[ad_1]

This week, govt launched a long-awaited portal referred to as RBI Retail Direct which permits traders to purchase and promote varied sorts of govt bonds on-line. You possibly can straight purchase the bonds with none middleman and with none Demat account. All you might want to do is open a Retail Direct Gilt (RDG) account on the web site.

The retail traders will be capable of purchase bonds in main and secondary markets. Main market means when a bond is issued for the primary time and secondary market means shopping for and promoting of bonds after they’re issued. Word that there isn’t a middleman/agent on this and you’ll be straight coping with RBI right here and all of your bonds might be with RBI itself. That is 100% FREE service and there aren’t any expenses at any stage.

What sort of bonds you should buy on RBI Retail Direct?

It is possible for you to to purchase varied G-Sec bonds issued by govt like

- RBI Bonds

- Central Govt Bonds

- State Govt Bonds

- Sovereign Gold Bonds

- Treasury Payments

Who can open the RDG account?

As per the RBI notification, the retail investor wants the next to open an account.

- Rupee financial savings checking account maintained in India;

- PAN issued by the Revenue Tax Division;

- Any formally legitimate doc reminiscent of Aadhaar, Voter ID for KYC functions;

- Legitimate e-mail ID; and

- Registered cellular quantity

Different factors

- The account could be opened in single or joint names

- NRI’s can open this account, offered they’re able to meet the eligibility standards

What sort of Govt bonds can be found to put money into?

IF we depart apart the quick time period bonds, it is possible for you to to purchase bonds with 5-40 yrs of tenure. Govt of India points very very long run bonds additionally like for 30 yrs, the place if you happen to purchase the bond at this time, it would mature after 30 yrs and it is possible for you to to get the curiosity (primarily referred to as coupon charge) for each 6 months. The speed of coupon is mounted for you, so in a manner, you’ll be able to lock within the returns as soon as you purchase the bonds

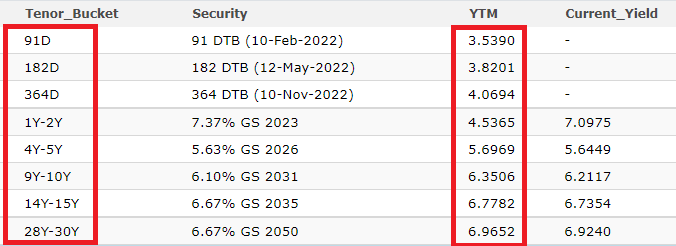

Right here is an indicative desk that offers you the concept of the yield as of fifteenth Nov 2021

How one can register on RBI Retail Direct Portal?

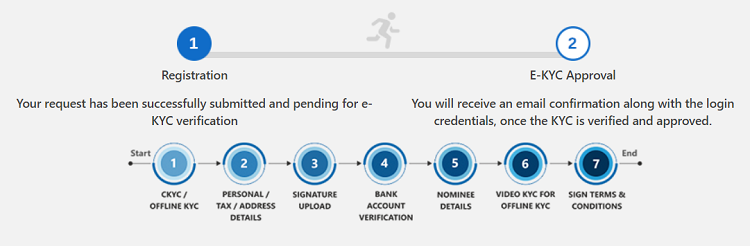

Traders can register on the net portal by filling up the net kind and utilizing the OTP obtained on the registered cellular quantity and e-mail ID to authenticate the data.

Upon profitable registration, ‘Retail Direct Gilt Account’ might be opened and particulars for accessing the net portal might be conveyed by way of SMS/e-mail.RDG Account shall be accessible for main market participation in addition to secondary market transact

- Go to https://rbiretaildirect.in/#/rdg-account-registration

- Select Single Holder or Joint Holder from the dropdown

- Enter Identify (higher enter as per PAN)

- Enter PAN

- Enter E mail ID and Generate OTP to validate

- Enter a Cellphone quantity and generate OTP and validate

- Select Date of Beginning

- And at last, enter a login title

On the subsequent web page, you’ll get the appliance request quantity

- Click on on “Provoke KYC course of” button

- Be prepared with the next issues

- Scanned Picture of Signature

- Scanned Picture of Cancelled Cheque

- Any Legitimate Handle Proof

- On the subsequent web page, based mostly in your PAN, you probably have a CKYC quantity, your particulars might be fetched like your date of beginning and different particulars

- On the subsequent web page enter different particulars like private particulars, nominee particulars, checking account, signature add, cancelled cheque,. nominee particulars together with nominee financial institution particulars and so forth

- Lastly, you might want to eSign the contract in direction of the tip

- A signed contract is shipped to you over your e-mail

- Essential: Your login and password particulars might be despatched to you after 3-4 days, which was not clear on the portal, however I confirmed this by calling their buyer care.

My Expertise with the registration course of

I personally registered on the platform underneath a single title and my total expertise was fairly passable. The second I entered the PAN quantity, it fetched the CKYC quantity linked after which fetched all different particulars like Adhaar quantity, aadhaar picture, tackle and so forth. I simply needed to add my signature and cancelled cheque.

The registration course of was a bit prolonged and can take time (15-20 min). Some individuals on Twitter mentioned that it was fairly lengthy for them they usually had been annoyed, however for me, it labored advantageous. Dealing in bonds straight with RBI could require an excessive amount of documentation and it’s okay if it’s prolonged a bit at the beginning. It’s a one-time course of anyhow!

Why did govt introduced this platform?

This can be a huge growth in our nation as there was no straightforward manner for a retail investor to take a position straight in govt bonds with RBI straight. There have been platforms that had some methods of shopping for bonds, however nonetheless, it was by no means complete. With this platform, now retail traders will be capable of promote the bonds on to different traders (nameless transaction) straight from the platform itself.

The entire bond market will increase as all retail traders have a option to entry it. Additionally, the govt. will be capable of increase the funds for infrastructure by issuing the bonds to a bigger market.

How are you going to promote the bonds later?

There’s a screen-based digital nameless order matching system referred to as NDS-OM by RBI which can be utilized to promote the bonds to different entities. Until now it was solely accessible to huge institutional gamers, however with this platform, all of the customers already registered will get entry to this platform the place they will commerce the bonds. It is possible for you to to place an order for promoting/shopping for the bonds on the platform and if it matches with different customers (just like the inventory market), the transaction will undergo.

Appropriate for senior residents and warranted revenue seekers

Whereas anybody can make investments the govt. bonds, it’s essential to notice that the cash might be locked in for a really very long time if you happen to purchase long run bonds and revenue in type of curiosity might be paid on a bi-yearly foundation. So it’s best suited for senior residents who need to park some a part of their portfolio into assured bonds from govt to generate some common revenue.

Nevertheless shopping for very quick time period bonds doesn’t make sense, as a result of the yields should not that enticing and anyhow there are easier choices like debt mutual funds or banking merchandise like mounted deposits.

The most important drawback of the platform for retail traders is that the bonds market will not be fairly liquid as of now for small traders. So if you wish to promote your bonds and urgently want cash, it would occur that you’re caught as a result of there isn’t a one else on the lookout for shopping for.

Ultimate factors

Word that this platform is kind of new and we will give some extra time for it to evolve and issues to get clear. There could be small bugs within the platform, so be somewhat affected person. This platform provides a brand new manner for retail traders to put money into debt markets

[ad_2]

Source link