[ad_1]

Vauld, a Singapore-headquartered crypto lending and alternate startup, has suspended withdrawals, buying and selling and deposits on its eponymous platform with quick impact because it navigates “monetary challenges,” it stated Monday.

The three-year-old startup — which counts Peter Thiel-backed Valar Ventures, Coinbase Ventures and Pantera Capital amongst its backers and has raised about $27 million — stated it’s dealing with monetary challenges amid the market downturn, which it stated has prompted buyer withdrawals of about $198 million since June 12.

Vauld founder and chief government Darshan Bathija stated the startup is exploring restructuring choices and has engaged with Kroll for monetary recommendation and Cyril Amarchand Mangaldas and Rajah & Tann for authorized recommendation in India and Singapore.

The startup intends to use to the Singapore courts for a moratorium. “We’re assured that, with the recommendation of our monetary and authorized advisors, we will attain an answer that can greatest defend the pursuits of Vauld’s prospects and stakeholders,” he wrote in a weblog submit, including that the startup will make “particular preparations” for sure prospects who want to fulfill their margin calls.

It’s unclear what number of customers Vauld serves.

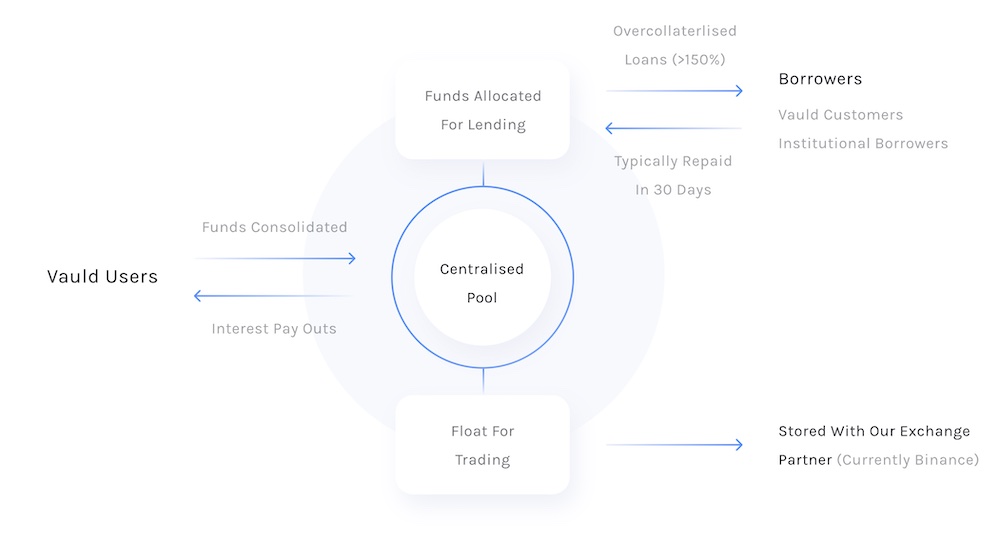

An illustration of how Vauld’s platform labored. (Picture: Vauld)

Vauld allows prospects to earn what it claims to be the “trade’s highest rates of interest on main cryptocurrencies.” On its web site, it says it presents 12.68% annual yields on staking a number of so-called stablecoins together with USDC and BUSD and 6.7% on Bitcoin and Ethereum tokens. The platform allowed prospects to borrow towards their tokens and likewise facilitated a number of different buying and selling providers.

On its web site, Vauld says it presents customers the power to borrow as much as an LTV (mortgage to worth) of 66.67% towards their tokens and “immediately” approves their loans. Like a number of tech shares, many crypto tokens have tumbled by over 70% in worth up to now six months.

“We search the understanding of shoppers of the Vauld platform that we are going to not be ready to course of any new or additional requests or directions on this regard. Particular preparations shall be made for buyer deposits as could also be vital for sure prospects to fulfill margin calls in reference to collateralised loans,” Bathija wrote at this time.

The announcement follows Vauld reducing its workforce by 30% two weeks in the past.

The transfer comes as a shock. On June 16, Bathija assured Vauld prospects that the platform had no publicity to Celsius, one other lending startup that’s dealing with rising monetary challenges, and Three Arrows Capital, one of many high-profile crypto hedge funds that filed for a Chapter 15 chapter over the weekend.

“We stay liquid regardless of market circumstances. Over the previous few days, all withdrawals have been processed as ordinary and this can proceed to be the case sooner or later,” Bathija wrote earlier.

A number of crypto veterans together with Binance founder and chief government Changpeng Zhao have warned in current weeks that many extra DeFi platforms are on the verge of dealing with a collapse. In a current podcast, Zhao stated Binance has engaged with over 50 companies in current weeks to judge funding / bailing out alternatives in some companies.

“The identical offers that you just see within the information of different folks taking a look at, they usually come to us first,” he stated. “We’ve the most important money reserves of any alternate. We like to avoid wasting the trade as a lot as potential, however not all initiatives are price saving.”

On Friday, FTX’s U.S.-based arm inked a take care of troubled crypto lender BlockFi that offers the crypto alternate the choice to purchase the startup for as much as $240 million primarily based on the startup’s efficiency. BlockFi, which was among the many companies that liquidated not less than some positions held by Three Arrows Capital, was valued at $3 billion in a financing spherical it disclosed in March 2021.

[ad_2]

Source link