[ad_1]

The specified end result of the most recent central financial institution transfer to mobilise overseas forex deposits from the Indian diaspora to arrest the rupee’s slide should await additional coverage price will increase at dwelling, with the present arithmetic evidently tilting the stability in favour of home savers that native banks will discover extra enticing to faucet.

On Wednesday, the Reserve Financial institution of India (RBI) introduced a raft of measures to arrest the slide within the rupee that just about fell to the 80 mark to the greenback, a lifetime low for the unit. Among the many measures introduced was removing of rate of interest caps on FCNR(B) (overseas forex non-resident financial institution) and NRE deposits and exemption for banks from the incremental deposits raised by means of these routes of their non-interest bearing money reserve ratio (CRR) calculations. These guidelines will stay in drive till October 31.

Bankers mentioned the measures are pre-emptive, however may not instantly entice lenders to draw extra greenback deposits.

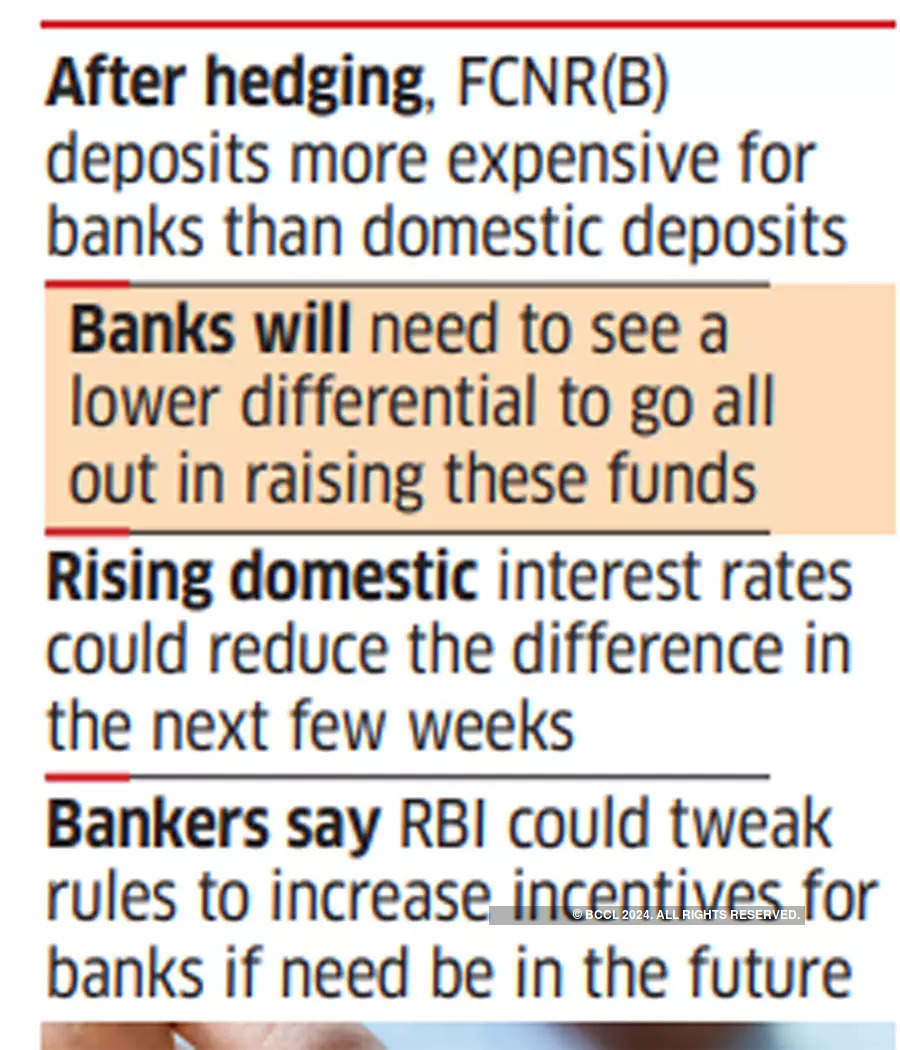

“The after-hedging value of FCNR(B) deposits is 1 to 1.5 proportion factors increased than the prevalent rupee deposit price, making it unattractive for banks,” mentioned Ashish Vaidya, managing director, treasury, DBS Financial institution India.

No Curiosity Charge Subsidy

“However issues may change in a number of weeks as charges are solely headed increased, which may make these deposits extra viable,” he mentioned.

At the moment, the price of one-year rupee time period deposits is within the neighborhood of 6%. In contrast, after contemplating abroad benchmark charges, value of hedging and the premium charged by banks, FCNR(B) deposits may value 7% to 7.5%, clearly suggesting a enterprise case for native financial savings.

Moreover, not like final time when such a scheme was introduced in 2013, this time there isn’t any RBI assist to banks within the type of subsidies to maintain prices decrease. In FY14, banks had raised a report $27 billion by means of the FCNR(B) route after the RBI eliminated rate of interest caps and likewise provided banks a 3.5% rate of interest subsidy to stop the rupee’s rout.

Bankers mentioned that though the rupee is underneath stress presently, the disaster is just not as acute because it was in 2013, with the rupee shedding about 6% of its worth in 2022. India can also be not among the many worst performing rising market currencies and its overseas alternate reserves of $593 billion are greater than double of what they had been in 2013.

Bankers mentioned the RBI may tweak its measures and supply banks some extra assist to make the schemes extra enticing.

“It’s a step in the fitting course and a optimistic transfer. Sure, in line with the calculations presently, it is probably not possible for banks to boost these deposits however the RBI at all times has the choice so as to add extra incentives and make it extra enticing,” mentioned KK Tarania, head of treasury at Punjab Nationwide Financial institution. “So, it’s early days to gauge the success (of those measures).”

In a notice printed Thursday, Kotak Institutional Equities mentioned the RBI measures signalled a stronger intent in addressing the present greenback scarcity.

“Whereas we’re cautious on the quantum of incremental flows, we see these measures as being pre-emptive in capping any sharp depreciation bias and decreasing volatility within the INR,” Kotak mentioned within the notice. “We proceed to see USD-INR inside 78.5-80 within the close to time period. We notice that the basics proceed to weigh on the INR. Nevertheless, the RBI will endeavour to make sure an orderly depreciation.”

[ad_2]

Source link