[ad_1]

Whats up pals, and welcome again to Week in Evaluate!

Final week, we talked about Apple’s subscription dependancy. This week, I’m diving deep into whether or not there’s truly any which means to tug out of the NFT mania of 2021.

Should you’re studying this on the TechCrunch website, you may get this in your inbox from the publication web page, and comply with my tweets @lucasmtny

Picture by way of OpenSea

the massive factor

The NFT market continues to be defying cause, however then once more that’s type of its factor. However one factor I’m particularly uncertain about recently as I see JPGs proceed to promote for hundreds of thousands of {dollars} is… does any of this truly matter?

I’ve spent loads of time over the past yr grappling with the NFT market, at occasions I’ve misplaced sleep over it. As a reporter regularly masking this market, I don’t personal or commerce the little pictures myself, however that hasn’t stopped me from obsessing over the fluctuations of their costs and scouring Discords attempting to comply with the developments. I’ve tuned into numerous Twitter Areas and lurked subreddits attempting to know all of it. I’ve additionally executed my finest to maintain most of that out of this article — it’s a bizarre area of interest curiosity that’s particularly area of interest in the meanwhile — however as Bitcoin flirts with a brand new all-time-high and the NFT mania persists, simply take into account this a well timed replace.

So, previously month, buyers have continued dropping billions upon billions of {dollars} on NFTs. OpenSea has seen greater than $3 billion in transaction quantity previously 30 days, and that quantity is definitely approach down fairly a bit from August, showcasing simply how a lot off-peak cash continues to move into NFTs.

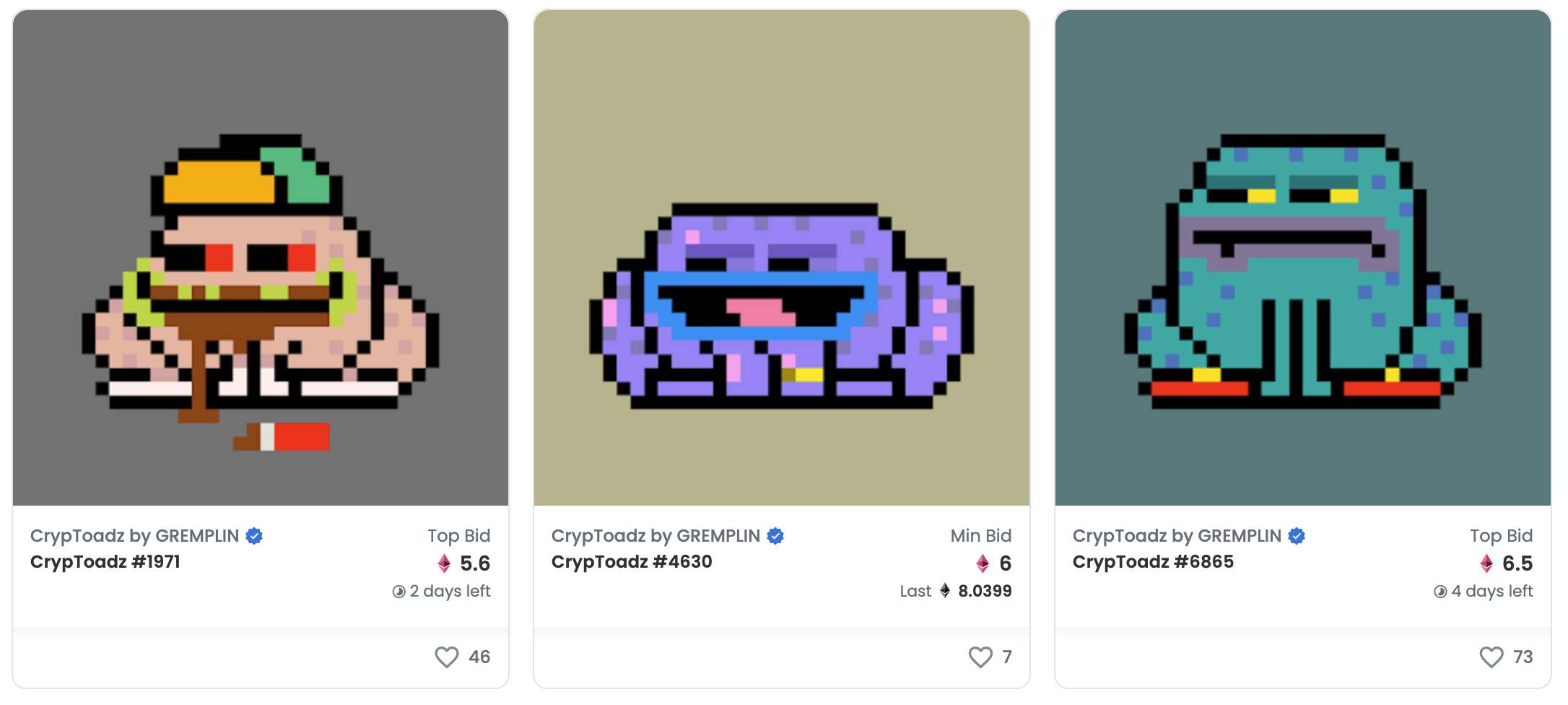

All of that cash has gone to some colourful locations. One of many greater success tales of the previous month has been the platform CrypToadz which buyers dumped $100 million into. They appear to be this. Previously couple weeks, a model new undertaking known as MekaVerse noticed $130 million in transaction quantity. They’re a bit prettier, however would you spend greater than $8,000 on one? The platform Cryptoslam (the place I pulled many of the knowledge I reference right here) is monitoring 163 platforms which did greater than $1 million in quantity previously 30 days, a quantity which doesn’t even account for particular person artists promoting their work on platforms like OpenSea.

Now, there are two extremely completely different segments of NFT communities on the market, larger-scale NFT tasks like Axie Infinity and NBA Prime Shot with tens and lots of of hundreds of customers and smaller-scale NFT tasks like CryptoPunks and Artwork Blocks with only a few hundred or thousand house owners. Bigger-scale tasks can symbolize extra conventional gaming titles with extra advanced in-game economies whereas smaller-scale tasks merely look extra like tremendous artwork markets teamed with unique social golf equipment. Some smaller-scale tasks have the ambition to ultimately turn into larger-scale ones, however many have capped the variety of NFTs of their tasks and are designed to be unique.

Previously 30 days, Axie Infinity did greater than $500 million in gross sales unfold throughout almost 2 million transactions and over 350,000 consumers. On the flip facet, CryptoPunks did $200 million in gross sales throughout that very same time-frame throughout 484 transactions and 309 consumers.

Typically, once I’m speaking about a few of these massive gross sales from smaller-scale tasks with pals of mine, the very first thing they point out is how that is most likely all simply cash laundering. Whereas I’d definitely think about some of that is happening, that’s finally a way more boring rationalization than my finest guess of what’s actually occurring, which is {that a} group of a number of thousand buyers have individually rationalized irrational investing. They simply occur to have chosen to take action by means of shopping for pixel artwork and drawings of animals.

Whereas some buyers would possibly recommend {that a} handful of the earliest NFTs maintain intrinsic worth as historic objects, there are many model new NFT tasks incomes ten-million greenback valuations on day one with low quantities of effort and creativeness.

It’s seemingly the results of momentum from awe-struck retail buyers coming into a market crammed with huge quantities of wealth being generated and re-invested by Ethereum millionaires who can massively overpay for offers whereas pushing the implied worth of the objects, the tasks, your complete NFT market and the value of Ethereum up concurrently. Most of those buyers are additionally individuals who have held onto Ethereum by means of its waves and have grown basically averse to cashing out, which means they’re much less prone to promote the NFTs they purchase until they’re simply attempting to purchase one other costlier NFT or have been made a proposal too good to refuse. Consequently, many high-value smaller-scale tasks keep liquid on the low-end whereas fewer gross sales of the rarer gadgets underpin the large valuations of the tasks and people occasional massive buys preserve pushing costs greater.

All of this babbling of mine is to say, what’s taking place right here is unusual. It’s additionally an extremely great amount of noise principally coming from just a few thousand consumers.

However when most buyers speak about mainstream adoption and future use instances, they’re trying on the creation of extra larger-scale tasks like Axie and Prime Shot which embody lots of the technical bells and whistles of crypto economics in additional user-friendly packages that may attain the mainstream. NFTs as an idea for driving extra advanced digital economies is, certainly, actually fascinating, however I don’t assume there are as many takeaways to attract from billions of {dollars} flowing into digital artwork and these smaller-scale tasks like CrypToadz as many crypto buyers and enterprise capitalists are attempting to persuade themselves.

Solely three NFT platforms on the market had greater than 10,000 lively distinctive consumers of their group previously 30 days, and whereas the successes of platforms like Axie Infinity are positively price dissecting, it additionally appears clear we’re within the midst of a speculative frenzy and it’s not a very simple time to attract sober conclusions about what all this insanity means for the way forward for the online.

Ali Balikci / Anadolu Company

different issues

Listed below are just a few tales this week that I feel it is best to take a better have a look at:

Apple most likely received’t be supporting alternate App Retailer funds anytime quickly

Apple did their finest to persuade the press and public that the courtroom’s determination in its authorized combat with Epic Video games was an outright win for Apple, however over the weekend they quietly introduced that weeks later they’re interesting the choice and asking the courts to place the ordered adjustments to permit various funds inside iOS apps on maintain.

Apple placed on a cool demeanor after this ruling, nevertheless it’s obvious that there are billions on the road for Apple if this order stands. Subsequently delaying its rollout means billions of {dollars} that aren’t going to different fee suppliers or staying in developer coffers. Epic had already appealed the choice as effectively, hoping to strive for a extra favorable ruling, nevertheless it’s clear that anybody hoping for a speedy decision shall be upset — as is usually the case in company legislation.

Nintendo reshapes its SaaS ambitions

Nintendo has been and possibly all the time shall be a little bit of an odd massive firm. They’ve been immune to new developments in gaming and once they embrace them, they don’t essentially do an ideal job capitalizing on them, and but their mountain of beloved IP permits them likelihood after likelihood to get issues proper. This week, they introduced extra particulars on their new annual membership known as Nintendo Swap On-line+ which, for $50 per yr will give players a deeper array of content material. That’s a very good deal greater than the usual $20 per yr for the common Nintendo Swap On-line subscription, however past expanded digital console help for an unannounced array of N64 video games, it’s not clear what precisely the promote is for shoppers.

Curiously, they’re launching the service with free entry to a significant replace for Animal Crossing: New Horizons. It’s a play that solely works while you’re Nintendo and the penetration of your first-party titles is so extremely excessive amongst device-owners (and particularly doubtless subscribers). Nintendo has bought greater than 3.4 million copies of the brand new Animal Crossing title globally.

Microsoft pulls LinkedIn from China

It’s been a very turbulent time for tech corporations throughout China as authorities regulators crack down and the outlook clouds for giant platforms there. This week, Microsoft introduced that it’s pulling LinkedIn out of China, detailing that LinkedIn was now “going through a considerably more difficult working surroundings and larger compliance necessities in China.” LinkedIn didn’t have an enormous presence in China so this received’t make main waves, however as different American tech giants are pressured to make main changes to their China technique, this marks yet one more datapoint within the cooling of relations between China and the West.

The LinkedIn’s of the world don’t maintain a lot sway in China, essentially the most curious little bit of that is how this regulatory upswing ultimately impacts Apple which does maintain loads of affect. Whereas officers most likely aren’t eager to jam them up, the previous yr has proven that China’s regulators have loads of surprises up their sleeves.

Picture Credit: Manuta / Getty Photos

added issues

A few of my favourite reads from our newly-renamed TechCrunch+ subscription service this week:

Inside Plaid

“…Visa and Plaid might need chosen to go their very own methods in the long run, however the yr wasn’t a complete loss for the information connectivity startup: Plaid claims its buyer depend grew 60% in 2020, and firm execs say it has had comparable development thus far this yr….”

Founders ought to use predictive modeling to fundraise smarter

“Extra capital is flooding into development fairness at earlier phases, and it’s taking place quicker than ever earlier than. However even with the rampant enthusiasm for pouring greater fairness checks into startups, founders at the moment are in a singular place in time the place they will assume otherwise about capitalize their corporations….“

How one startup boosted productiveness with ‘get s*** executed’ day

“…To enhance our productiveness, we launched a Getting Shit Executed Day (GSDD): Our workers outline clear-cut targets and obtain particular, often non-trivial, duties with little to no communication concerned (we encourage our workers to keep away from social media on today, however we aren’t trying over their shoulder). The aim of GSDD is to extend the period of time we spend in deep work by minimizing distractions for at some point each different week…”

Thanks for studying, and once more, should you’re studying this on the TechCrunch website, you may get this in your inbox from the publication web page, and comply with my tweets @lucasmtny

Lucas Matney

[ad_2]

Source link