[ad_1]

hxdbzxy/iStock by way of Getty Pictures

By no means seen rising mortgage charges (presently at 5.7% from a mean of simply 3.2% at 2022 begin), rising dwelling costs and a imbalanced dwelling provide and demand have been some traits of the U.S. actual property sector previously 6 months.

In Might, new dwelling gross sales rose 10.7% M/M whereas Y/Y it noticed a progress of 5.9%; present dwelling gross sales dropped 3.4% in Might marking its straight fourth month of lower and on Y/Y foundation it sees 8.6% dip.

The market typically believes that it’ll firmly be a sellers market with consumers not having a bonus available in the market.

Whereas housing affordability is on the lowest level for the reason that monetary disaster, rental market additionally doesn’t point out any good indicators with occupancy charges at all-time highs and rents on the rise.

A chief economist at CoreLogic forecasts a gradual slowing of dwelling value progress right down to single-digit appreciation a yr from now whereas U.S. Financial institution chief economist sees a robust housing market with low housing stock, low unemployment, wage progress and a big demographic of consumers getting into their peak homebuying years.

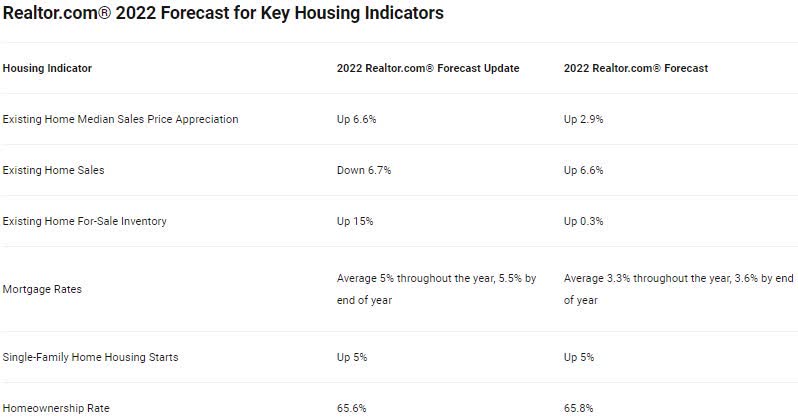

Economists at Realtor.com not too long ago revised their forecasts:

It additional added, “Whereas housing prices stay excessive, pushing dwelling consumers to make powerful selections about their funds priorities, the variety of houses on the market is anticipated to proceed to develop, constructing on the turnaround begun in Might.”

Most trade analysts foresee that stock will stay scarce in 2022 and 2023 with slower value appreciation than it’s seen in previous two years; rise in listings and excessive demand are seen persevering with.

Freddie Mac expects some cooling in housing demand, forecasting home value progress to gradual from 15.9% in 2021 to six.2% in 2022 after which to 2.5% in 2023; This autumn dwelling gross sales anticipated to come back in at 7.1M and contact 6.9M in 2022 and enhance to 7M in 2023.

Altos Analysis signifies greater than 25% of houses in the marketplace proper now have reduce their value opposite to how costs have been climbing over the past two years.

[ad_2]

Source link