[ad_1]

NEW DELHI: The rupee’s slide might have some implication for inflation administration. However general, the macroeconomic fundamentals of the financial system stay sturdy to cope with short-term shocks. For now, essentially the most essential affect could be on inflation because the nation imports practically 80% of its crude oil wants. This might imply that imports would turn into costlier and journey by way of the worth chain to boost enter prices.

Whereas retail inflation has proven some indicators of moderation in current weeks, the rupee depreciation might affect the general inflation scenario. Slowing of commodity costs can also assist cushion the affect. “It compounds inflation drawback by elevating price of imports and partially mutes the affect of responsibility cuts on imports,” mentioned Crisil’s chief economist D Okay Joshi. He added rupee’s depreciation raises debt servicing prices for firms as 44% of abroad industrial borrowings are unhedged.

Whereas exports would rely upon the worldwide demand scenario moderately than the rupee’s depreciation, the commerce deficit is barely seen to be correcting it- self at a modest tempo. The commerce deficit widened to $25. 6 billion in June, led by surging crude oil & coal imports, and piling stress on the rupee. The volatility in change price additionally has implications for policymakers as opposition events will step up assaults on the federal government for the hovering inflation and a weak forex. “Quick phases of sharp depreciation could be tolerated. However continued weakening of the rupee can intensify macro issues. Previous episodes of forex volatility additionally inform us that the rupee can bounce again when underlying circumstances stabilise,” mentioned Joshi.

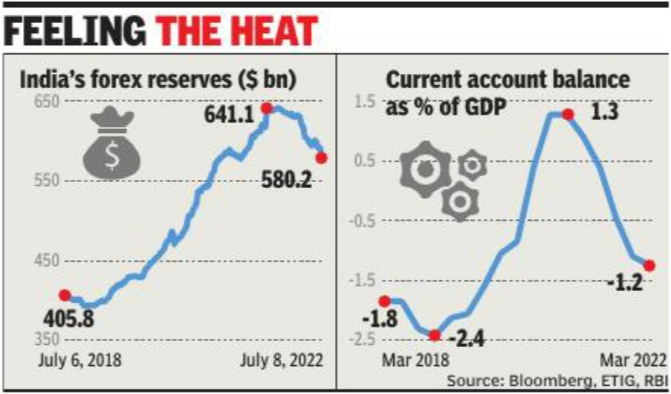

The Centre and the RBI have each reiterated that the financial restoration is holding up towards world headwinds. The RBI and the federal government have taken a number of measures to extend greenback inflows. The rupee’s slide additionally has implications on foreign exchange reserves. Based on a finance ministry report, to satisfy the financing wants of a widening CAD and rising FPI outflows, foreign exchange reserves — within the six months since January — have declined by $34 billion. The RBI has spent greater than $40 billion in the course of the present fiscal defending the rupee.

[ad_2]

Source link