[ad_1]

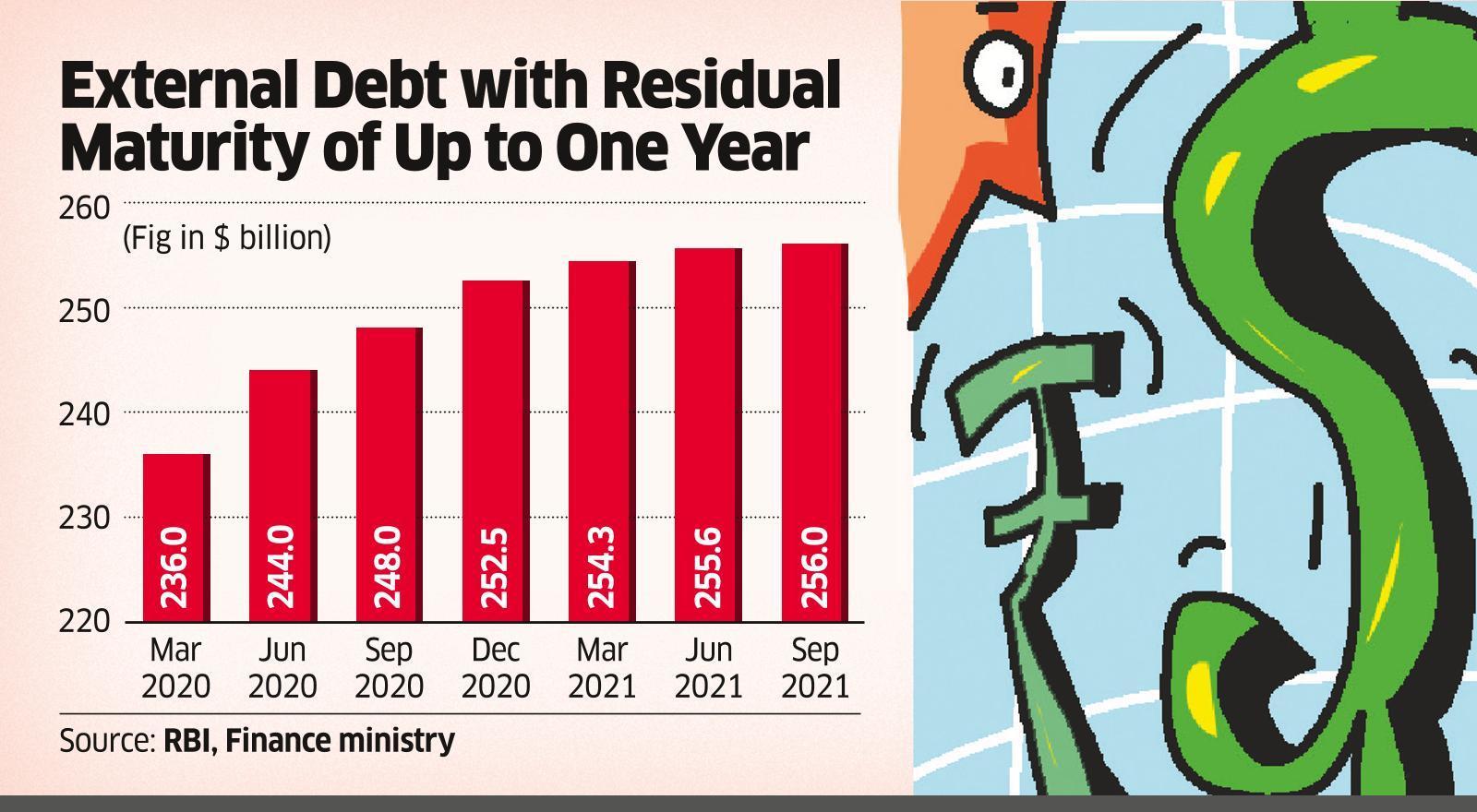

India’s monumental overseas change reserves faces its greatest take a look at within the subsequent 12 months as a report $256 billion of whole abroad debt comes up for reimbursement amid a doable flight of capital attributable to financial tightening by the Federal Reserve.

Exterior debt value $256 billion matures over the following 12 months, in accordance with the September knowledge launched by the finance ministry. That is about 43 per cent of the September exterior debt excellent at $596 billion.

Whereas the reserves nonetheless high $600 billion there could possibly be brief time period pressures on the foreign money because the RBI is prone to mood its interventions relatively than defend the foreign money.

The current US client worth inflation at 7 per cent at 39 yr excessive, the Fed is likely to be swifter in mountaineering charges than earlier anticipated that might lead to greater pull out of {dollars} from rising markets together with India. “The expectation of a fee enhance by the Fed and different superior economies is prone to intensify capital outflow, and that is prone to put stress on the change fee, present account deficit and costs” stated M Govinda Rao, chief financial advisor at Brickwork Scores.

India continues to be in a cushty place with reserves satisfactory to fund over 12 months’ imports and this brief time period debt is nearly 40 p.c of foreign exchange reserves then. ” Residual debt maturity is kind of manageable within the present surroundings each when it comes to composition and given our reserve place.” stated Rahul Bajoria, chief India economist at Barclays Capital.

Although reserves place is comfy in comparison with 2013, they might not develop as a lot, or as persistently, as they’ve within the final couple of years. “After all, the affect could also be lower than that of the 2013 taper tantrum, however the stress will probably be actual,” Rao stated. India added solely $48 billion to its inventory of reserves in 2021 in comparison with $124 billion in 2020.

Economists are additionally bracing for an general stability of funds deficit after nearly twelve quarters in March’22 if capital outflows surge as the present account is anticipated to widen additional on rising crude and commodity costs. Furthermore India faces a double blow with rising funding prices as rates of interest are set to rise as additionally greater quantities of greenback funds because the capex cycle is ready to choose up.

There will surely be an affect on the way in which it might intervene within the foreign exchange market. “We consider the RBI might now not proceed have to soak up extra overseas foreign money inflows by way of intervention, however might at occasions must promote reserves to stabilise the foreign money” , stated Bajoria.

Corporates can be caught on the incorrect foot in a state of affairs of a risky rupee with a downward bias, particularly those that haven’t hedged their overseas foreign money publicity. ” From the RBI’s perspective, it could possibly be actively monitoring hedging ratios of the company sector in order that they’re nicely coated” Bajoria stated.

Final two years have been benign for the rupee. “However this yr with higher volatility of the rupee you’d wish to be sure that corporates don’t make losses simply in case the rupee depreciates” stated Rao.

Additionally Learn:

[ad_2]

Source link