[ad_1]

MUMBAI:

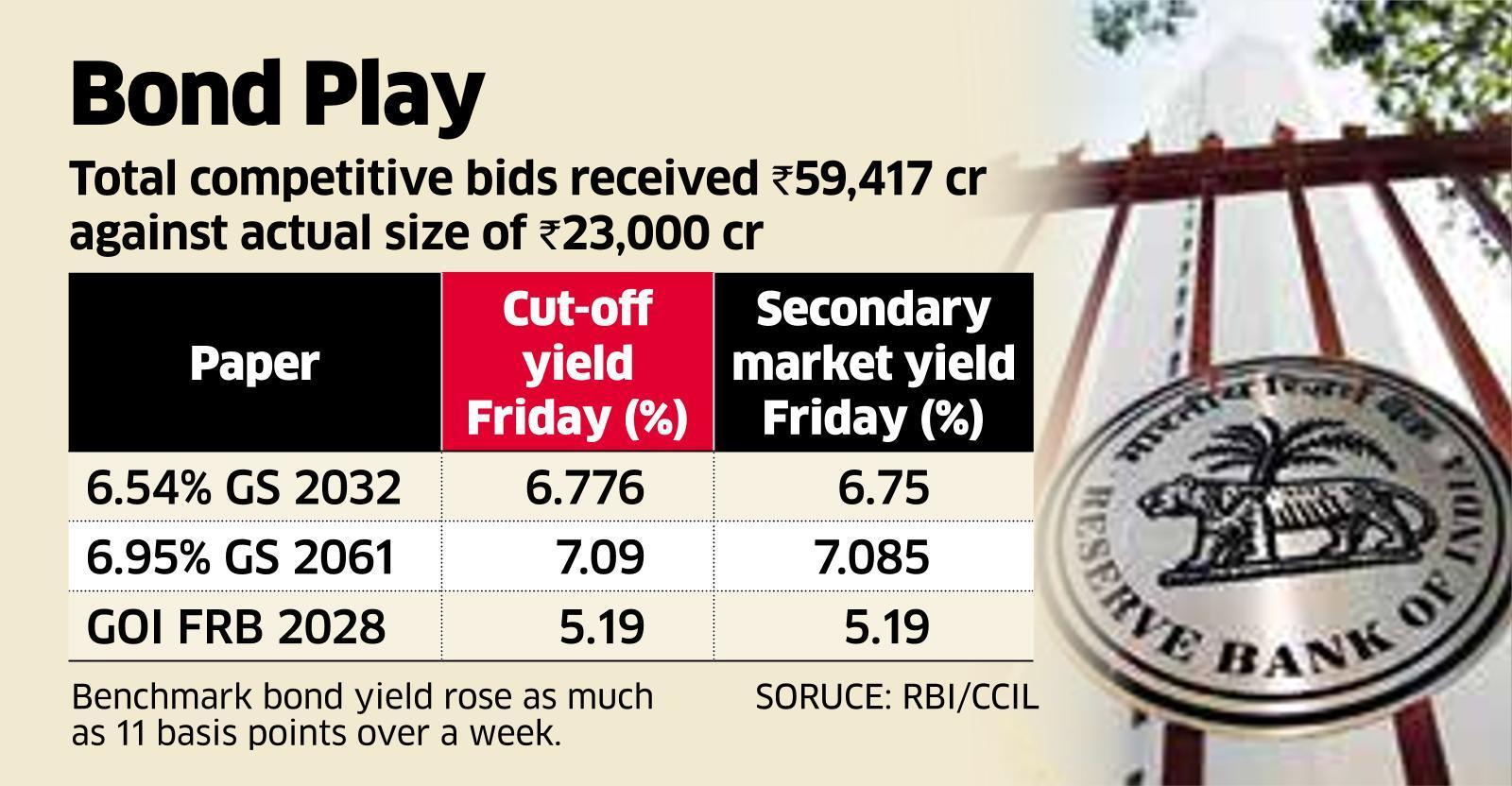

About Rs 23,000 crore of scheduled federal borrowing by means of bond auctions was garnered with none hiccups this week on investor optimism that New Delhi will elevate greater than Rs 50,000 crore by promoting a minuscule portion of its inventory within the preliminary public providing (IPO) of India’s greatest insurer.“The central financial institution’s public sale cancellation earlier had shocked market contributors,” stated Madan Sabnavis, chief economist at Financial institution of Baroda. “This time round, the public sale went unhindered, reflecting the necessity for funds. Amid the continued geopolitical disaster, the federal government could also be trying to be higher geared up financially forward of the focused disinvestments.”

Earlier this month, the Reserve Financial institution of India (RBI) cancelled two auctions, due on February 11 and February 18, respectively, for as much as Rs 48,000 crore of bonds, citing the federal government’s (beneficial) money stability.

North Block is aiming to divest about 5 p.c within the Life Insurance coverage Company, which is predicted to launch its IPO by March finish.

Mint Highway Friday accepted all bids for 3 units of sovereign papers. The benchmark bond shaped greater than half of the whole public sale dimension. The central financial institution obtained greater than double the bids for the sequence at Rs 13,000 crore.

The cut-off yield above which none could be allotted securities was 6.776 p.c, about three foundation factors increased than the secondary market stage that yielded 6.75 p.c Friday.

One foundation level is 0.01%.

“The rise in yields isn’t any extra unique to India however a worldwide phenomenon,” Gurumurthy R Ok, head – treasury at Dhanlaxmi Financial institution. “We gained’t be shocked if the federal government broadcasts one or two extra auctions earlier than the monetary yr ends. With Russia-Ukraine conflict clouding prospects of the fairness market, the federal government will probably drive efforts to tighten its monetary power.”

Higher funds also needs to enhance the prospects of the LIC IPO, billed as India’s greatest to this point.

“This in flip could be useful to promote the distinguished IPO for the nation’s insurance coverage behemoth,” he stated.

Two different units of papers have been included within the public sale. Whereas the bonds maturing in 2061 obtained bids thrice increased than the precise dimension at Rs 6,000 crore, a floating charge sequence maturing in 2028 fetched practically thrice increased subscription bids than the slated dimension of Rs 4,000 crore.

In between, RBI Friday revised Treasury Invoice public sale goal. It would now goal to promote Rs 1.86 lakh crore value of shorter period sovereign papers between March 2 – 30 this fiscal, which is increased by Rs 60,000 crore from its December estimate.

“The probability of upper yields might have prompted the RBI to cancel auctions earlier,” stated a fund supervisor from an insurance coverage firm.

“The federal government desires to make sure a clean crusing for the LIC IPO, for which it determined to retain the public sale even at comparatively increased yields,” the individual stated.

On Friday, the BSE Sensex recouped practically half its losses logged a day earlier, when Russia started its army operations throughout the Ukraine frontier.

Additionally Learn:

[ad_2]

Source link