[ad_1]

October looms massive in U.S. inventory market lore. But there’s just one means the month lives as much as its outsized status: It actually is especially unstable.

Earlier than I summarize the historic knowledge supporting this status, let me first dispel two Wall Road tales about October that change into myths.

Fantasy #1: October is the month with essentially the most main development adjustments

That is merely not true. In line with the bull and bear market calendar again to 1900 maintained by Ned Davis Analysis, 9 adjustments to the U.S. market’s main development occurred in October. September is available in larger with 10, whereas November is tied with October at 9.

The typical variety of development adjustments throughout all months is between six and 7. None of those three months’ totals differs from the typical to a statistically important extent.

The supply of this fantasy could also be a associated perception that October is a so-called “bear killer.” It’s true that an above-average variety of bear markets within the Ned Davis Analysis calendar did come to an finish throughout October: eight, versus an all-month common of between three and 4. However this historic factoid sheds no gentle on the U.S. inventory market in October of this 12 months, except you suppose shares are already in a bear market.

To make sure, the inventory market might nonetheless expertise a development change this October. But when it does, it gained’t be as a result of it’s the tenth month of the 12 months.

That is vital to remember as a result of it’s human nature to ascribe which means to random occasions. For instance, I argued a month in the past that there was no good purpose to count on September to be a foul month for the U.S. market. My argument nonetheless stands, regardless that the month did change into tough for shares, with the S&P 500

SPX,

shedding 4.8%.

If I informed you that there’s no purpose to count on a coin flip to come back up heads, you wouldn’t conclude I used to be fallacious even when the coin nonetheless did produce a heads. The identical precept applies right here.

Fantasy #2: October is the tip of the 6-month seasonally unfavorable interval

Really this isn’t completely a fantasy. It’s simply true in solely one among each 4 years, and 2021 isn’t one among them.

I’m referring to the well-known six-months-on, six-months-off seasonal sample that goes by the names “Promote In Could and Go Away” and the “Halloween Indicator.” As I’ve written earlier than, this sample’s statistical assist traces to the third 12 months of the so-called presidential election 12 months cycle.

The third 12 months of the presidential cycle so dominates the “Promote In Could and Go Away” sample that, upon focusing solely on the opposite three years, there isn’t a statistically important distinction between the typical Could-through-October and November-through-April returns. The underlying knowledge is summarized within the desk under, based mostly on the Dow Jones Industrial Common

DJIA,

again to its creation in 1896.

| Common November-through-April return | Common Could-through-October return | Distinction in returns is important on the 95% confidence degree | |

| All years | 5.3% | 1.9% | Sure |

| Third years of presidential cycle | 10.7% | 0.0% | Sure |

| First, second and fourth years of presidential cycle | 3.6% | 2.5% | No |

Preserve this in thoughts this month whenever you hear funding advisers making an attempt to pinpoint the day in October through which it’s best to leap the gun on the official starting of the seasonally-favorable interval — Halloween. In actuality, as a result of there isn’t a seasonal sample starting in November, there’s nothing to get a leap on.

October is a very unstable month for shares

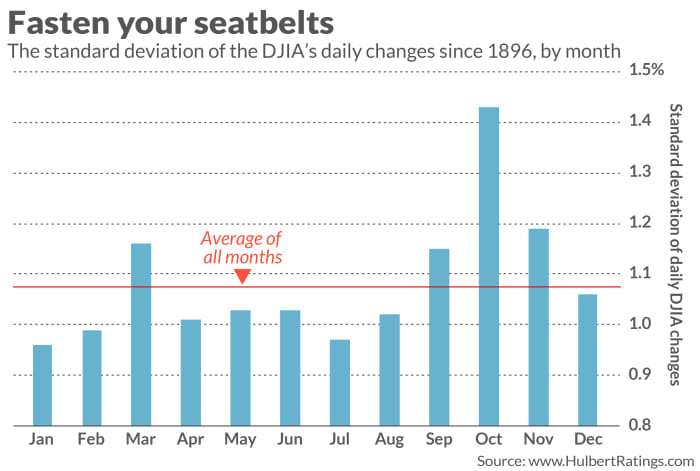

Having distributed with these two myths, we will give attention to what’s true about October: It’s he most unstable month of the calendar, as you may see from the chart under:

Not like what we discovered with the “Promote In Could and Go Away” sample, October’s above-average volatility isn’t a operate of only one 12 months of the presidential cycle. It’s additionally been constant: If we halve the interval for the reason that Dow’s creation, October seems to be essentially the most unstable in each the first- and second halves. Moreover, the month stays on the high of the volatility rankings even when we take away 1929 and 1987 from the pattern — the years through which the 2 worst crashes in inventory market historical past occurred, each in October.

I’m not conscious of any theoretical rationalization for why October needs to be so unstable, and would usually suggest ignoring any sample for which such an evidence is lacking. However as a result of larger volatility could be attributable to nothing greater than the expectation of upper volatility, there’s a superb chance that October’s status for volatility might persist.

There are a few funding takeaways. The primary is to not let your self be spooked by the elevated volatility. Maintain on tight and don’t get thrown off of your funding technique.

Second, for these of you with a excessive urge for food for danger, is perhaps to take a place in a number of of the exchange-traded funds that rise when volatility spikes. The one with the best belongings below administration is the iPath S&P 500 VIX Brief-Time period Futures ETN

VXX,

Be aware rigorously that this product (and different exchange-traded merchandise that revenue from volatility) is appropriate for very short-term trades solely, since these investments lose a small quantity each day even when volatility stays fixed.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Rankings tracks funding newsletters that pay a flat price to be audited. He could be reached at mark@hulbertratings.com

Additionally learn: Why shares might lose reputation because the market’s ‘presidential election cycle’ enters its second 12 months

Plus: The S&P 500’s vitality sector was the one port in a raging September storm for shares

[ad_2]

Source link