[ad_1]

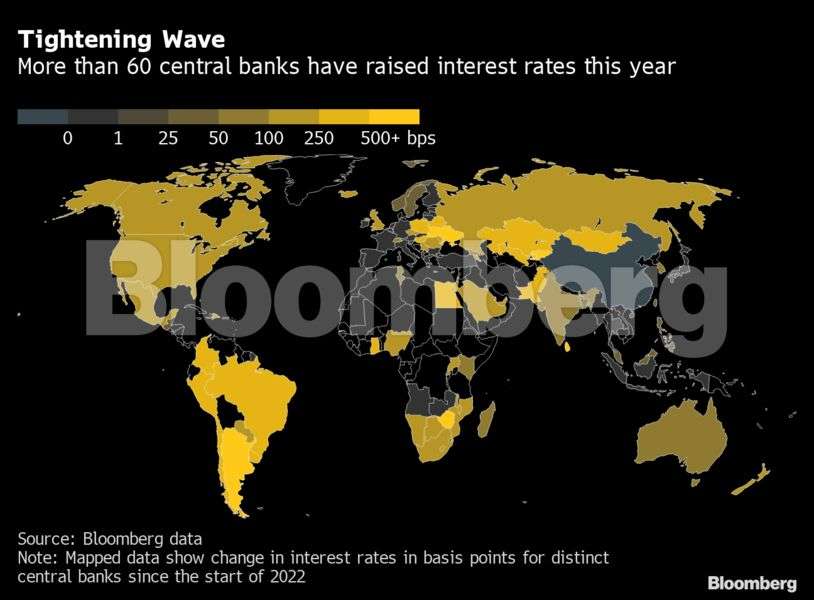

The Federal Reserve led a number of worldwide central banks this week in ratcheting up financial coverage tightening efforts geared toward turning again an inflationary wave that dangers steam-rolling the world economic system.

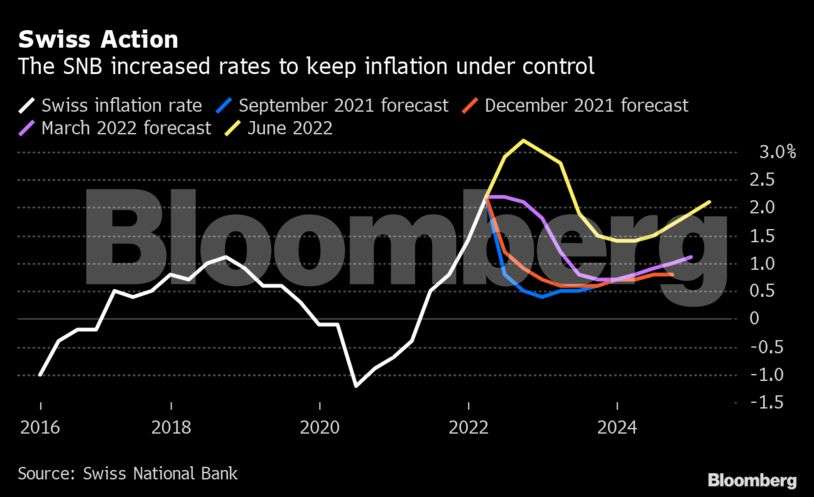

The Fed’s greatest price enhance since Alan Greenspan headed the US central financial institution was adopted by the Swiss Nationwide Financial institution’s stunning hike. The

Financial institution of England additionally tightened, whereas indicating it’s open to larger changes if wanted.

Listed below are a few of the charts that appeared on Bloomberg this week on the newest developments within the world economic system:

World

The Fed raised its benchmark rate of interest by 75 foundation factors, prompting some financial authorities similar to these in Bahrain and the United Arab Emirates to maneuver on the identical tempo. The Swiss Nationwide Financial institution unexpectedly elevated its benchmark for the primary time since 2007, becoming a member of greater than 50 different central banks this yr in mountaineering charges by a half share level in a single transfer.

US

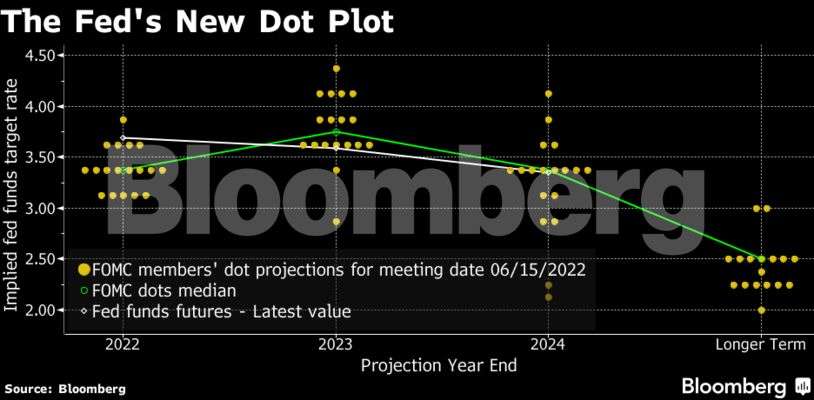

Fed Chair Jerome Powell engineered the central financial institution’s greatest interest-rate enhance since 1994 and held out the distinct risk of one other jumbo three-quarter share level enhance in July. Coverage makers are projecting a steep rise in rates of interest in coming months. They now see the federal funds price they management rising to three.4% by the top of this yr and three.8% on the finish of 2023.

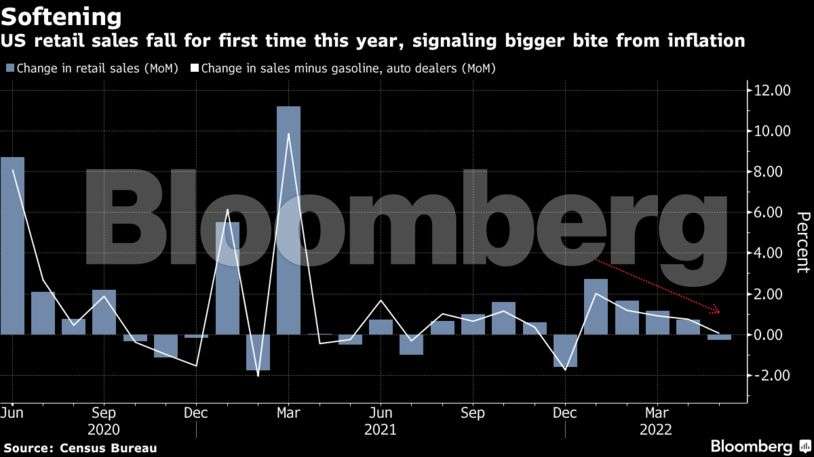

Retail gross sales fell in Could for the primary time in 5 months, restrained by a plunge in auto purchases and different big-ticket objects, suggesting moderating demand for items amid decades-high inflation.

Europe

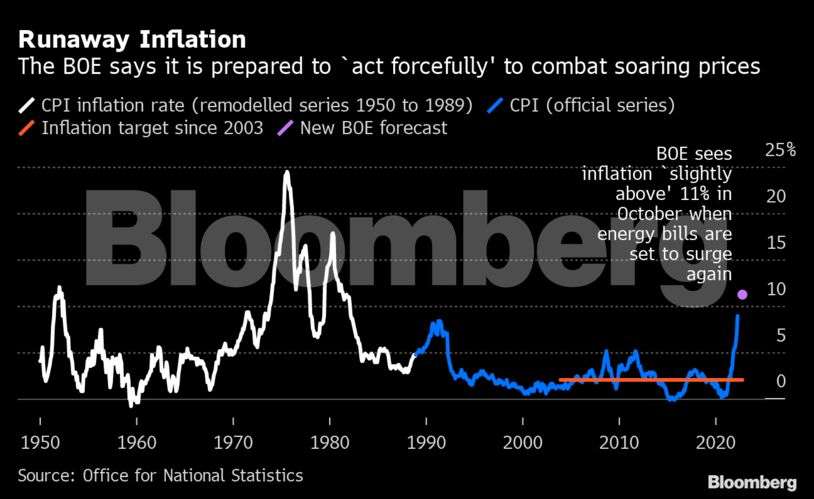

The Financial institution of England raised rates of interest for a fifth straight assembly and despatched its strongest sign but that it’s ready to unleash bigger strikes if wanted to tame inflation.

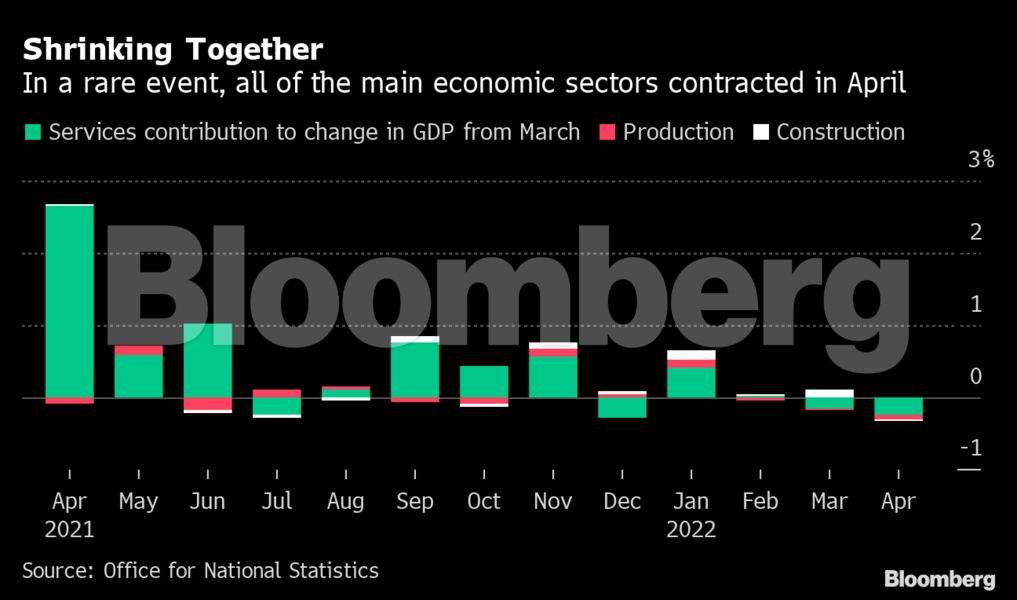

The UK economic system shrank in April on the sharpest tempo in additional than a yr, highlighting dangers {that a} broader contraction is below approach. The figures underscore a dimming outlook for the economic system, with manufacturing, providers and development all contracting collectively for the primary time since January 2021.

Asia

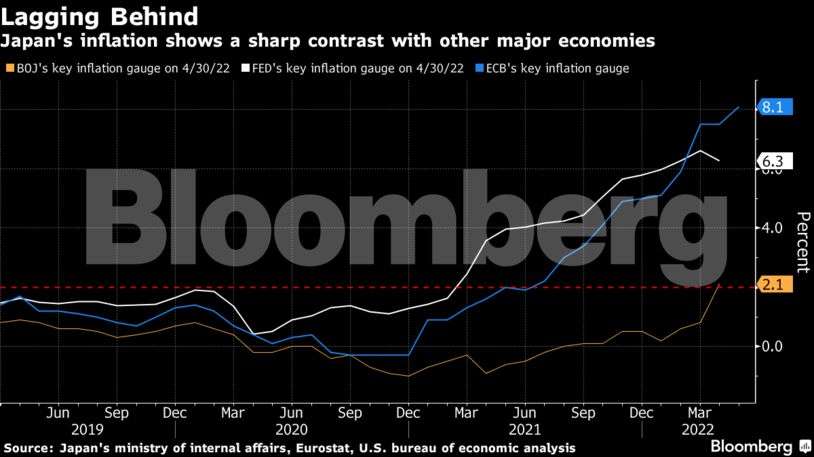

Financial institution of Japan Governor Haruhiko Kuroda held agency with rock-bottom rates of interest, defying an intensifying world wave of central financial institution tightening and concentrated market stress on the yen and authorities bonds.

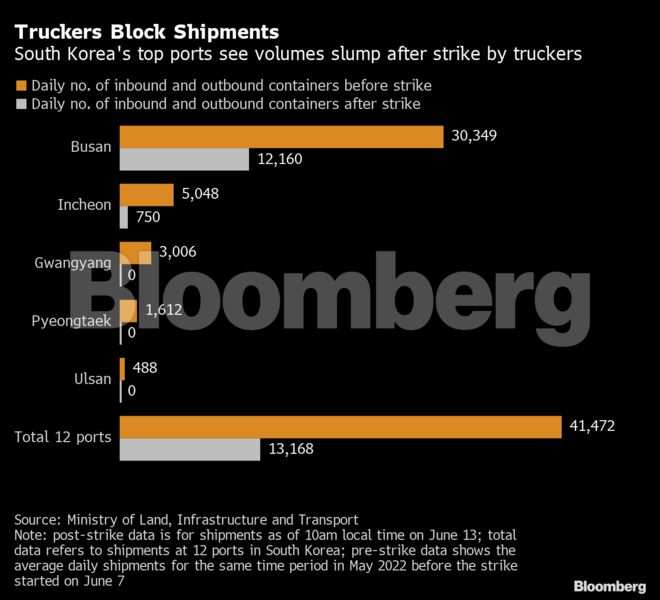

The danger to South Korea’s economic system and world provide chains is rising as a nationwide trucker strike widens, curbing output at high steelmaker Posco and inflicting growing harm to the petrochemicals sector.

India’s wholesale inflation accelerated for a 3rd straight month as excessive commodity costs and provide chain disruptions continued to stoke enter prices for producers.

Rising Markets

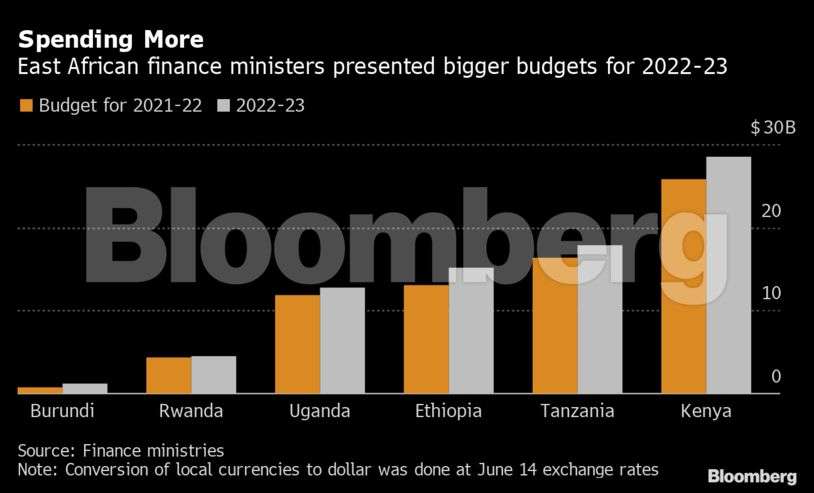

East African finance chiefs elevated spending plans to a report to maintain financial development as they struggle to deal with the fallout from Russia’s battle in Ukraine. Challenges they face on account of the battle and home points, together with extended drought and political disruptions, vary from heavier debt burdens to mounting inflationary pressures and weakening currencies.

—With help from Philip Aldrick, Andrew Atkinson, Vrishti Beniwal, Allegra Catelli, Libby Cherry, Toru Fujioka, David Goodman, Sam Kim, Heesu Lee, Wealthy Miller, Chikako Mogi, Ana Monteiro, Fumbuka Ng’wanakilala, Fred Ojambo and Olivia Rockeman.

[ad_2]

Source link