[ad_1]

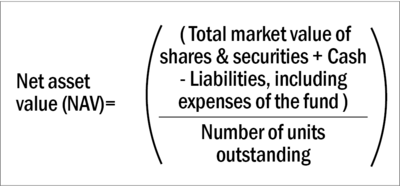

The calculation of a fund’s efficiency on our web site Worth Analysis On-line is predicated on the expansion within the fund’s internet asset worth (NAV). NAV is calculated after taking out the bills. So what’s a NAV and the way is it calculated? If we have a look at the formulation for NAV, we’ll perceive it higher.

In order depicted within the formulation above, NAV is the entire market worth of all of the shares held in a portfolio, together with money. Liabilities or bills are deducted and it’s then divided by the entire variety of models excellent. After we are subtracting the liabilities from the property, we take off all of the bills the fund incurs, together with the administration charges. So we’re left with internet property. This train is finished by the fund homes every day to derive the NAV of their respective funds. At any time when we’re calculating returns generated by a mutual fund scheme, it’s primarily based on these each day NAVs revealed by the respective fund homes. For instance, to illustrate the NAV of a fund is Rs 12 as of as we speak and was Rs 10 precisely a yr again. So the one-year return can be 20 per cent, because the NAV has appreciated by 20 per cent. Likewise, if the NAV would have depreciated from Rs 12 to Rs 10, the return generated by the fund during the last yr would have been -20 per cent. When the returns for greater than a yr are calculated, compounded annualised development fee (CAGR) is taken into account.

That is how the fund’s efficiency is calculated. Because the NAV itself is internet of bills, the returns too are internet of the bills.

Instructed learn:

What’s NAV in mutual funds?

How one can assess the efficiency of a mutual fund?

[ad_2]

Source link