[ad_1]

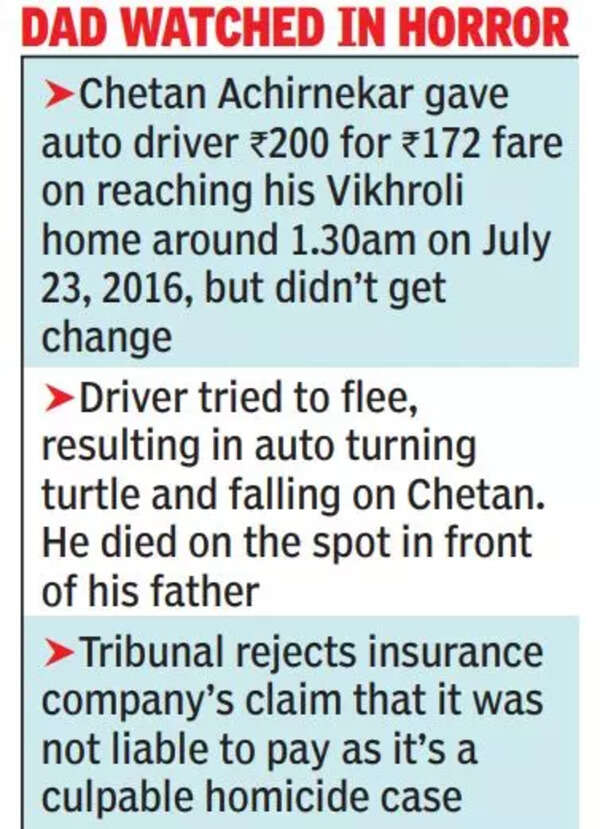

The sufferer, Chetan Achirnekar, had handed Rs 200 for a Rs 172 fare and when he insisted on the change, the auto driver tried to hurry off with out paying, inflicting the automobile to topple over him. Chetan died on the spot whilst his father watched in horror.

The Motor Accident Claims Tribunal refuted the defence of Future Generali India Insurance coverage Co Ltd that since this was a culpable murder case, they weren’t liable. The tribunal famous the demise certificates and autopsy report confirmed Chetan died because of accidents sustained in a motorized vehicle accident.

“The style wherein the accident occurred clearly reveals that the autorickshaw driver was rash, negligent and answerable for the accident,” mentioned the tribunal.

Calculating the compensation to be paid to Chetan’s familyparents Ganpat and Sneha Achirnekar and youthful brother Omkar Achirnekar, the tribunal additionally thought-about the sufferer’s month-to-month wage of Rs 15,000. On the time of his demise, Chetan was working in a software program agency.

The compensation should be paid collectively by the insurance coverage firm and the proprietor of the autorickshaw Kamlesh Mishra.

The household mentioned on July 23, 2016, at about 1.30am, Chetan was getting back from the airport to their residence at Vikhroli East by autorickshaw. When he got here near his residence, he paid Rs 200 to the motive force.

The motive force refused handy over the change claiming he didn’t have it and began the automobile. Chetan requested the motive force to cease. As a substitute, he tried to hurry. Because of this, the auto turned turtle and fell on Chetan who suffered deadly accidents.

The matter was reported to police. The household mentioned because of Chetan’s demise they suffered each emotionally and financially.

The automobile proprietor didn’t seem earlier than the tribunal and an ex parte order was handed in opposition to him. Amongst arguments made to disclaim legal responsibility within the declare, the insurance coverage firm submitted on the time of the incident, the auto driver didn’t maintain a sound driving licence.

The tribunal mentioned to substantiate this declare, the insurance coverage firm had not adduced any proof.

[ad_2]

Source link