[ad_1]

Integrated in 2002, Vedant Fashions is India’s largest firm within the males’s marriage ceremony celebration put on phase. Finest recognized for its flagship model Manyavar, the corporate sells its merchandise below varied different manufacturers akin to Mohey, Mebaz, Manthan, and Twamev. Underneath the manufacturers Mohey and Mebaz, it additionally caters to girls’s marriage ceremony put on. The corporate primarily operates via EBOs (Unique Model Shops), the place they generated 90 per cent of the gross sales as of FY21. The remaining got here from MBOs (Multi Model Shops), which accounted for six per cent, LFS (Lengthy Format Shops), which accounted for 1 per cent, and the remaining from on-line channels.

As of September 2021, the corporate had a complete retail house of 1.2 million sq. toes throughout 212 cities in India and eight cities internationally. It has 535 EBOs in India and 11 EBOs throughout international locations like the USA, Canada, and UAE. Because the EBOs are operated by the franchises, the corporate is asset-light, which helps obtain a excessive return on capital. To maintain this, Vedant Fashions outsources its manufacturing to 3rd events or ‘jobbers’. It’s anticipated to comply with the identical mannequin sooner or later since 73 per cent of its franchisee shops have operated for over three years.

By 2025, the Indian attire market’s projected development is eighteen per cent CAGR, with the marriage and attire retail market anticipated to develop by 15 per cent. And with many weddings taking place every year, an underpenetrated males’s marriage ceremony put on phase, and growing family revenue, the corporate will possible profit from utilizing its model as leverage.

Strengths:

1) Robust model presence: ‘Manyavar’, the corporate’s flagship model, is the chief in branded marriage ceremony and celebration put on phase, in keeping with CRISIL in 2020. Their pan-India presence and various portfolio of merchandise have attracted clients all through the years. Vedant Fashions cater to girls’s marriage ceremony and celebration put on phase via its model ‘Mohey’.

2) Asset-light mannequin: The corporate predominantly operates via EBOs managed by the respective franchisees. Thus, it doesn’t have to put money into manufacturing amenities and distribution methods, growing its capital return. It proved this in FY21 when its income and revenue decreased drastically, nevertheless it nonetheless maintained a return on capital employed of 34 per cent.

3) Omnichannel community: Vedant Fashions has clean integration between on-line and offline channels, guaranteeing constant availability to clients. It has additionally launched a way the place EBOs can place orders requested by clients, which could be then acquired at any EBO of the client’s selection.

Weak point:

1) Weak working capital place: The corporate has a working capital turnover of 0.8 instances in FY21 and 0.7 instances for six months ended FY22. Vedant fashions has a working capital cycle of 258 days for FY21 with excessive quantities of commerce receivables. The corporate’s gross sales conversion may be very low, which might, in flip, impression its day-to-day operations if it continues or will increase additional.

2) Geographical focus: The warehouse and jobbers of Vedant Fashions are situated in and round Kolkata. Any sort of pandemic restrictions can hurt its manufacturing operations. Because the firm shouldn’t be concerned instantly in it, a labour scarcity within the area or any subject within the third-party organisations can have an effect on the product availability in its shops.

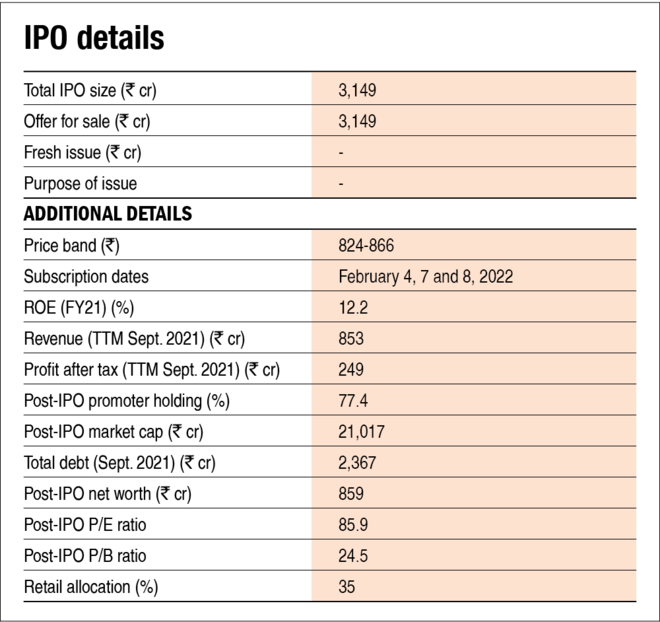

3) Aggressive valuation: Vedant Fashions will debut out there at a worth to earnings of 86 instances and worth to ebook of 24 instances. Its market capital to gross sales is at 25 instances, and this valuation is probably not sustainable going ahead.

Additionally, learn Vedant Fashions IPO: How good is it? to find out how we consider Vedant Fashions on varied metrics.

Disclaimer: The creator could also be an applicant on this Preliminary Public Providing.

[ad_2]

Source link