[ad_1]

In our story, Adani Wilmar IPO: Info evaluation, we’ve shared the important thing particulars of the IPO, together with necessary details about the corporate. Right here we’ll reply some questions on Adani Wilmar and consider it on parameters like administration, financials, valuations, and so forth.

IPO questions

The corporate/enterprise

1) Are the corporate’s earnings earlier than tax greater than Rs 50 crore within the final 12 months?

Sure. The corporate’s earnings earlier than tax stood at Rs 829 crore for the twelve months ended September 2021.

2) Will the corporate be capable of scale up its enterprise?

Sure. The corporate has deliberate to utilise the proceeds from the difficulty to fund their capital expenditure which is able to assist them develop seven of their present manufacturing services and develop a brand new manufacturing facility.

3) Does the corporate have recognisable manufacturers really valued by its clients?

Sure. The corporate’s flagship model ‘Fortune’ is effectively recognised within the households of India with 11.5 per cent market share, and one other recognised model ‘King’s’ holds 2.3 per cent market share.

4) Does the corporate have excessive repeat buyer utilization?

Sure. The corporate was in a position to create a powerful model consciousness and obtain management as a result of repeat buyer utilization and powerful penetration by its premium model ‘Fortune’.

5) Does the corporate have a reputable moat?

No. Though the corporate has sturdy model recall and effectively recognised administration, it doesn’t supply something distinctive that its rivals can’t supply.

6) Is the corporate sufficiently strong to main regulatory or geopolitical dangers?

No. The corporate sources round 60 per cent of its uncooked supplies via imports. Though Wilmar Group’s experience might help them deal with this, any restriction posed by the federal government concerning imports can severely have an effect on the enterprise.

7) Is the corporate’s enterprise proof against simple replication by new gamers?

Sure. Though new gamers can enter the enterprise simply, they want a substantial quantity of expertise in sourcing of uncooked supplies, provide chain administration, good manufacturing capabilities and good market share to duplicate the enterprise. Since there are a number of different giants on this business, it’s robust for a brand new participant to enter and acquire market share.

8) Can the corporate’s product face up to being simply substituted or outdated?

No. Though the corporate’s merchandise are important in everyday life, there are a number of rivals who supply related merchandise which may substitute the corporate’s merchandise.

9) Are the shoppers of the corporate devoid of great bargaining energy?

Sure. For the reason that customers are principally people, they don’t have important bargaining energy.

10) Are the suppliers of the corporate devoid of great bargaining energy?

Sure. Adani Wilmar will get its uncooked supplies from numerous sources and a good portion can be sourced via its personal promoters, Wilmar Group.

11) Is the extent of competitors the corporate faces comparatively low?

No. The corporate exists in a extremely aggressive surroundings stuffed with main established rivals.

Administration

12) Do any of the corporate’s founders nonetheless maintain at the least a 5 per cent stake within the firm? Or do promoters maintain greater than a 25 per cent stake within the firm?

Sure. Publish-IPO, the promoters will maintain about 88 per cent stake within the firm.

13) Do the highest three managers have greater than 15 years of mixed management on the firm?

Sure. The CEO and Managing Director of Adani Wilmar, Angshu Mallick, has been with the corporate since 1999.

14) Is the administration reliable? Is it clear in its disclosures, that are according to SEBI tips?

Sure, we’ve no cause to consider in any other case.

15) Is the corporate freed from litigation in courtroom or with the regulator that casts doubts on the administration’s intention?

Sure, the corporate is free from any materials litigation.

16) Is the corporate’s accounting coverage steady?

Sure. As per the auditors’ report, the accounting coverage is steady.

17) Is the corporate freed from promoter pledging of its shares?

Sure. The corporate’s shares are freed from any pledging.

Financials

18) Did the corporate generate a present and three-year common return on fairness of greater than 15 per cent and return on capital employed of greater than 18 per cent?

Sure. The corporate’s three-year (FY19-21) common return on fairness was 19.3 per cent and a return on capital employed of 25.3 per cent. For FY21, the corporate generated a return on fairness of twenty-two.1 per cent and a return on capital employed of 23.1 per cent.

19) Was the corporate’s working money movement constructive over the last three years?

Sure, Adani Wilmar reported constructive working money movement over the last three years.

20) Did the corporate enhance its income by 10 per cent CAGR within the final three years?

Sure. The corporate’s income elevated from Rs 28,797 crore in FY19 to Rs 37,090 crore in FY21, on the fee of 13.5 per cent CAGR.

21) Is the corporate’s internet debt-to-equity ratio lower than one, or is its interest-coverage ratio greater than two?

Sure. The corporate’s internet debt-to-equity ratio stood at 0.07 as of September 30, 2021. The curiosity protection ratio stood at 2.76.

22) Is the corporate free from reliance on enormous working capital for day-to-day affairs?

Sure. With working capital as a share of gross sales being lower than 1 per cent, on common, over FY19-21, the corporate does not have reliance on enormous working capital for day-to-day operations.

23) Can the corporate run with out counting on exterior funding within the subsequent three years?

Sure. Whereas the enterprise is free money movement constructive, the complete proceeds from the IPO will likely be used to deleverage and spend money on future development. So, the corporate ought to be capable of run with out counting on exterior funding within the subsequent three years.

24) Have the corporate’s short-term borrowings remained steady or declined (not elevated by larger than 15 per cent)?

No. Adani Wilmar’s short-term debt has elevated 16 per cent from Rs 865 crore in FY19 to Rs 1,004 crore as of September 30, 2021.

25) Is the corporate free from significant contingent liabilities?

Sure. The corporate is free from significant contingent liabilities.

Inventory/valuations

26) Does the inventory supply an operating-earnings yield of greater than 8 per cent on its enterprise worth?

No, the inventory will supply an operating-earnings yield of 4.3 per cent on its enterprise worth.

27) Is the inventory’s price-to-earnings lower than its friends’ median stage?

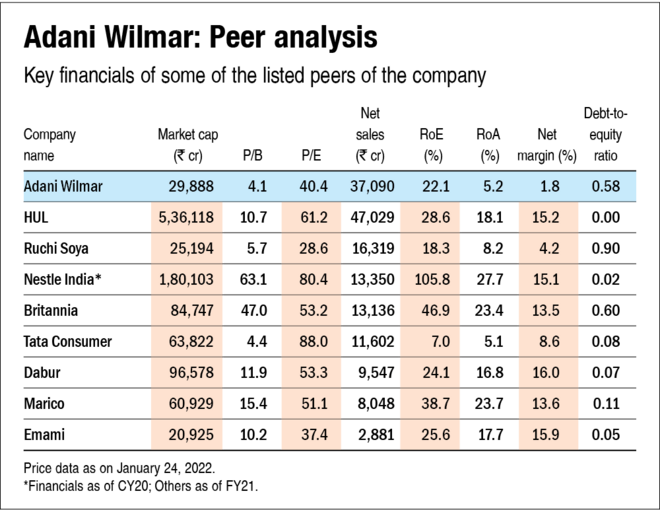

Sure. Publish-IPO, the corporate’s inventory will commerce at a P/E of round 40.4, which is lower than its friends’ median P/E of 53.2.

28) Is the inventory’s price-to-book worth lower than its friends’ common stage?

Sure. Publish-IPO, the corporate’s inventory will commerce at a P/B of round 4.1, which is lower than its friends’ common P/B of 21.

Additionally learn Adani Wilmar IPO: Info evaluation to study in regards to the firm’s key IPO particulars and necessary data.

Disclaimer: The authors could also be an applicant on this Preliminary Public Providing.

[ad_2]

Source link