[ad_1]

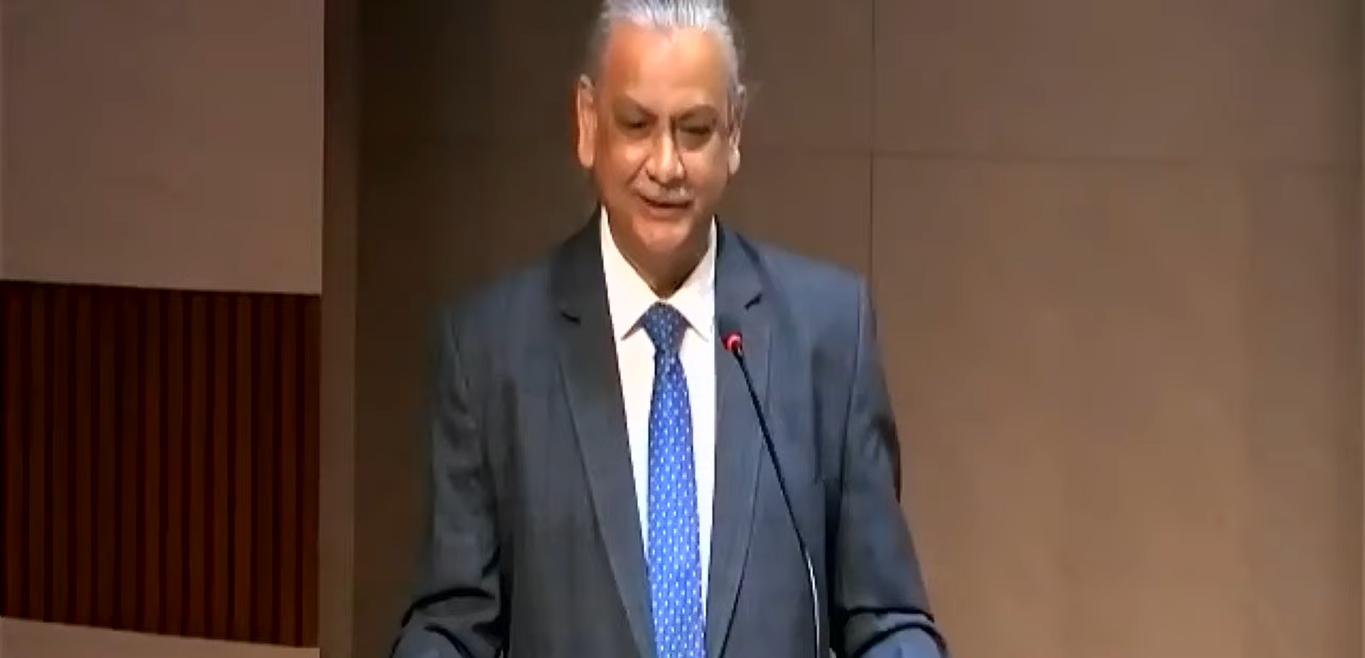

The Reserve Financial institution of India is hopeful that required financial coverage actions might be extra average than in the remainder of the world and that it will likely be in a position to convey again inflation to focus on inside a two 12 months time span, mentioned deputy governor Micheal Patra.

He mentioned inside analysis has proven that progress is unambiguously impaired when inflation exceeds 6% and with core measures of inflation exhibiting indicators of generalisation, financial motion is actually warranted.

In keeping with him, there are indications that inflation is peaking and is anticipated to fall again into the brink within the fourth quarter of 2022-23 and fall even additional within the subsequent 12 months in a baseline state of affairs.

“No doubt due to geopolitical dangers, the decline in inflation might be very grudging however India can have succeeded in bending down the long run trajectory of inflation and thereby it’ll win the warfare, perhaps lose the battle,” he mentioned.

Patra was talking at an occasion organised by the PHD Chamber of Commerce and Trade at New Delhi.

Inflation

In keeping with Patra, on this planet of world inflation costs, it’s higher to have a look at the change in inflation, not the extent. Towards this backdrop, he mentioned, RBI hopes that required financial coverage actions might be extra average than in the remainder of the world.

The MPC, which hiked the coverage repo price by 50 foundation factors (bps) to 4.90 p.c in its June assembly, has dedicated to convey down the inflation to the RBI’s tolerance degree which was increased than the 6 p.c higher restrict of the 2-6 p.c for the fifth month in a row.

Retail inflation eased marginally in Might, after touching an eight-year excessive of seven.79% in April, however remained above the central financial institution’s tolerance band of 2-6% for a fifth month in a row.

“The RBI Act mandates that in case the inflation goal will not be met for 3 consecutive quarters, which is the possible state of affairs, the RBI shall set out a report back to the central authorities and in that report it’ll state the explanations for failure to attain the inflation goal,” Patra mentioned.

The RBI sees Client Value Index (CPI) inflation averaging 7.5 p.c in April-June, 7.4 p.c in July-September, 6.2 p.c in October-December, and 5.8 p.c within the first quarter of 2023.

RBI won’t permit ‘jerky actions’ of rupee

Patra mentioned the central financial institution won’t permit “jerky actions” of Rupee and pressured that the Indian forex has witnessed least depreciation in current instances; he attributed the lesser depreciation of Rupee to excessive overseas change reserves of round $600 billion.

“We’ll stand for its stability, and we’re doing it on an ongoing foundation whilst I converse. We’re there out there. We won’t permit disorderly actions. We now have no degree in our thoughts, however we won’t permit jerky actions that’s for sure and let or not it’s extensively identified that we’re out there defending the rupee in opposition to volatility,” he mentioned.

On Thursday, Rupee had closed at its all-time low of 78.32 in opposition to the US greenback. Nonetheless, within the morning session on Friday it opened 12 paise up at 78.20 in opposition to the US greenback.

[ad_2]

Source link