[ad_1]

The low-interest-rate setting and inflationary financial system have lowered the scope for traders to earn significant actual returns from fixed-income devices. A sudden fall in rates of interest could possibly be attributed to the RBI’s accommodative financial coverage, which was aimed toward boosting the financial system and mitigating the influence of COVID-19. However left in dire straits, regular-income seekers at the moment are searching for higher return alternatives.

In opposition to this backdrop, credit-risk funds have began stealing the highlight. These debt funds search to earn excessive returns by investing in decrease rated company bonds (AA & beneath), together with the unruly unrated papers. Nonetheless, in a seemingly kabhi khushi, kabhi gham spin, the journey of those funds to date has been fairly dramatic. The final three years have underscored the truth that credit-appraisal practices should not very environment friendly to detect monetary stress. Additional, the dearth of liquidity in lower-rated bonds enhances the chance. However then, from the funding perspective, the significance of yields cannot be neglected both. Fastened-income returns have shrunk massively throughout the globe, critically hurting those that depend upon them for his or her day-to-day earnings wants.

Most likely, subsequently, the credit-risk-fund class has been receiving steady web inflows since Might 2021 and garnered practically Rs 1,300 crore until September 2021 – a major turnaround after extended web outflows totalling Rs 57,000 crore between April 2019 and April 2021. So, are credit-risk funds a viable choice? Have they learnt sufficient from previous misadventures and emerged as a extra sturdy, investment-worthy different? Let’s discover out.

A chequered previous

Though the first-ever credit-risk fund got here into being in 2002, these funds gained prominence in 2014 when the toddling class had an enormous run. Throughout this era, rates of interest began falling and the targeted credit score technique emerged to seize the elevated urge for food for yields. Since lower-rated securities are extra liable to defaults, they supply larger returns to compensate for the extra threat. The technique proved to be rewarding, as these funds outperformed different comparatively high-quality debt funds, comparable to short-duration funds.

All of this acted as a tailwind for the class and AMCs began lining up these funds. Between 2014 and 2016, eight new schemes had been launched – nearly half of the full credit-risk funds accessible now. In only a matter of those two years, the property managed by these funds rose from Rs 16,000 crore to round Rs 55,000 crore by the tip of 2016 – an increase of a whopping 244 per cent! Persevering with its progress momentum, the fund’s AUM additional climbed to greater than Rs 94,000 within the third quarter of CY2018. See the chart ‘Credit score-risk funds on excessive and low’.

However, the following interval turned out to be a backflip for these funds, owing to the most important debt disaster that hit the Indian monetary trade and revealed a number of cracks in the best way these funds had been being managed. We’re speaking concerning the IL&FS debacle right here (naam toh suna hello hoga!). The episode put an enormous query mark on credit-assessment practices because the NBFC, regardless of being the best rated, defaulted on its obligations and it was solely after the mishap in September 2018 that its score was abruptly downgraded to default grade (‘D’) by score businesses. The incident was adopted by a collection of defaults, downgrades (DHFL, Essel Group, Vodafone Thought, YES Financial institution, and so forth.) and ensuing side-pocketing of portfolios, which forged a darkish shadow on debt mutual funds, notably credit-risk funds. To date, they account for 27 per cent of the whole segregated worth of practically Rs 6,000 crore, as coated in certainly one of our earlier article collection on side-pocketing.

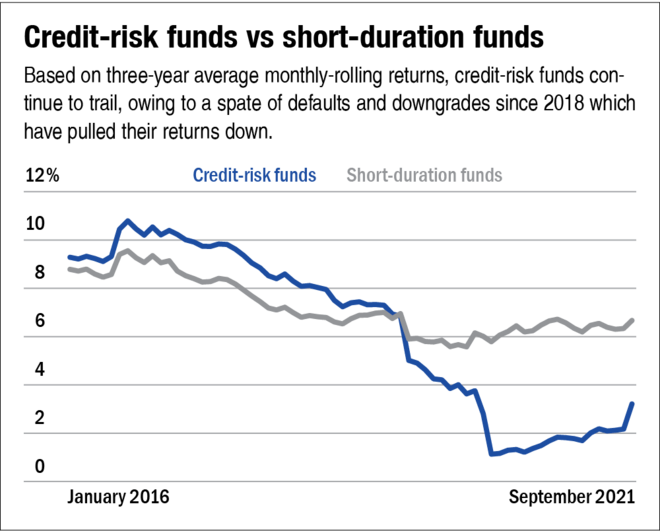

Additional, the closure of six yield-oriented Franklin schemes in April 2020 due to redemption stress and liquidity points acted as the ultimate nail within the coffin. The complete saga effectively illustrates what may doubtlessly occur with a major allocation to low-rated securities when many traders flip up demanding their a refund at a troublesome time. Whereas some funds had been capable of navigate effectively by all this mess, collectively as a set, the darker facet of those funds got here to mild. Consequently, the class AUM has nosedived during the last three years, whereas the returns proceed to path. Verify the chart ‘Credit score-risk funds vs short-duration funds’.

As a enjoyable reality, credit-risk funds had been known as ‘credit-opportunities funds’ earlier than the SEBI’s categorisation in October 2017. And now you understand why their names had been deceptive earlier! However have they learnt something from all these previous disasters? Are they safer now? We assess their funding case within the subsequent a part of this two-part article collection.

[ad_2]

Source link