[ad_1]

Apple is the biggest holding of Berkshire Hathaway. As of March 31, 2022, the corporate represented practically 40 per cent of Berkshire’s fairness portfolio. Buffett has earned returns of greater than 4 occasions on his funding of about $31 billion.

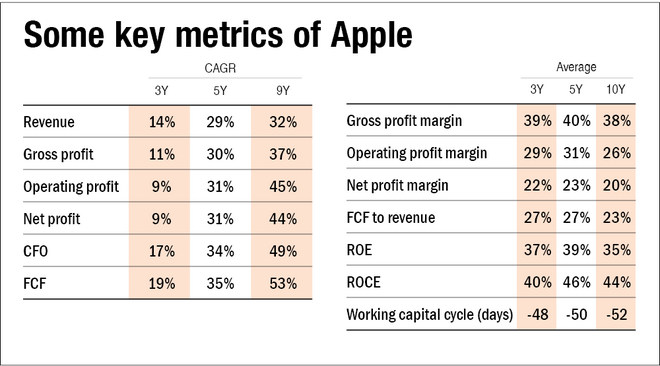

The next desk has some knowledge factors on Apple. The numbers are as of the fiscal 2015 finish. That is what Buffett would have seen in 2016 (when he began shopping for).

The expansion charges and ratios are phenomenal. That is true of any yr since Apple launched the primary iPhone. And this begs the query: Buffett would have identified about these numbers previous to 2016 as nicely, then why did he select to spend money on 2016 and never earlier than?

It isn’t as if the corporate was hidden from mainstream media. In actual fact, Buffett has been requested about Apple on multiple event (previous to 2016). Additionally, given his aversion to technology-oriented firms, it was a shock for Buffett-followers that he had positioned an enormous wager on the corporate. So what modified?

You may must recall two Buffett quotes for this:

What does ‘perceive’ actually imply? It doesn’t suggest solely realizing what services and products are supplied by Apple. It additionally doesn’t suggest that you must know each element that goes into making an iPhone. Understanding an organization means that you’ve the power to evaluate (with confidence) the place the corporate shall be in 5 or 10 years’ time. This would come with understanding what the corporate has completed proper up to now and what it has to maintain doing to take care of or enhance its place. This doesn’t imply that you just extrapolate the previous or that you just attempt to quantify all the pieces.

The investing world considers Apple to be a tech firm. Nevertheless, Buffett understood it as a client product firm. He understood the significance of an iPhone or an iPad to a consumer and the worth of the ecosystem these merchandise have. This ecosystem contains the power of Apple to cost customers for storing knowledge on the cloud, listening to music and paying for the apps.

For the corporate to command comparable mindshare sooner or later as nicely, Buffett realised that Apple has to guarantee that the alternative merchandise are top-notch as nicely. He would have judged whether or not the administration is able to that process. Then there was the truth that Tim Prepare dinner (in contrast to Steve Jobs) understood the benefits of shopping for again their very own shares. Thus, Buffett additionally noticed a wise capital allocator working the present.

After all, there are various different elements that an investor has to contemplate. However, ‘understanding’ a enterprise is the place to begin. You’ll not be an professional on all firms. You need to discover firms for which you’ll develop an understanding on comparable traces. Furthermore, you must suppose independently. Do not let the consensus information your ideas.

By understanding the corporate on this method, you might be additionally capable of cut back threat. With out understanding, you do not know what to anticipate or anticipate and thus, you tackle dangers that you just did not suppose even existed. Nevertheless, understanding of an organization helps you visualise the place the corporate is heading and that can assist you establish the assorted dangers.

The subsequent time you come throughout an organization with an awesome set of numbers, do not get swayed by it. Take a while to know what the corporate is and what elements have performed and can proceed to play a essential function in its success.

Recommended learn: Phrases of knowledge and expertise

[ad_2]

Source link