn:

[ad_2]

Source link