[ad_1]

The recognition of exchange-traded funds (ETFs) has been on an increase. Nonetheless, one apprehension has been a supply of fear for buyers – determining whether or not they’re shopping for and promoting their ETF items at a good worth.

To offer some context, ETFs will be purchased and offered on inventory exchanges on the traded market costs identical to fairness shares. However notably, these market costs can (and infrequently are) considerably completely different from their NAVs that are derived from the costs of the underlying securities they maintain. As an example, a unit of an ETF could have an NAV of Rs 100 but it surely is likely to be buying and selling at a worth of Rs 105 on the inventory alternate. Clearly, on this case, an investor shopping for it on a inventory alternate will find yourself paying a steep premium which is undesirable. The problem is additional sophisticated by the truth that till now, there was no easy manner for an investor to determine this out. That is as a result of the NAV is simply disclosed on the finish of the day whereas the ETFs commerce on inventory markets on a real-time foundation.

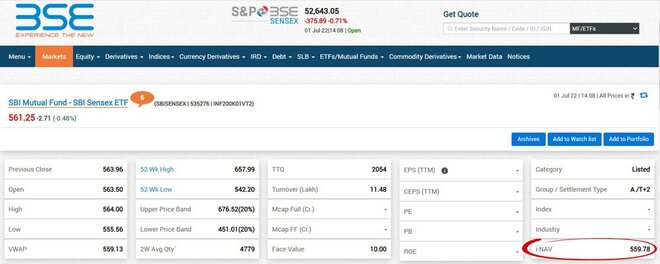

To handle this concern, ETFs have been mandated to reveal intraday NAV (iNAV) beginning immediately. We expect this can be a fairly helpful addition for ETF buyers as now they’ll examine the traded worth with the iNAV on a real-time foundation to determine whether or not they’re paying far more than the precise value of the items. Likewise, a vendor of ETF items will immediately know if the going worth is at a steep low cost to the underlying value of the items.

For fairness ETFs, the iNAV could be declared inside a most time lag of 15 seconds from the underlying market. For debt ETFs, the iNAV could be declared at the very least 4 occasions in a day with a minimal time lag of 90 minutes between the 2 disclosures. For gold and silver commodity ETFs, iNAV disclosed could both be static or dynamic relying upon the provision of the underlying worth. Equally, for ETFs monitoring worldwide indices, iNAV disclosed could also be static or dynamic relying on the intersection in buying and selling hours of home and abroad markets.

You may get the iNAV from the inventory alternate’s web site (see under screenshot), and even the web sites of the AMCs. Hopefully in occasions to come back, outstanding inventory brokers would even be offering this data on their platform.

Make use of it to make extra knowledgeable funding selections.

Recommended learn:

Introduction to ETFs

How to decide on an ETF

[ad_2]

Source link