[ad_1]

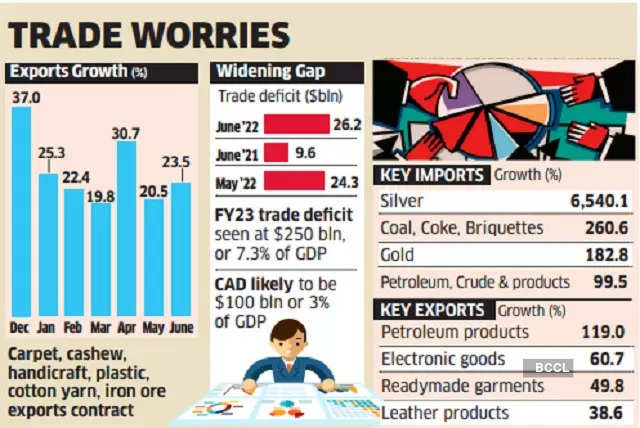

Led by petroleum merchandise, digital items, and gems and jewelry, India’s merchandise exports in June grew 23.52% to $40.13 billion however a sharper rise of 57.55% in imports widened the commerce deficit to a file $26.18 billion.

The commerce deficit was $9.6 billion in June and economists count on it to rise to a file $250 billion or 7.3% of GDP this fiscal.

Information launched by the commerce and business ministry on Thursday confirmed imports at $66.31 billion in June, led by silver, petroleum, coal, and gold. As per preliminary knowledge launched earlier this month, merchandise exports had grown 16.8% on-year. “Imports of petroleum, crude and their merchandise at the moment are $21.3 billion in comparison with $10.6 billion a 12 months in the past. It’s because demand is inelastic,” stated an official.

As per the official, restrictions on wheat exports have impacted total outbound shipments although the complete influence could be seen within the July numbers. Within the first quarter of the continued fiscal, the merchandise commerce deficit widened to $70.8 billion from $31.42 billion a 12 months in the past.

Exports of petroleum merchandise had been up 119.03% in June and people of electronics rose 60.7%. Outbound shipments of cotton yarn, plastics and handicrafts shrank. Amongst imports, petroleum, crude & merchandise had been up 99.48% whereas silver rose 6,540% year-on-year in June.

“Although the general exports within the first quarter of FY23 have grown by round 25%, the export efficiency of non-petroleum and non-gems and jewelry has slowed all the way down to 13.8%,” stated Prahalathan Iyer, chief common manager-research and evaluation at India Exim Financial institution. Nonetheless Iyer stated the silver lining is that non-petroleum and non-gems and jewelry imports have grown at 34.8% within the first quarter of FY23, which signifies that the slowdown is just non permanent.

Aditi Nayar, chief economist at ICRA, stated that the correction in commodity costs has softened the present account deficit (CAD) outlook for the continued quarter, though export development might endure a slowdown amidst a weaker outlook for the worldwide financial system. “We foresee modest downsides to our FY23 CAD forecast of $105 billion or 3% of GDP,” Nayar stated.

Financial institution of Baroda in a be aware stated that the June commerce knowledge implies CAD of just about $100 billion or 3% of GDP and a widening CAD together with persistent FPI outflows will weigh on the INR going ahead.

[ad_2]

Source link