[ad_1]

IIFL Residence Mortgage, the Housing Finance firm from IIFL Group has come out with IIFL Residence Mortgage NCD (Tranche 1) providing 10% and opens for subscription from July 6, 2021. It’s know-how pushed HFC with concentrate on low & center revenue group in suburbs of Tier 1, Tier 2 and Tier 3 cities.

IIFL Residence Mortgage NCD – Important Factors:

- Supply Interval: July 6 to twenty-eight, 2021

- Annual Curiosity Charges for Retail Traders: 10%

- Value of every bond: Rs 1,000

- Minimal Funding: 10 Bonds (Rs 10,000)

- Max Funding Restrict for Retail Investor: Rs 10 Lakhs

- Credit score Score: CRISIL AA/ Outlook STABLE and Brickwork AA+/ Outlook Detrimental

- NCD Dimension: Base problem dimension of ₹100 crore, with an choice to retain oversubscription as much as ₹900 crore aggregating as much as ₹1,000 crores

- Date of Allocation: August 4, 2021

- Allotment: First Come First Serve

- Itemizing: Bonds could be listed on BSE & NSE and can entail capital positive aspects tax on exit by means of secondary market

Study All about NCDs

NCDs or non-convertible debentures or extra popularly referred to as Bonds are a bit complicated funding merchandise. It’s essential to perceive the product, threat concerned, the taxation on curiosity acquired and once you sale it. Now we have achieved a separate submit concerning this titled – Know all about NCDs.

Additionally you possibly can maintain monitor of upcoming NCD points right here.

IIFL Residence Mortgage NCD – Funding Choices:

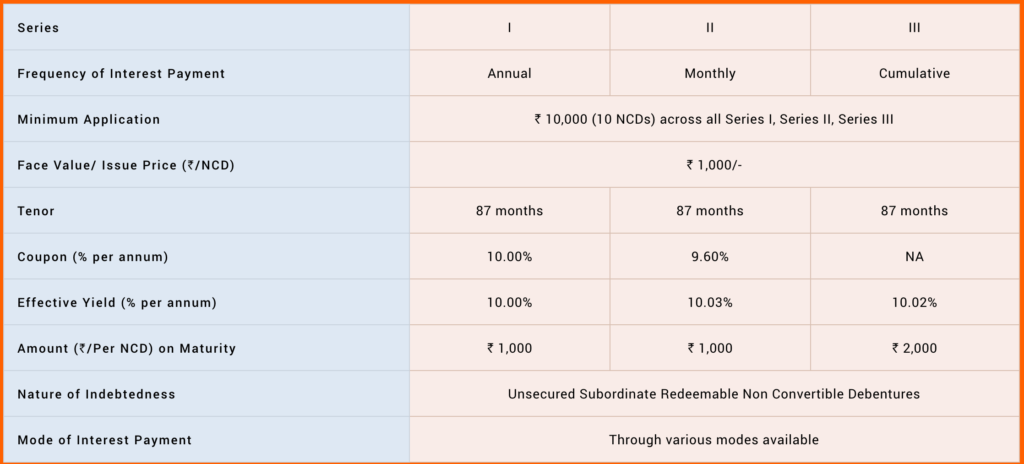

There are 3 choices of funding in IIFL Residence Mortgage NCD.

IIFL Residence Mortgage NCD – Who can Apply?

This problem is open to all Indian residents, HUFs and Establishments.

- Class I – Institutional Traders – 10% of the difficulty is reserved

- Class II – Non-Institutional Traders, Corporates – 10% of the difficulty is reserved

- Class III – HNIs – 40% of the difficulty is reserved

- Class IV – Retail Particular person Traders – 40% of the difficulty is reserved

Nonetheless NRIs can’t apply for this NCD.

IIFL Residence Mortgage NCD Evaluate

Why it is best to put money into IIFL Residence Mortgage NCD?

- AA Credit standing means low seemingly hood of credit score default

- The rates of interest are 4% – 5% increased than your common Financial institution FDs

- No TDS as it might be solely issued in Demat Kind

- Improve earnings and mortgage portfolio yr over yr

Why you shouldn’t put money into IIFL Residence Mortgage NCD?

- There have been points with some properly rated corporations like DHFL, IL&FS the place ranking businesses all of the sudden downgrade the ranking. This threat all the time existed nevertheless it has come to forefront in previous few months

- The NCD is “subordinated unsecured debt“. Which means that this isn’t backed by any asset of the corporate & therefore the upper rate of interest to cowl for increased threat. In case firm goes to liquidation, there are going to be others within the queue that should be paid off in full earlier than you get something.

- NPAs have improve in final 2 years, which can be a priority particularly after COVID.

Methods to Apply for IIFL Residence Mortgage NCD?

You’ll be able to apply on-line by ASBA facility offered by banks. It’s the simplest technique to apply and likewise avoids quite a lot of trouble when it comes to KYC and paper work.

Methods to apply for NCD by means of ASBA?

If you wish to apply to NCDs, ASBA is the easiest way to take action. It’s simple, safe and the cash leaves the account solely when the bonds are allotted. Now we have coated step-by-step course of for ASBA in SBI within the submit. You’ve gotten ASBA facility in most massive banks.

In case you don’t wish to do it on-line, you possibly can obtain the applying kind from firm web site or Monetary Establishments and undergo assortment facilities.

Advice:

- My advice is to maintain away or make investments small a part of your Fastened Earnings funding in IIFL Residence Mortgage NCD Problem (provided that you perceive the danger)

- It is best to all the time have diversified portfolio be it fastened deposit, NCD or fairness funding

- Its good thought to stay invested until maturity as a result of liquidity on exchanges are low and therefore you’ll get decrease than market worth

How a lot Taxes you Have to Pay this Yr? Obtain Our Earnings Tax Calculator to Know your Numbers

Have you learnt how a lot tax it is advisable pay for the yr? Have you ever taken advantage of all tax saving guidelines and investments? Do you have to use the “NEW” tax regime or proceed with the previous one? In case you may have all these questions simply Obtain the Free Excel Earnings Tax Calculator for FY 2021-22 (AY 2022-23) and get your solutions.

IIFL Residence Mortgage NCD FAQs

✅ Methods to apply for IIFL Residence Mortgage NCD?

You’ll be able to apply on-line by ASBA facility offered by most banks. It’s the simplest technique to apply and likewise avoids quite a lot of trouble when it comes to KYC and paper work. In case you don’t wish to do it on-line, you possibly can obtain the applying kind from firm web site or Monetary Establishments and undergo assortment facilities.

✅ Is IIFL Residence Mortgage NCD Safe?

✅ What’s tax on IIFL Residence Mortgage NCD?

For Tax Objective NCDs are handled just like Fastened Deposits. The curiosity earned is added to your revenue as “revenue from different sources” and taxed accordingly.

In case the NCD is offered earlier than maturity on inventory exchanges, it might result in Capital Positive aspects and taxed in accordance with the holding interval.

-If the NCD was offered inside 12 months of allotment, it results in Brief Time period Capital Positive aspects and

-if the promoting interval is greater than 12 months its Lengthy Time period Capital Positive aspects

-Brief Time period Capital Positive aspects could be added to revenue and taxed accordingly

-Long run capital Positive aspects could be taxed on the flat fee of 10% (u/s 112 of IT Act)

✅ Is IIFL Residence Mortgage NCD secure to speculate?

The credit standing for IIFL Residence Mortgage NCD is AA+. That is funding grade and fewer more likely to default on principal or curiosity cost. Do keep in mind that these rankings are as of as we speak and these might change relying on firm’s efficiency and exterior conditions. So traders want to trace the corporate intently.

[ad_2]

Source link