[ad_1]

New Delhi:

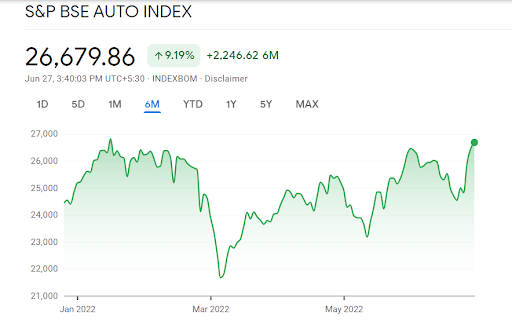

Within the post-Covid rebound, shares of main car corporations are outperforming the benchmark index for the previous few weeks because the trade is anticipating one other month of sturdy automobile and industrial automobile gross sales. Prior to now one month the S&P BSE Auto index has gained 4.3%, in comparison with a 2.7% decline within the S&P BSE Sensex.For the auto shares, which have a direct reference to the nationwide economic system, issues are swiftly altering for the higher, based on market consultants. A moderation in commodity costs, low base of final yr and gradual easing out of the semiconductor disaster are turning the trade in direction of normalcy, foreseeing improved margins for all auto shares within the coming quarters.

One other change that’s being witnessed within the Indian passenger automobile phase is robust demand prospects with file ready intervals throughout prime promoting fashions within the utility automobile house. This shift is essentially serving to Mahindra and Mahindra (M&M) and Tata Motors extra on the expense of Maruti Suzuki.

Persevering with its surge for the final three months, the share value of M&M on Monday has touched a recent life-time excessive of INR 1094.9 per share on the BSE, after gaining by over 2% intraday, outperforming the market on sturdy enterprise outlook of its sports activities utility automobile, industrial automobile and tractor phase. The inventory has rallied over 42% within the final three months in comparison with an 8.5% fall within the S&P BSE Sensex. It additionally gained over 63% from its 52-week low of INR 671 per share that was hit on March 8, 2022.

Within the PV phase, the corporate at present holds an order e-book of above 1.7 lakh models which is equal to about six months of month-to-month gross sales run fee. The maker of Thar and XUV 700, noticed about 88% leap in its SUV gross sales at 48,800 models in April-Might of the continued monetary yr as in comparison with 25,934 models in the identical interval in FY22.

The corporate’s sturdy management in farm tools, constructive rural sentiment, and a robust dedication on constructing electrical SUVs make it a candidate for the long-term portfolio. At standalone degree it’s India’s largest tractor producer with over 40% market share and second largest industrial automobile producer, and fourth largest passenger automobile maker.

Among the many different particular person shares, Hero MotoCorp, Maruti Suzuki India, Bosch and TVS Motor Firm additionally continued the northward development within the vary of 10%-13% up to now one week. Moreover, Eicher Motors, Tata Motors, MRF, Ashok Leyland, Minda Company, Bajaj Auto and Cummins India additionally gained between 6% and 9%.

Beneficial components

The latest rally in auto shares are majorly on the again of decline in metals costs, enhancing chip availability and enticing valuations together with anticipated pickup in new launches forward of excellent monsoon and festive season.

Metals are key uncooked materials for the auto house with metal and aluminium collectively constituting practically 50%-65% of the general enter prices. Within the latest previous home metal costs are down practically 20% submit restrictions positioned on their exports whereas international aluminium costs are down practically 25% amid muted demand from key markets like China.

At current, aluminium is hovering round USD 2,466 per tonne in comparison with the height of USD 3,878 per tonne in March 2022. Metal is at present all the way down to INR 69,000 per tonne from the height of INR 84,500 per tonne in April 2022.

“This softness of metallic costs is an indication of aid and is prone to help profitability of the auto house within the close to time period. Over and above this, market chief in two-wheeler Hero MotoCorp has introduced a value hike of as much as INR 3,000 sensing wholesome demand prospects with alternative to understand higher pricing and consequent working margins,” ICICI securities stated in its newest be aware.

That aside, the development of the southwest monsoon past the jap components of the nation coupled with a cool off in oil buoyed auto shares. Brent crude oil has corrected to USD 110 per barrel after skyrocketing to USD 130 per barrel up to now amid the on-going geopolitical disaster.

“Auto sector have been going through few headwinds together with elevated possession price and provide chain constraints. Current softening in commodity costs is a constructive for the auto sector. Regular monsoon would additionally brighten the outlook for some segments throughout the auto sector. Gradual restoration in auto gross sales quantity is predicted over the medium to long run,” stated Arun Aggarwal, Vice President, Kotak Securities.

Outlook

Analysts consider that as the agricultural demand will begin bottoming out within the backdrop of a traditional monsoon, the two-wheeler phase will see enchancment in demand. Furthermore, channel checks point out enchancment in tractor demand as sellers throughout the nation count on strong farmer spending outlook after they fetch good costs for his or her crops within the markets.

On the passenger automobile entrance, client pleasure can be upbeat with a sequence of recent launches within the latest previous and slew of impending launches particularly Scorpio-N from M&M, New Brezza from Maruti Suzuki, and the brand new SUV from Toyota- Suzuki partnership amongst others.

[ad_2]

Source link