[ad_1]

Panuwat Dangsungnoen

Energy/energy-related inventory have been among the many prime gainers for the week ending July 8, whereas delivery shares led the decliners’ record amid looming fears of recession because the Federal Reserve’s policymakers eye as much as a 75 basis-point fee hike at their subsequent assembly to struggle inflation.

The SPDR S&P 500 Belief ETF (SPY) was again amongst good points (+3.03%) after being within the crimson every week in the past. YTD, the ETF is -18.17%. The Industrial Choose Sector SPDR (XLI) was additionally within the inexperienced (+0.65%), after falling within the prior week. YTD, XLI is -16.92%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +14% every this week. Nevertheless, YTD, all these 5 shares are within the crimson.

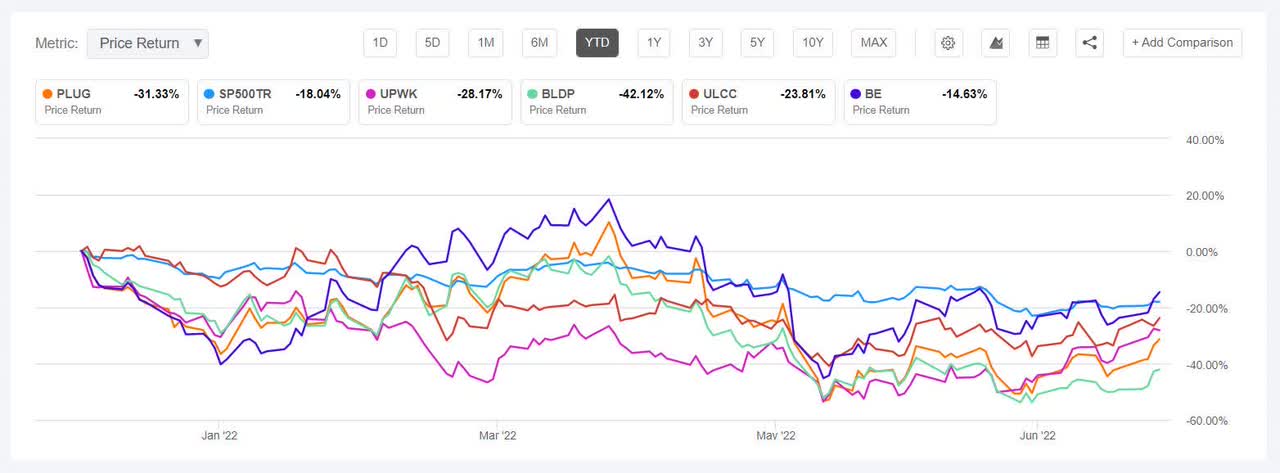

Plug Energy (NASDAQ:PLUG) +19.31% took the primary spot once more after two weeks. The inventory gained all through the week however probably the most on July 7 (+7.83%) as photo voltaic and clear power shares rallied amid U.S. authorities’s plans to elevate tariffs on Canadian photo voltaic merchandise and China mulling a $220B stimulus package deal to spice up its economic system.

Nevertheless, YTD, the Latham, New York-based firm’s inventory is down -29.97%. The SA Quant Score on the shares is Promote, which which takes into consideration components comparable to progress and profitability, amongst others issues. The score is in distinction to the typical Wall Road Analysts’ Score of Purchase, whereby 14 out of 28 analysts give the inventory a Sturdy Purchase score.

Upwork (UPWK) +17.26% appeared to reflect Plug’s inventory efficiency because it got here in second, similar as two weeks in the past. The Santa Clara, Calif.-based firm, which offers a web based work market, was additionally among the many prime 5 gainers ( on this phase) in June. Nevertheless, YTD, the inventory has shed -29.01%. The SA Quant Score on the inventory is Maintain, with Profitability having an element grade of D+ whereas Valuation with issue grade of F. However the common Wall Road Analysts’ Score differs and offers the inventory a Purchase score, with an Common Value Goal of $32.18.

The chart under reveals YTD price-return efficiency of the highest 5 gainers and SP500TR:

Ballard Energy Programs (BLDP) +16.03%. The Canadian gasoline cell methods developer was among the many shares that gained on July 7 (+9.88%) with the U.S.-Canada accord on eradicating tariffs for Canadian photo voltaic merchandise. The shares have been additionally helped by a report that photo voltaic and wind installations within the U.S. generated extra electrical energy than nuclear energy vegetation for the primary time in April. YTD, Ballard has declined -41.80%, probably the most amongst this week’s prime 5 gainers. The common Wall Road Analysts’ Score for BLDP is Maintain, whereby 13 out of 23 analysts backed the inventory as Maintain. The score is in distinction to the SA Quant Score of Promote, with Valuation getting an element grade of C and Profitability with an element grade of D-.

Frontier Group (ULCC) +14.73%. On the finish of the week got here a setback for Frontier as Spirit Airways (SAVE) postponed a shareholder vote for its acquisition by the corporate so it may have extra time to proceed discussions with JetBlue (JBLU). SA contributor Dhierin Bechai wrote: Solely trying on the worth of the provides from whole and money perspective, the Frontier provide is unattractive at finest. The common Wall Road Analysts’ Score on ULCC is Sturdy Purchase, with an Common Value Goal of $16.86, contradicting the SA Quant Score of Maintain. YTD, Frontier’s inventory has misplaced -20.78%.

Bloom Power (BE) +14.55%. The San Jose, Calif.-based Bloom, which offers energy era platform, additionally gained on the proposed lifting of Canadian photo voltaic merchandise tariff. The inventory additionally noticed Northland provoke protection with an Outperform score calling the corporate “at an inflection stage” and positioned strongly to make use of its stable oxide platform. YTD, BE has declined -13.82% however the a median Wall Road Analysts’ Score is Purchase, whereas the SA Quant Score is Maintain.

This week’s prime 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -5% every. YTD, just one out of those 5 is within the inexperienced.

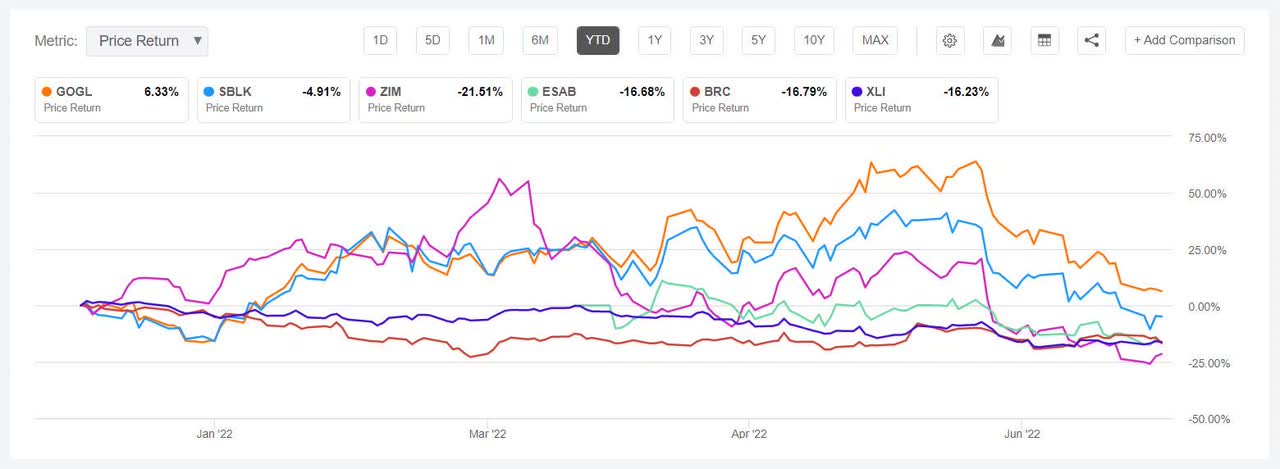

Golden Ocean (NASDAQ:GOGL) -10.48% led the decliners adopted by delivery friends Star Bulk Carriers (SBLK) -10.12% and ZIM Built-in Transport (ZIM) -5.67%, which took the second and third spot, respectively, amid rising fears of recession. Based on an evaluation by Germany’s IfW financial institute greater than 2% of worldwide cargo capability is at a standstill on the North Sea whereas there was decline in freight volumes within the Crimson Sea in June affecting European commerce.

“Total, world commerce reveals a barely constructive pattern in June, however vital congestion, excessive transportation prices and ensuing provide chain woes dampen the alternate of products,” stated Vincent Stamer, head of Kiel Commerce Indicator.

Stamer, nonetheless, added that the scenario in North America improved. “The pandemic induced excessive demand progress for shopper items has slowed and the congestion off the port of Los Angeles has dissolved,” famous Stamer.

The chart under reveals YTD price-return efficiency of the worst 5 decliners and XLI:

Bermuda-based GOGL has had a comparatively higher first-half of the 12 months in comparison with the broader market and sure industrial shares (on this phase). The inventory was among the many prime 5 gainers (on this phase) for H1 (+29.48%). The SA Quant Score on GOGL is a Sturdy Purchase, with Profitability and Valuation each having an element grade of A+. In the meantime, the typical Wall Road Analysts’ Score is Purchase. YTD, the inventory is the one one amongst this week’s decliners to be within the inexperienced.

Star Bulk — which was amongst 2021 prime 5 industrial shares (on this phase) was additionally again among the many losers together with GOGL after two weeks. The SA Quant Score and the typical Wall Road Analysts’ Score on SBLK is Sturdy Purchase. YTD, SBLK is -0.93%.

YTD, ZIM has declined -24.31% however will get an SA Quant Score of Sturdy Purchase, which is in distinction to the typical Wall Road Analysts’ Score of Maintain.

ESAB (ESAB) -5.67%. The North Bethesda, Md.-based welding merchandise maker landed the fourth spot amongst decliners. YTD, the inventory has fallen -16.68% however the common Wall Road Analysts’ Score is Purchase with an Common Value Goal of $57.67.

Brady (BRC) -4.34%. The Milwaukee, Wis.-based firm, which makes office security merchandise, has seen its inventory decline -16.16% YTD. SA Quant Score on BRC is a Maintain, which is in distinction to the typical Wall Road Analysts’ Score of Purchase.

[ad_2]

Source link