[ad_1]

Prashant Jain, one of the vital celebrated and longest serving fund managers within the Indian asset administration trade, has resigned from HDFC AMC after his 19 years stint on the fund home.

Mr Jain, who was a Chief Funding Officer (CIO) at HDFC AMC, began his cash managing work from SBI Mutual Fund after which moved to twentieth Century Mutual Fund, which was later acquired by the Zurich Mutual Fund.

Prashant Jain holds a bachelor’s diploma in expertise from Indian Institute of Expertise, Kanpur and a publish graduate diploma in administration from Indian Institute of Administration, Bangalore. He was appointed because the CIO at HDFC AMC in 2004 – a yr after becoming a member of the fund home.

Prashant Jain used to handle three funds specifically, HDFC Flexi Cap Fund, HDFC Prime 100 Fund and HDFC Balanced Benefit Fund, collectively managing Rs 89,500 crore.

The Balanced Benefit Fund was launched as Centurion Prudence Fund in January 1994 and was renamed to Zurich India Prudence Fund after which to HDFC Prudence Fund. The identify was final modified to HDFC Balanced Benefit Fund in June 2018.

From a small starting of Rs 35.5 crore in belongings in February, 1994, HDFC Balanced Benefit Fund has develop into one of many largest balanced benefit funds in India with an AUM of over Rs 43,000 crore. The fund has given returns of 17.87 per cent since its inception.

Prashant Jain’s strengths lies in navigating the schemes by way of numerous market cycles with a disciplined strategy to investing and at all times having long-term focus in thoughts whereas managing buyers’ cash.

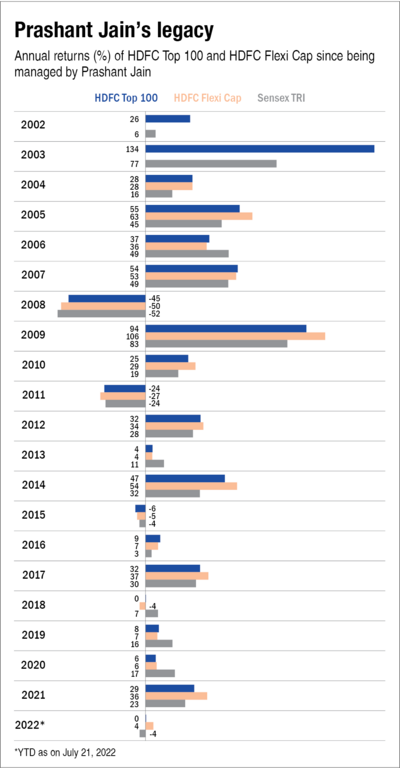

HDFC Prime 100 Fund, launched in October 1996 and managed by Mr Jain from January 2002, has given returns round 21 per cent CAGR as in opposition to 16.56 per cent of Sensex TRI. Even HDFC Flexi Cap Fund (erstwhile HDFC Fairness) has rewarded buyers with returns of 20.74 per cent since Mr Jain began managing the fund in June 2003.

One of many main traits of Mr Jain whereas managing cash was to have unshakeable perception in his inventory picks and never be perturbed by the noises out there. A number of the bets which Prashant Jain took in his three-decade previous profession generally is a case examine on how one can steer clear of sectors that are overheated.

Prashant Jain has managed to keep away from large disasters when a number of different fund managers have been taking part in with the momentum out there. Amidst the peak of the tech bull market within the late 90s, Mr Jain began promoting IT shares in 1999 which triggered ache within the quick run, however because the IT bubble burst in early 2000, Mr Jain was relieved, which result in immense positive aspects in subsequent years for his buyers.

Related story was additionally witnessed in 2007, when he stayed away from actual property shares. Once more, quick time period returns have been impacted, however returns in following years have been fairly robust.

However there was additionally a interval of underperformance for Prashant Jain’s funds as a result of his resolute funding type. His earlier calls of investing in some public sector undertakings (PSUs) didn’t work for a number of years. However in the previous few months, the theme has began taking part in out and the funds have rewarded.

Within the final one yr, all of the three funds managed by Mr Jain have ranked among the many prime funds of their respective class. To provide an instance, HDFC Flexi Cap Fund has given returns of 14.94 per cent within the final one yr as in comparison with the class common of 4.56 per cent.

With the exit of Prashant Jain from HDFC, there will likely be large footwear to fill for the subsequent rungs of fund managers on the fund home. Nevertheless, buyers shouldn’t be overly involved as HDFC AMC has a pedigree of skilled and competent fund managers like Chirag Setalvad and Gopal Agrawal at its helm.

HDFC AMC, in its announcement on inventory exchanges, said that they’ve appointed Chirag Setalvad as Head – Equities and Shobhit Mehrotra as Head – Mounted Earnings. Each will likely be reporting to Navneet Munot, Managing Director & CEO of the fund home. Future plan of action from Mr Jain just isn’t but recognized.

[ad_2]

Source link