[ad_1]

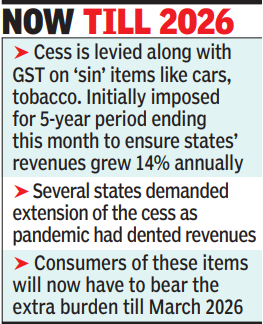

NEW DELHI: The central authorities has prolonged the validity of compensation cess levied together with the GST on luxurious and “sin” items resembling automobiles and tobacco by almost 4 years to lift funds for the extra borrowings undertaken throughout Covid-19 pandemic to compensate states for his or her “income loss”.

The cess is because of finish on June 30 as a part of the five-year method devised by the Centre and the states to make sure that the latter’s income grew 14% yearly. However as a result of pandemic, the burden has now been handed on to customers as much as March 2026.

Extension of compensation cess comes forward of GST council meet

The notification extending the levy of GST compensation cess for 4 extra years comes simply days forward of subsequent week’s essential assembly of the GST Council amid calls for from a number of states to increase the compensation interval.

States have argued that the necessities for increased spending and decrease income through the Covid-19 have battered their funds and compensation is required to assist them overcome the stress.

“The extension of the levy of compensation cess, though anticipated, will proceed to impose a burden on the impacted companies, particularly sectors like automotive, which should be inspired because it is likely one of the sectors that has a multiplier impact on GDP and employment,” mentioned M S Mani, accomplice at consulting agency Deloitte India.

A latest examine by economists at RBI had recognized 10 states which can be going through excessive monetary stress with Punjab, Rajasthan, Kerala, Bengal and Bihar seen to be probably the most weak.

The Centre has maintained that pandemic has resulted in an extension of the cess by one other 4 years and offering additional compensation will not be possible in the meanwhile. “To implement the choice of the GST Council, these guidelines have been issued to increase the levy of the compensation cess until March 2026 to cowl the shortfall for the ancient times. The difficulty whether or not states can be compensated past 5 years might get determined in upcoming GST Council assembly,” mentioned Abhishek Jain, accomplice for oblique tax, KPMG in India.

[ad_2]

Source link