[ad_1]

India’s Niyo has raised $100 million in a brand new financing spherical because the consumer-facing neobank platform seems so as to add lending and different options to its choices and make deeper inroads on this planet’s second largest web market.

Accel and Lightrock India co-led the Bengaluru-headquartered startup’s Sequence C financing spherical. Present buyers Prime Enterprise Companions, JS Capital additionally participated within the spherical, which brings the six-year-old startup’s all-time elevate to about $150 million.

Niyo supplies digital financial savings accounts and different banking providers to largely salaried people in India. It really works with banks to assist them ship a extra trendy and expansive consumer expertise and options.

It additionally operates a wealth administration product to assist customers put money into mutual funds and home equities. A few of its hottest options embody zero-percent foreign exchange markup and one thing referred to as “make investments the change,” which rounds up a buyer’s spendings and invests part of it.

Niyo co-founder and chief govt Vinay Bagri advised TechCrunch in an interview that the startup has amassed over 4 million prospects throughout its banking and wealth administration merchandise. Most of those prospects are of their 20s and early 30s, he mentioned.

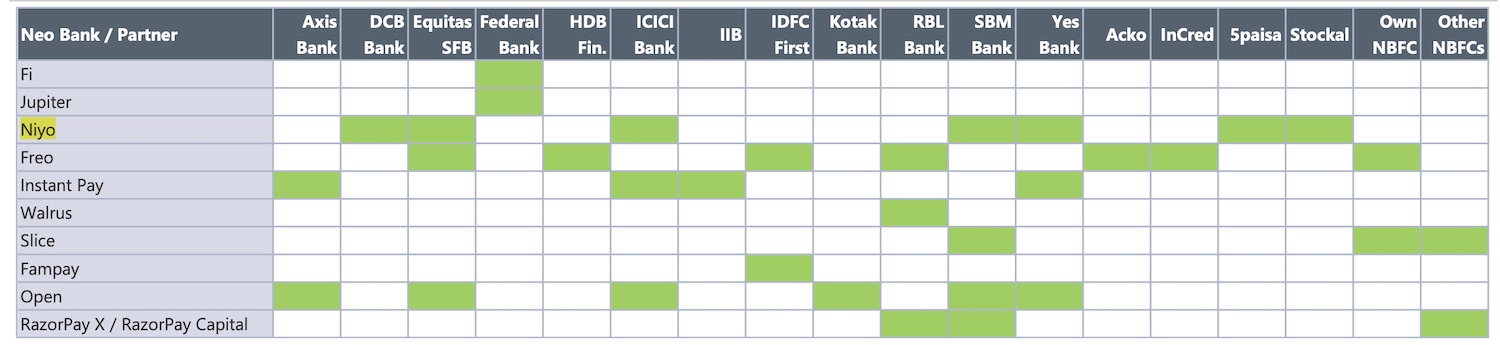

A have a look at neobanks in India and the banks with whom they’ve partnered to serve prospects. (Knowledge: Corporations and Jefferies. Picture credit: Jefferies.)

The startup mentioned it’s including over 10,000 new customers every day and is processing greater than $3 billion of transactions on an annualized timeframe. Virender Bisht, co-founder and chief know-how officer of Niyo, mentioned the startup is seeing “large tailwinds for digital monetary merchandise” because the outbreak of the pandemic.

“Launched lower than a yr in the past, our first-of-a-kind product providing ‘NiyoX,’” he mentioned, “is democratizing the superior digital banking expertise for customers, and has witnessed super consumer adoption.”

Niyo plans to supply lending to prospects beginning subsequent month. The scale of the loans will probably be within the vary of ₹70,000 ($930). Because it broadens its choices, it’s also searching for inorganic progress through acquisition alternatives, mentioned Bagri.

Scores of startups try to modernize the banking expertise in India. However the problem they face is that in contrast to in lots of nations, banking may be very inexpensive in India that has made it tough for them persuade prospects to make what’s a substantial change.

As an business govt described to TechCrunch, the present technology of neobanks are largely solely providing an “expertise layer” to prospects. However many startups are hoping that India will quickly give them licence to personal and function their very own digital-only banks.

“We’re excited to again the quickest rising neo-bank in India, Niyo. Vinay, Viren and staff have constructed a unbelievable product with a transparent worth prop for purchasers which is mirrored of their phenomenal progress. We stay up for partnering with Niyo in altering the best way India banks,” mentioned Anand Daniel, associate at Accel, in an announcement.

[ad_2]

Source link