[ad_1]

India has permitted 80 International Direct Funding (FDI) proposals involving Chinese language entities as on June 29, in accordance with information accessed by means of Proper to Data (RTI).

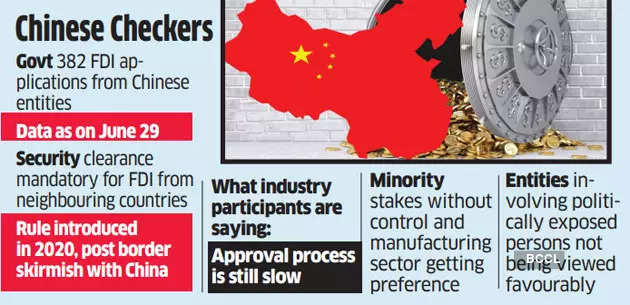

The federal government obtained 382 proposals from the Chinese language in all for consideration since India imposed restrictions on investments from international locations that share land border with it, Division for Promotion of Business and Inner Commerce (DPIIT) mentioned in response to the RTI.

It isn’t clear as to what number of proposals have been rejected.

Following the skirmish on the border, New Delhi in 2020 made a previous authorities approval, together with a safety clearance, obligatory for any FDI coming from international locations that share land borders with India.

Market members mentioned the federal government was adopting a cautious method in evaluating such proposals subsequently approvals are slower. Moreover, the offers getting authorities’s nod are typically ones involving acquisition of minority stakes that does not lead to change of management. Capital-intensive sectors, comparable to manufacturing, are getting choice over the sought-after sectors for FDI comparable to e-commerce and monetary providers

“The functions getting permitted appear to be for comparatively decrease stakes. By way of sectors, it appears that evidently functions within the manufacturing sectors are getting forward sooner than others,” mentioned Nandini Pathak, chief, fund formation & regulatory observe at Nishith Desai Associates. “A number of the functions have been pending for over a yr, whereas the trade expectation is to get a response inside 3-4 months.”

DPIIT didn’t reply on the questions concerning what number of functions have been rejected or the quantum of funding that can come into India by means of the 80 functions that have been permitted.

One other key issue being thought-about by the federal government is the profile of the investor. Market members mentioned the federal government goes gradual on the funding proposals that contain entities near Beijing. In some circumstances, the founders or promoters of the funds/investing entities are recognized for his or her nearer ties to the present ruling dispensation of China.

“The ministries are exercising lot of warning in relation to functions involving politically uncovered individuals (PEPs) in China or Hong Kong. Additionally, the preparations the place the Chinese language entity will get board illustration or different passive management instruments are usually not being considered favourably,” mentioned an trade knowledgeable looking for anonymity.

One other one who handles the FDI proposals informed ET that entities that arrange bodily infrastructure carry decrease potential threat than those involving digital property. “With digital platforms, there are all the time issues over information privateness, whereas bodily property are simpler to defend even in hostile situations.”

Whereas the approvals have began lastly coming, the federal government is concurrently tightening the principles for Chinese language entities investing in India. Final month, the ministry of company affairs (MCA) introduced out a slew of measures to examine Chinese language affect within the company sector.

[ad_2]

Source link