[ad_1]

Knowledge out Wednesday will doubtless pile extra stress on Financial institution of Canada

Article content material

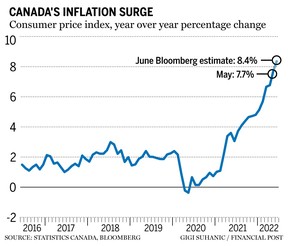

Canada’s predominant gauge of inflation doubtless topped eight per cent in June, complicating Financial institution of Canada Governor Tiff Macklem’s efforts to persuade companies and households that value pressures will ultimately ease.

Commercial 2

Article content material

Statistics Canada is scheduled to replace its shopper value index on Wednesday morning. The month-to-month reviews have change into sources of alarm, because the year-over-year change has exceeded three per cent — the higher restrict of the Financial institution of Canada’s consolation zone — for greater than a yr.

The Could shopper value index elevated 7.7 per cent from a yr in the past, and most economists anticipate that the acquire breached eight per cent final month. Such a studying could be per the Financial institution of Canada’s prediction for inflation to hover round eight per cent for the subsequent few months, earlier than declining to a few per cent within the latter half of the yr.

Nevertheless, inflation that quick would put further stress on the central financial institution to ship one other supersized fee hike at its subsequent interest-rate choice in September. The Financial institution of Canada shocked many observers final week with a full-point enhance, the largest since 1998.

Commercial 3

Article content material

Throughout a webinar final week with the Canadian Federation of Unbiased Enterprise, Macklem reaffirmed the central financial institution’s dedication to get inflation again to its two-per-cent goal, the midpoint of a goal zone of 1 per cent to a few per cent.

“By front-loading interest-rate will increase, we’re making an attempt to keep away from the necessity for even increased rates of interest down the street,” Macklem informed an viewers on July 14. “Entrance-loaded tightening cycles are usually adopted by softer landings.”

Macklem added that the central financial institution expects the economic system to develop 3.5 per cent this yr earlier than slowing to 1.75 per cent subsequent yr. Regardless of an anticipated financial slowdown and decades-high inflation, Macklem mentioned he believes Canada can keep away from a Nineteen Seventies-style stagflation atmosphere as a result of again then, the economic system had already been overheated within the years main as much as a decade of excessive inflation and disappointing financial progress.

Commercial 4

Article content material

The excessive inflation that now we have at this time is just not regular, it is not right here to remain

Financial institution of Canada Governor Tiff Macklem

One other distinction between then and now’s that international locations through the Nineteen Seventies deserted the Bretton Woods system that offered a foreign money peg to america greenback, which was pegged to gold costs.

“That was the financial anchor, nevertheless it wasn’t changed with a brand new anchor,” he mentioned. “Financial coverage was adrift. It responded slowly. Inflation expectations ratcheted up. There was a wage-price spiral and the result’s we had very excessive inflation for a decade. It took, sadly, a really sharp recession within the early ’80s to convey it again down.”

The Financial institution of Canada’s financial coverage report in July pointed to world provide challenges such because the Russian invasion of Ukraine and China’s pursuit of a zero-COVID coverage as current disruptions which might be anticipated to unwind over the subsequent yr. The report initiatives inflation to peak within the third quarter earlier than petering out as these provide challenges ease and demand slows.

Commercial 5

Article content material

Nevertheless, the central financial institution acknowledged it didn’t get its forecast proper prior to now, pointing to those identical world elements, which prompted provide shortages and hovering commodity costs and transport prices, as the rationale for two-thirds of its inflation goal miss.

-

Unique: Tiff Macklem on the Financial institution of Canada’s shock fee hike, wrestling inflation and its forecast miss

-

Financial institution of Canada points shock fee hike in effort to crush inflation

-

Canadian meals suppliers sign extra value hikes coming to grocery shops this fall

Economists at Financial institution of Nova Scotia revised their inflation outlook and now count on the patron value index to common 7.1 per cent this yr, after peaking in July, earlier than slowing to three.6 per cent in 2023.

Commercial 6

Article content material

“A broad vary of provide chain indicators and enter costs recommend inflation will cool in coming months,” chief economist Jean-François Perrault mentioned in a July 18 report. “But, regardless of that and a marked downward revision to the expansion outlook (to three.5-per-cent progress in 2022), incoming inflation has been hotter than anticipated and wage pressures recommend that inflation might be stronger than earlier anticipated in 2023.”

Perrault and his group count on the Financial institution of Canada’s coverage fee will peak at 3.5 per cent later this yr and keep at that degree by means of 2023. He added they don’t count on the central financial institution to crank charges above this degree solely to chop them again subsequent yr.

Macklem has been signalling all year long that the Financial institution of Canada is getting more durable on inflation and that Canadians mustn’t count on these ranges to persist indefinitely.

“The excessive inflation that now we have at this time is just not regular, it’s not right here to remain,” he mentioned to the CFIB. “We’re resolute in our dedication to convey inflation down.”

• Electronic mail: shughes@postmedia.com | Twitter: StephHughes95

Commercial

[ad_2]

Source link