[ad_1]

NEW DELHI: The Centre’s capex outlay is estimated at Rs 7.5 trillion in FY23,up from Rs 6.02 lakh crore in FY22, with a view to drive financial revival. Of this, Rs 1 trillion will go to states as a long-term, interest-free mortgage.

Capital expenditure is the cash spent by the federal government on the event of equipment, gear, constructing, well being amenities, training, and so on. It additionally contains the expenditure incurred on buying fastened property like land and funding by the federal government that offers income or dividends in future. An instance of capital expenditure is cash spent on Indian Railways or constructing nationwide highways and roads.

In keeping with Finance Minister Nirmala Sitharaman, a thrust on capital expenditure will ease supply-chain bottlenecks and revive demand.

Authorities spending within the 2022/23 funds included a considerable pick-up in spending on infrastructure. Efficient capital expenditure is budgeted at 27% above the revised 2021/22 estimates. The federal government goals to realize about Rs 4.45 lakh crore, which is 60% of the annual goal, by the September quarter.

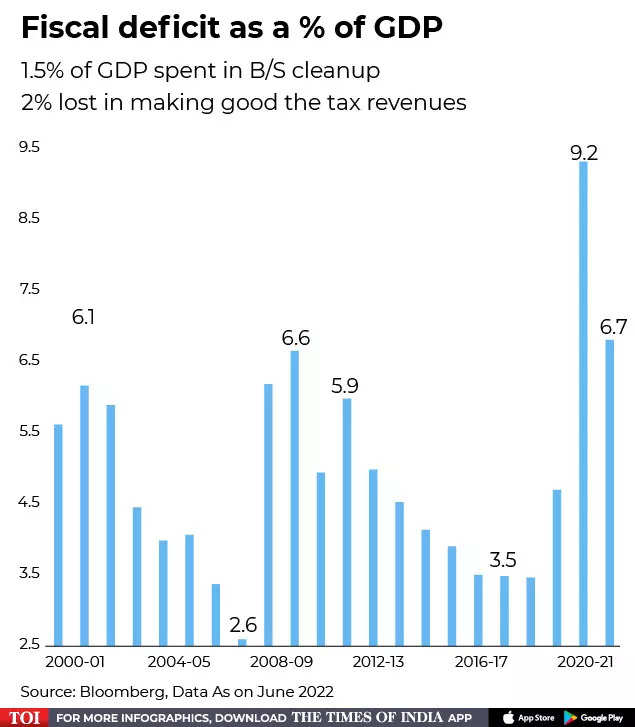

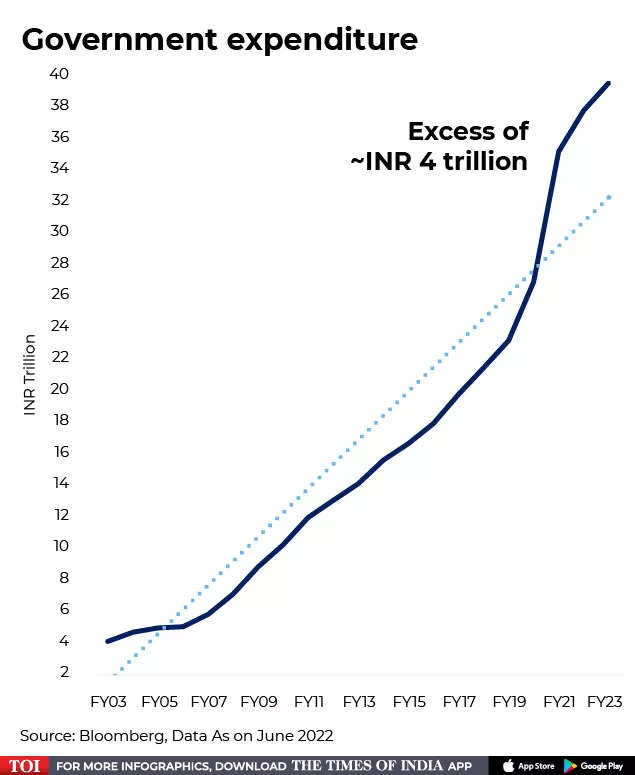

“There’s an extra Rs 4 trillion authorities expenditure over and above the long run pattern. Within the final two monetary years most of this expenditure was utilized in paying increased subsidies & normal authorities expenditure as a result of Govt. revenues weren’t rising. However in FY23, the revenue tax assortment is working above common, oblique taxes like GST have improved and authorities is prone to meet its disinvestment goal,” famous DSP in a analysis report.

This implies extra expenditure in FY23 and until FY25 can act as a financial stimulant to help development.

GST collections have been up 56% to over Rs 1.44 lakh crore in June. In Could, the GST assortment quantity was at Rs 1,40,885 crore, a rise of 44% year-on-year.

“The excessive GST collections, which ends up in a brand new month-to-month regular of Rs 1.4 trillion throughout Q1 of FY23, comes on the heels of a number of macro financial parameters being on the upswing. Since this comes within the backdrop of the assured compensation to states coming to an finish, it could assuage many states who have been fearful about their income mobilization capacity within the publish cess interval,” mentioned MS Mani, Associate, Deloitte India on June GST collections.

Web direct tax collections for the present fiscal 12 months surged 45 per cent to Rs 3.39 trillion between April 1 and June 16, in comparison with Rs 2.33 trillion in the identical interval a 12 months in the past. Advance tax collections for the primary quarter of this fiscal stood at over Rs 1.01 trillion towards Rs 75,783 crore within the corresponding interval final fiscal.

In the meantime the federal government has lined up over half-a-dozen corporations for strategic sale, together with Transport Company of India, CONCOR, Vizag Metal, IDBI Financial institution, Nagarnar Metal Plant of NMDC and HLL Lifecare. Up to now within the present fiscal 12 months, the federal government has mopped up over Rs 24,000 crore from disinvestments, together with the general public itemizing of LIC. The goal for the complete 12 months has been set at Rs 65,000 crore.

[ad_2]

Source link