[ad_1]

What a loud time it has been. Since about February 2020, when China’s virus began spreading world wide, buyers’ choices have been virtually fully primarily based on uncommon occasions. Though reacting to information has all the time seemed to be an integral a part of deciding whether or not and what to spend money on, the dimensions and nature of what has been taking place since is considerably uncommon. Over the past three a long time, all of us who spend money on the Indian fairness markets have been used to very large financial cycles, deep adjustments in the way in which the financial system works, an entire revolution available in the market’s operations and naturally, greater than a justifiable share of scams.

And but, the final year-and-a-half has been uncommon even by these requirements. The primary pandemic in trendy occasions, a world financial catastrophe precipitated – let’s be clear about this – not by the virus however by each authorities’s ham-handed efforts to deal with this virus, and to high all of it, a weird mass psychosis below which lots of people have come to consider {that a} digital ponzi scheme is definitely some type of a common foreign money of the long run which is able to change all currencies on the earth. Thrilling occasions, certainly.

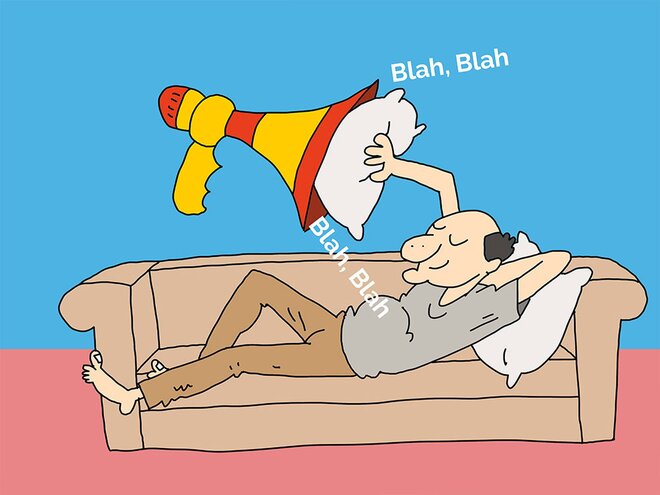

For buyers, the issue is to remain focussed on what’s regular and what’s noise. We reside in a time when there appears to be an enormous noise business on this world. Nevertheless, removed from this noise, our lives should go on. We’ve got to work each day, make a residing, lower your expenses, carry up our kids, care for them, educate them, save for our outdated age, pay medical payments, and many others. and many others. and many others.

On the degree of companies and whole economies too, there’s an equal dichotomy between the fact and the noise. The overwhelming majority of companies should quietly labour on day after day, produce items and companies that clients can pay for, try to get extra clients each day, try to enhance margins, hold prices below management, enhance merchandise, sustain with know-how and easily accomplish that many different issues which might be wanted to maintain the ball rolling, even when the trail is uphill.

As an investor, and at the same time as knowledgeable or a businessperson, it seems to be like that our principal job is to soak up and analyse the noise after which use it to make investing choices. Nevertheless, the actual job is to disregard the noise, or slightly, to determine what the noise is. At this second, our principal job as an investor is not to determine the brand new age IPOs of loss-making corporations, irrespective of how a lot noise the hype business has made round them. Most actually, it is not to pay critical consideration to noise about bitcoin or the way it will take over the world.

Past all that is the persistent actuality of companies that have to earn a living and have to go on making more cash each day. Nevertheless, essentially guided buyers know that they have to keep rooted to the fact of what’s taking place. The large image will not be all the time related. Typically, the person timber are extra vital than the forest. The large image, even past the noise, is that the fears of mid-2020 haven’t been realised and that fairness costs have run forward of themselves. Nevertheless, on the finish of the day, we spend money on particular person shares, not in information objects or in information.

It is nobody’s case that occasions should not have any affect. Nevertheless, it is unattainable for the person investor to map them sensibly to any motion that they’ll take. We have had a string of high-noise occasions over the previous couple of years, emanating from numerous crises across the globe. Nevertheless, I can not recall any the place the apparent first response has finally confirmed to be something however a counterproductive knee-jerk response.

[ad_2]

Source link