[ad_1]

Cathay Pacific data as much as $783m loss in 2021 as Covid curbs chew

Cathay Pacific recorded losses of as a lot as HK$6.1bn ($783m) final yr as a continued decreased demand and strict coronavirus journey restrictions hit the Hong Kong airline.

The de-facto flag service anticipated to see a loss to shareholders of $719m to $783m within the yr ended December 31, it stated in a preliminary assessment on Monday. The determine nonetheless marked an enchancment from the virtually $2.8bn hit that its accounts sustained in 2020 following a pick-up in cargo demand.

Cathay has confronted intense stress from Hong Kong authorities who blamed its workers for fomenting the primary outbreak of the Omicron variant. The corporate warned {that a} tightening of aircrew quarantine measures and different curbs final month might end in an estimated money burn of virtually $193m per thirty days from February.

“These measures may have a big impression on our passenger and cargo flight capability,” chief government officer Augustus Tang stated.

The airline additionally stated it carried 92,219 passengers final month, a greater than 130 per cent improve from the yr earlier than, however nonetheless a 95 per cent decline from the pre-pandemic stage in 2019.

Hong Kong has adopted a zero-Covid technique just like that in mainland China, which included three-week resort quarantines and a ban on flights from eight international locations till not less than subsequent month. Regardless of such measures authorities recorded 140 infections on Sunday, the best quantity in a single day for 18 months, because the territory battles a spiralling outbreak of the Omicron variant.

Australian non-public sector shrinks for first time in 4 months, PMI reveals

Australia’s non-public sector shrank for the primary time in 4 months because the Omicron coronavirus variant disrupted operations, the most recent buying managers’ index knowledge present.

The IHS Markit Flash Australia Composite Output Index fell to a five-month low of 45.3 in January from 54.9 in December 2021, as each non-public sector output and demand declined whereas employment progress floor to a halt.

The Australian financial system appeared to have bounced again within the second half of 2021. However a pointy rise in Omicron infections, which noticed a each day file of virtually 90,000 final week, has curbed progress, damage shopper confidence and enterprise optimism and affected provide chains, with supermarkets and the hospitality sector hit by anaemic workers ranges. These elements contributed to rampant value inflation.

The mining-rich state of Western Australia has continued to maintain its border closed to different Australian territories on account of the unfold of Omicron.

Jingyi Pan, an economist with IHS Markit, stated: “The Australian financial system had slipped from a state of sturdy restoration [at] end-2021 to being affected by the surge in Covid-19 infections firstly of 2022.”

Regardless of the disruption posed by Omicron, Pan stated there was trigger for optimism: “There have been some early constructive indicators of Covid-19 infections peaking in Australia which can supply some hopes for a turnaround within the state of affairs absent any additional restrictions imposed.”

Australia’s Fortescue to purchase Williams F1 battery and tech arm for £164m

Fortescue Metals Group’s inexperienced funding division has agreed to purchase the battery and know-how arm of the Williams Method One racing group for £164m.

The Australian mining group stated that it might use the battery programs and electrification know-how acquired by Fortescue Future Industries to assist obtain its goal to be carbon impartial by 2030.

It plans to make use of the brand new programs to adapt its 3km-long freight trains, heavy industrial tools and 400-tonne haul vans to scale back emissions at its mining websites, it stated.

The primary main venture shall be an electrical practice idea, Fortescue stated, which it expects to turn out to be a big improvement within the inexperienced industrial transport sector.

Andrew Forrest, chair and founding father of Fortescue, stated: “This announcement is the important thing to unlocking the method for eradicating fossil-fuel powered equipment and changing it with zero carbon emission know-how.”

Williams, one of the vital well-known names in automotive racing, was bought in 2020 to US fund Dorilton Capital for £152m in what was seen as an admission that the group might now not compete with higher funded rivals akin to Pink Bull and Mercedes-Benz.

What to look at in Asia as we speak

Macau: The Chinese language territory’s legislature will conduct its first studying of a playing invoice. The proposal would improve authorities oversight of the profitable trade, halve the length of on line casino licences to 10 years and regulate junket operations in one of many largest shake-ups within the on line casino hub.

Singapore: Singapore is about to launch its shopper value index for December, which is able to give a sign of the tempo of restoration in home financial exercise.

Taiwan: Taiwan will launch industrial manufacturing knowledge for December following a coronavirus-related disruptions, akin to workers shortages, to manufacturing actions.

Pakistan: The State Financial institution of Pakistan is predicted to face pat at its financial coverage announcement, on expectations {that a} world surge in commodity costs will ease as central banks flip hawkish.

Markets: Futures for Australia, Hong Kong and Japan sign the area’s essential bourses are set to say no after world inventory markets recorded their steepest weekly drops for the reason that begin of the pandemic because the Federal Reserve strikes to tighten monetary situations.

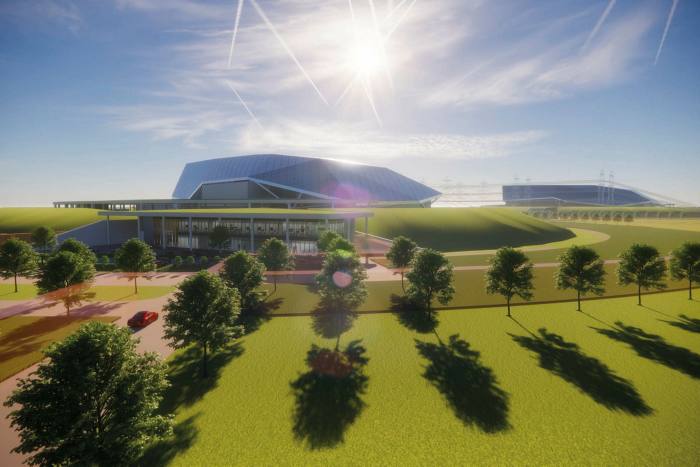

Rolls-Royce seeks bids for website to make small nuclear energy vegetation

Rolls-Royce, the UK aero-engine maker, has launched a contest between areas in England and Wales to be the situation of the primary manufacturing unit to construct a deliberate fleet of small nuclear reactors.

An trade consortium led by Rolls-Royce has written to a number of of England’s regional improvement our bodies and the Welsh authorities asking them to pitch for the manufacturing website, promising funding of as much as £200m and the creation of as much as 200 direct jobs.

The consortium secured £210m from the federal government final yr in the direction of the event of a fleet of mini-reactors after elevating the same quantity of personal sector funding.

UK prime minister Boris Johnson backed small modular reactors as a part of his 10-point plan for a “inexperienced industrial revolution” to assist meet the federal government’s 2050 internet zero carbon goal. The know-how is considered inside the authorities as a great way to create manufacturing jobs in addition to delivering on Johnson’s “levelling up” agenda to assist much less developed areas.

Below the plans, the reactors shall be inbuilt factories across the nation after which assembled on website, lowering the dangers and large prices of development of massive nuclear energy vegetation. The principle manufacturing unit will construct the heavy stress vessels which can be a part of the reactors.

Activist hedge fund Trian builds stake in Unilever

Nelson Peltz’s activist hedge fund Trian Companions has constructed a stake in Unilever, ratcheting up the stress on the FTSE 100 firm after its abortive pursuit of GlaxoSmithKline’s shopper well being enterprise.

Individuals with direct data of the matter advised the Monetary Occasions that the $8.5bn New York-based hedge fund had taken a place within the UK group’s shares, including to the challenges dealing with chief government Alan Jope.

The Unilever boss is already dealing with simmering shareholder discontent after its £50bn tried takeover of GSK Shopper Well being. He now confronts a fierce activist fund identified for demanding streamlining and governance reforms at shopper items teams together with Procter & Gamble, Sysco and Mondelez.

The folks with data of the stakebuilding didn’t present particulars on its dimension or when exactly it started.

The revelation comes after a tumultuous week for Unilever by which it was pressured to acquiesce to shareholder calls for that it halt its pursuit of GSK’s shopper well being enterprise after three failed bids.

The investor revolt final week drove Unilever’s share value down by as a lot as 11 per cent. It recovered a part of the losses after the corporate stated it might not increase its supply any additional.

Fed anticipated to again first pandemic-era rate of interest rise in March

The Federal Reserve is about to substantiate its plans to lift rates of interest in March for the primary time for the reason that onset of the pandemic, because the US central financial institution charts a extra aggressive course in the direction of financial tightening within the face of sticky inflation.

Fed officers will convene this week for his or her inaugural coverage assembly of 2022, the primary for the reason that central financial institution made its struggle in opposition to fast US shopper value progress its prime precedence.

The Fed has hardened its rhetoric in current weeks concerning the dangers posed by excessive inflation, with chair Jay Powell this month calling it a “extreme menace” to a sustained financial growth and a strong labour market restoration.

Its prime policymakers have additionally made it clear that they’re prepared to behave forcefully to make sure inflation doesn’t turn out to be ingrained, by contemplating elevating rates of interest “sooner or at a quicker tempo” than anticipated and swiftly shrinking the Fed’s huge stability sheet this yr.

Coupled with mounting proof that inflation is broadening out and the labour market is shortly therapeutic, the central financial institution is properly positioned to maneuver in March, many Fed officers and Wall Road economists argue.

[ad_2]

Source link