[ad_1]

Invesco Mutual Fund has floated a brand new fund supply for the launch of its Flexi-cap fund. The fund will dynamically handle its fairness holdings throughout large-cap, mid-cap, and small-cap shares.

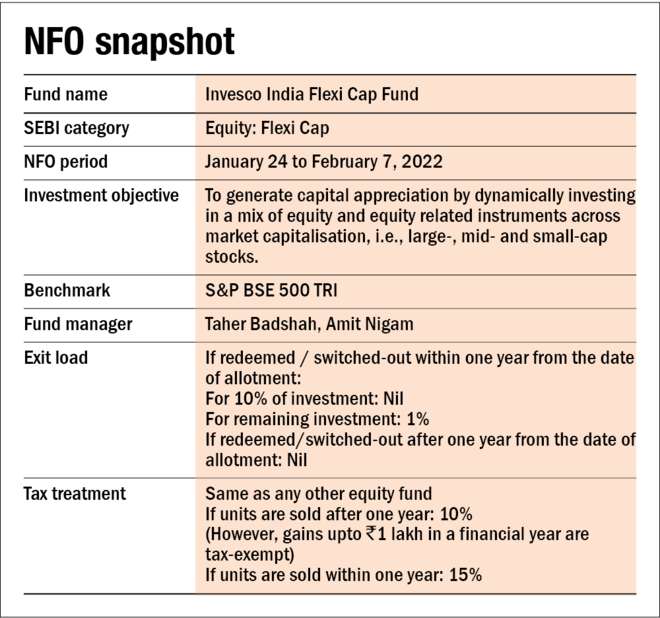

The brand new fund supply (NFO) is open for subscription since January 24, 2022, and can shut on February 7, 2022. The fund can be managed by Taher Badshah and Amit Nigam. The fund is benchmarked towards S&P BSE 500 TRI. Listed below are the important thing particulars of the brand new fund supply:

On September 11, 2020, SEBI got here out with a round for multi-cap schemes, whereby it requested fund homes to speculate a minimal of 25 per cent in all large-, mid- and small-cap market segments. Majority of the AMCs exercised the choice of changing their present multi-cap scheme right into a flexi-cap to be able to retain flexibility of their present portfolio mandate to dynamically make investments throughout market-caps. Invesco was one of many few AMCs that determined to adjust to the brand new regulation for multi-caps and therefore ended up having no choices within the new flexi-cap class.

Because the regulation got here into impact, we’re seeing many fund corporations seeking to fill the hole of their product line-up both within the multi-cap class or, as in Invesco’s case, the flexi-cap section.

In regards to the technique

Invesco India Flexi Cap Fund would intention to establish winners throughout sectors and market cap based mostly on the relative attractiveness of funding alternatives. It intends to seize the soundness of large-cap and progress potential of mid- & small-cap with an choice to dynamically change the allocation. The fund’s mandate facilitates longevity of inventory possession because the fund doesn’t must rebalance the portfolio on account of market cap modifications and offers needed diversification enabling it to generate constant returns whereas decreasing dangers.

Flexi-cap funds take pleasure in a larger diploma of flexibility as they have no restrictions concerning the minimal allocation to any market-cap section. Nevertheless, most flexi-cap funds are likely to have a decrease allocation to mid- and small-cap shares than the large-cap shares.

The efficiency comparability of a median common plan of flexi-cap funds and the S&P BSE 500 TRI reveals that the previous was an outperformer on a five-year rolling return foundation until in regards to the center of 2019. Of late, the common plans of many of the flexi-cap funds are trailing the benchmark.

In regards to the fund supervisor

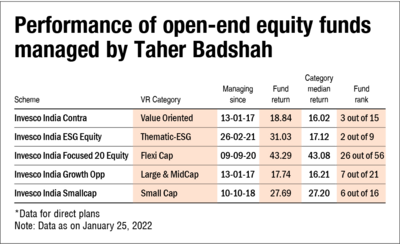

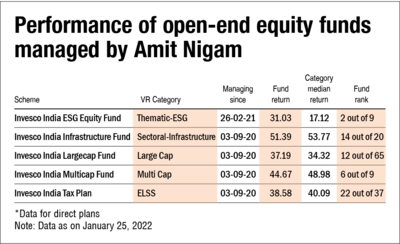

The fund can be managed collectively by Taher Badshah and Amit Nigam. The duo additionally manages the ESG scheme of the fund home collectively.

Taher holds a Grasp’s in administration research (MMS), with specialisation in finance from S.P. Jain Institute of Administration and a B.E. diploma in electronics engineering from the College of Mumbai. With over 26 years of expertise within the Indian fairness markets, he’s the CIO-Equities at Invesco. He joined the AMC after his six-year-long stint at Motilal Oswal Asset Administration the place he was the Head of Equities. Prior to now, he has additionally labored with Kotak Mahindra Funding Advisors, ICICI Prudential Asset Administration, Alliance Capital Asset Administration, and so on.

Amit Nigam holds a PGDBM diploma with specialisation in finance from IIM Indore and a B.E. diploma in mechanical engineering from IIT, Roorkee. He comes with greater than 20 years of expertise in Indian fairness markets and has had stints at Essel Finance AMC Ltd (as Head of Equities) which is now Navi AMC Ltd, BNP Paribas Asset Administration India Pvt Ltd (as Fund Supervisor), and so on.

In regards to the AMC

Invesco is an unbiased world funding administration agency with $1.5 trillion in property beneath administration across the globe. It employs greater than 8,200 workers worldwide with an on-ground presence in 20 international locations, serves purchasers in 120 international locations, and is a publicly-traded firm on NYSE. It owns Invesco Mutual Fund in India which has a median asset base of over Rs 55,622 crore for the quarter ending December 2021.

As per the top of December 2021 disclosures, the AMC manages a complete of Rs 43,067 crore of buyers’ cash in 36 funds which ranks it 17 out of 41 within the trade. The fund home presently has 16 open-end fairness schemes with AUM of Rs 24,753 crore, rating it 17 out of 38 on this house.

Right here is the break-up of AMC’s open-end lively fairness funds as per Worth Analysis’s star score system as of 31 December, 2021.

Additionally learn: Three questions you need to ask earlier than investing in an NFO

[ad_2]

Source link