[ad_1]

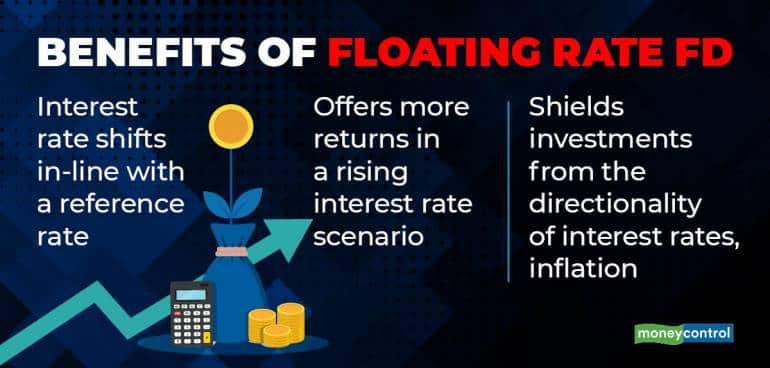

A floating price fastened deposit (FD) is the place the returns of the funding are linked to a reference price, just like the Reserve Financial institution of India’s repo price or a Treasury Invoice yield. An funding in such an instrument doesn’t entail a hard and fast rate of interest for the whole time period, however shifts in-line with the reference price. Sometimes, an FD entails a hard and fast price of return, which stays fixed all through the tenure of the deposit. With the RBI prone to enhance the repo price additional, a floating price FD will supply extra returns to depositors. It additionally shields one’s investments from the directionality of future rates of interest and inflation. Sure Financial institution, on June 21, launched a floating price FD linked to the repo price.

[ad_2]

Source link