[ad_1]

Round three-decade-old Indian mutual fund {industry} has grown by leaps and bounds and is slated to make big strides within the years to return. With the technological developments alongside the way in which, the {industry} has tailored itself to serve prospects higher. The benefit of mutual fund investing, particularly, has benefitted lots of people. With regards to shopping for a mutual fund, traders at the moment have many choices to select from, whereby the entry of Fintech gamers has acted as a cherry on the cake.

Nonetheless, shopping for a fund is simply step one. What follows is a sequence of providers that an investor could require over their investing journey, akin to, Systematic Switch Plans (STPs), Systematic Withdrawal Plans (SWPs), an outline of complete holdings, the necessity to change checking account particulars, e-mail tackle, or nominee particulars, transmission of models after the dying, and so forth. That is the place the bottom actuality turns soiled. Individuals typically must go completely different locations to get finished with every of their particular wants. Additionally, the method adopted is completely different throughout numerous AMCs. Thus, to make the end-to-end mutual fund investing expertise extra handy for the traders, SEBI, in its order within the month of July, requested Registrar and Switch Brokers (RTAs) to develop a standard industry-wide platform.

MF Central – The all-in-one portal

Following the SEBI directive, CAMS and KFintech, the 2 largest RTAs in India, have collectively developed MF Central with the assist of depositories and AMFI, as a unified hub for traders. As written on its web site, “Leveraging finest in school know-how, MF Central brings ease, comfort, and pace to your service necessities throughout all of the Mutual Funds.” This portal guarantees to supply seamless providers conveniently by preserving traders because the central focus level. It’s solely free and can change into totally purposeful by the top of this 12 months, panning out in three phases.

The primary section has gone stay at the moment, permitting traders to get a consolidated view of their portfolio, place service requests like change within the cellular quantity, consolidation of folios, and so forth., obtain Consolidated Account Assertion (CAS), and think about unclaimed payouts. The second section would enable folks to carry out the identical duties by way of a cellular app, and the third will lastly facilitate shopping for and promoting mutual funds.

Here’s what’s in it for the traders –

Simple login: You may shortly get began with this new portal in lower than 5 minutes. Simply go to their web site, click on on enroll, enter your PAN and cellular quantity, adopted by OTP verification, set your password, and 5 safety questions. That is it. Subsequent time onwards, you possibly can log in by clicking on sign up, enter your PAN and password/generate OTP, and reply a safety query already set by you to get entry to the platform.

Consolidated view of your portfolio: You may see the main points of your complete mutual fund holdings held in each assertion of account (SOA) and Demat kind. That is just like what traders get by means of CAS. Nonetheless, CAS is generated month-to-month or must be accessed by way of mail-back providers, however with MF Central, you get to view your portfolio on a real-time foundation. In actual fact, you can too obtain CAS in just some clicks for any interval of your selection.

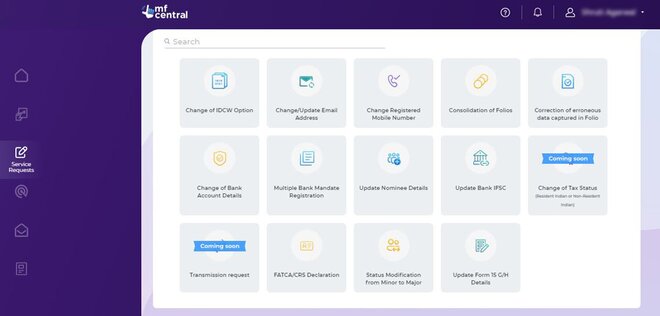

Service requests: The sweetest spot of MF Central lies within the comfort folks get right here in putting all varieties of mutual fund service requests underneath one roof. It permits non-financial transactions like updating e-mail tackle or cellular quantity, consolidating mutual fund folios, correcting any folio information, altering checking account particulars, including a brand new account, updating nominee particulars, to be simply executed throughout all fund homes collectively. This generally is a game-changer for retail traders as in any other case, it’s inconvenient due to completely different processes adopted all over the place. It’s also possible to observe the standing of all of your service requests in a single place. Traders can be allowed to put transmission requests in phase-2, which is anticipated to be rolled out by the top of October or mid-November this 12 months.

Unclaimed payouts: That is one other useful function of MF Central. Traders can see the main points of unclaimed payouts like redemptions or dividends, which aren’t encashed by them/credited to their checking account, throughout all AMCs in a single window. With phase-3 anticipated to go stay by December 31, 2021, traders can even be allowed to assert these payouts on the platform.

Shopping for and promoting transactions: The ultimate leg of the brand new portal would allow monetary transactions for the customers throughout each web site and cellular functions. This is able to enable traders to purchase, swap and promote mutual fund models.

Other than this, MF Central would additionally allow traders to lodge and observe complaints made to any fund home or SEBI and entry different stories akin to capital positive factors/losses.

With a contemporary and easy web site interface and one-stop built-in and harmonised providers, this new platform absolutely appears to reinforce traders’ expertise with mutual fund investing. If this portal lives as much as what it guarantees, traders will be capable to carry out monetary and non-financial transactions with the snap of a finger, which is strictly what the brand of this new initiative is.

[ad_2]

Source link