[ad_1]

UK economic system shrank by 0.3% in April

Breaking: The UK economic system shrank in April, for the second month operating.

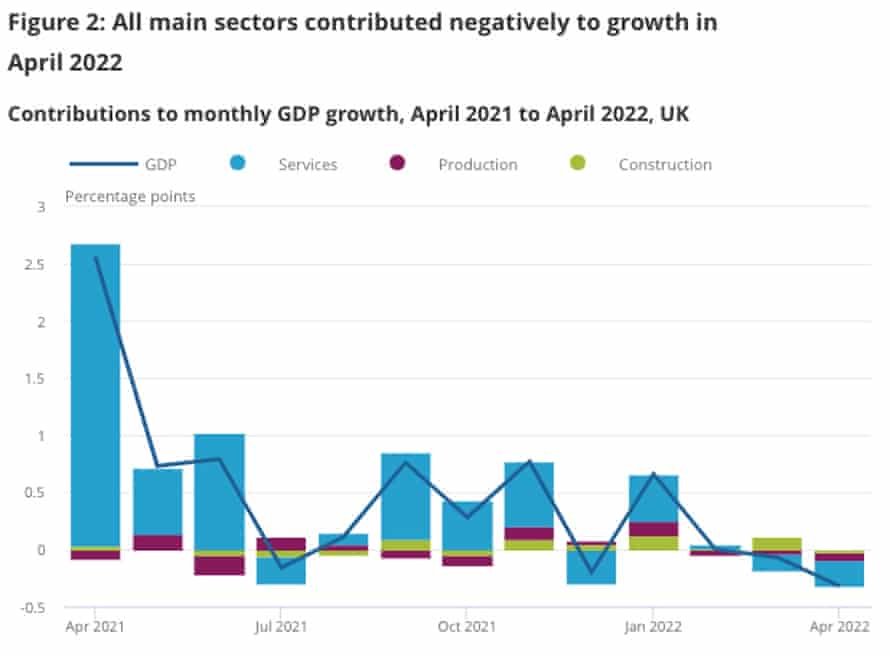

GDP declined by 0.3% in April, including to the 0.1% drop in March — with companies, manufacturing and development all shrinking in April.

The Workplace for Nationwide Statistics studies that the discount in NHS Check and Hint exercise weighed on the economic system, whereas provide chain issues hit factories.

The ONS says:

- Providers fell by 0.3% in April 2022 and these had been the primary contributors to April’s fall in GDP, reflecting a big lower (5.6%) in human well being and social work, the place there was a major discount in NHS Check and Hint exercise.

- Manufacturing fell by 0.6% in April 2022, pushed by a fall in manufacturing of 1.0% on the month, as companies proceed to report the affect of worth will increase and provide chain shortages.

- Development additionally fell by 0.4% in April 2022, following sturdy development in March 2022 when there was vital restore and upkeep exercise following the storms skilled within the latter half of February 2022.

- That is the primary time that each one major sectors have contributed negatively to a month-to-month GDP estimate since January 2021.

UK Month-to-month GDP M/M (Apr) act: -0.3%, exp: 0.1%, prev: -0.1%

UK Month-to-month GDP 3M/3M (Apr) act: 0.2%, exp: 0.4%, prev: 0.8%

— Michael Hewson 🇬🇧 (@mhewson_CMC) June 13, 2022

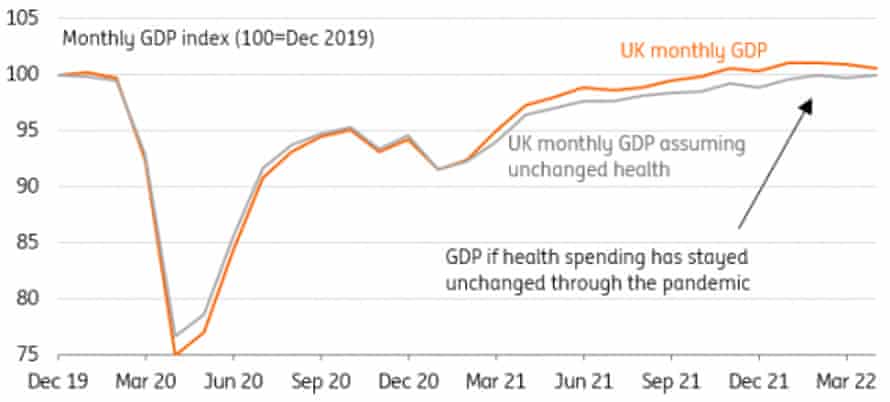

The ending of free Covid-19 exams means April’s UK GDP figures had been all the time going to look “worse than actuality”, says James Smith of ING.

However… that pandemic spending additionally gave GDP an ‘synthetic’ enhance in earlier months, making the economic system look stronger.

Smith explains:

Free Covid-19 testing stopped the earlier month and in line with the ONS that meant there was a 70% fall in take a look at and hint exercise. Pandemic-related well being spending shaved a full 0.5 share factors off GDP development in April.

And if we strip that out, the headline 0.3% decline in month-to-month GDP ought to even have been marginally into development territory.

In brief, simply as health-related spending gave the extent of GDP a man-made enhance final 12 months, serving to the economic system seem to get well to pre-virus ranges extra rapidly than it truly had, these classes at the moment are making the image look superficially worse.

Chancellor Rishi Sunak says the UK not alone in seeing a slowdown….

“Nations world wide are seeing slowing development, and the UK shouldn’t be immune from these challenges.

“I wish to reassure folks, we’re absolutely targeted on rising the economic system to deal with the price of dwelling in the long run, whereas supporting households and companies with the quick pressures they’re dealing with.”

It’s true that the US economic system, and France, each contracted within the first quarter of this 12 months.

However… the OECD has forecast that Britain would be the slowest-growing G7 economic system in 2023, hit by greater rates of interest, greater taxes, diminished commerce and dearer power.

Setting Secretary George Eustice has conceded there are “some actual challenges forward” after the UK economic system shrank in April.

Eustice was requested on Sky Information whether or not it was time for the Authorities to “cease sustaining that that is the fastest-growing economic system within the G7” after GDP fell 0.3% in April.

He cited the restoration from the pandemic, and provide chain pressures as causes of the decline.

“We’ve identified for a while this was going to be a problem.

“We’ve obtained unemployment that’s at document lows, the bottom it’s been since 1974, however in fact there are some actual challenges forward and these GDP figures are a reminder of these challenges.”

The NHS Check and Hint and COVID-19 vaccination programme detracted 0.5 share factors from GDP development in April 2022, the ONS explains:

This was pushed by additional falls in NHS Check and Hint numbers, which fell by 70%, reflecting the modifications to the COVID-19 testing coverage in England from April.

The vaccination programmes grew by 71% on the month on account of the spring booster marketing campaign.

BUT – GDP would’ve grown 0.1% had been it not for the winding down of Check & Hint

— Andy Bruce (@BruceReuters) June 13, 2022

April’s UK GDP report is weaker than forecast, factors out Andy Bruce of Reuters…

Economist Jumana Saleheen agrees it’s a damaging shock:

UK month-to-month GDP knowledge out this morning exhibits the economic system contracted in *April*

GDP -0.3% m/m

IP -0.6% m/mAnalysts anticipated a small contraction (given the weak spot in main indicators such because the PMIs). However they obtained a damaging shock immediately. pic.twitter.com/wfGyylPaZL

— Jumana Saleheen (@JumanaSaleheen) June 13, 2022

This chart exhibits how UK companies, manufacturing and development all contracted in April – the primary time that’s occurred in the identical month because the Covid-19 lockdown of January 2021.

Labour: Drop in GDP is ‘actually worrying’

Labour’s shadow chancellor, Rachel Reeves, tweets that the 0.3% fall in GDP in April is ‘actually worrying’:

NEW: GDP figures present UK economic system shrank by 0.3% in April.

Actually worrying.

As an alternative of addressing structural weaknesses, all of the Tories have are sticking plasters.

Labour will create a stronger, safer economic system – by boosting our power, provide chain and enterprise safety.

— Rachel Reeves (@RachelReevesMP) June 13, 2022

The TUC agrees:

GDP figures significantly worrying.

April present 0.3% decline on the month, following 0.1% decline in March.

ONS warn:

“That is the primary time that each one major sectors [manufacturing, construction and services] have contributed negatively to a month-to-month GDP estimate since January 2021”. pic.twitter.com/2hY1rnuxiV— TUC Economics and Social Affairs (@TUCeconomics) June 13, 2022

KPMG: Fall in output unlikely to be short-lived

April’s fall in GDP exhibits the UK economic system might shrink within the present quarter – placing it on the point of recession.

Yael Selfin, chief economist at KPMG UK, says:

“The general outlook stays downbeat because the squeeze on client earnings is predicted to weaken demand, and exterior headwinds intensify as a result of deteriorating outlook among the many UK’s major buying and selling companions.

“The remainder of Q2 might see an extra fall in GDP owing to the weakening momentum and the affect of the prolonged financial institution vacation.

“UK GDP fell by 0.3% in April, partially because of a fall in Covid associated well being spending but additionally as a result of additional provide chain disruptions and weakening demand.”

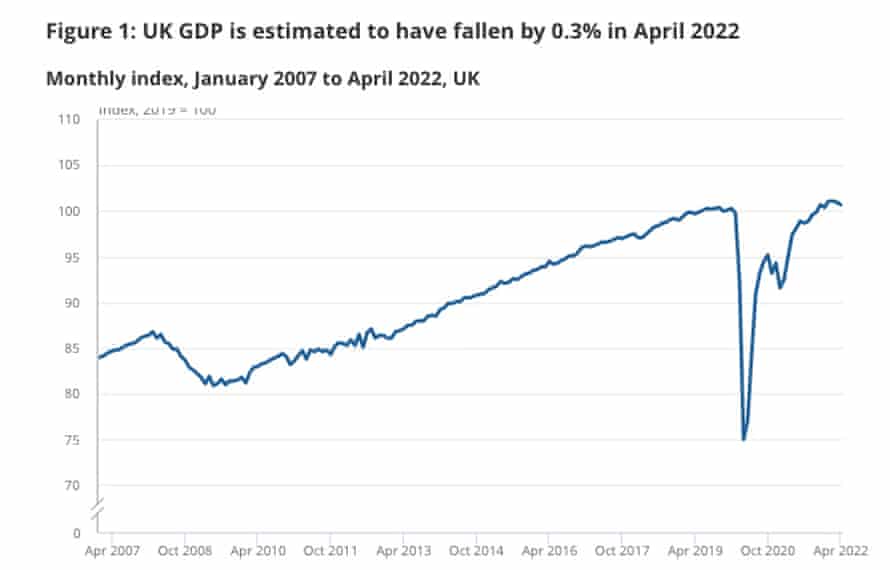

April’s contraction means the UK economic system is now solely 0.9% bigger than earlier than the primary Covid-19 lockdown in spring 2020, as this chart exhibits:

Darren Morgan, director of financial statistics on the ONS, explains that the winding down on take a look at and hint, and surging enterprise prices, led the economic system to shrink in April:

“A giant drop within the well being sector as a result of winding down of the take a look at and hint scheme pushed the UK economic system into damaging territory in April.

“Manufacturing additionally suffered with some firms telling us they had been being affected by rising gasoline and power costs.

“These had been partially offset by development in automotive gross sales, which recovered from a considerably weaker than normal March.”

UK economic system shrank by 0.3% in April

Breaking: The UK economic system shrank in April, for the second month operating.

GDP declined by 0.3% in April, including to the 0.1% drop in March — with companies, manufacturing and development all shrinking in April.

The Workplace for Nationwide Statistics studies that the discount in NHS Check and Hint exercise weighed on the economic system, whereas provide chain issues hit factories.

The ONS says:

- Providers fell by 0.3% in April 2022 and these had been the primary contributors to April’s fall in GDP, reflecting a big lower (5.6%) in human well being and social work, the place there was a major discount in NHS Check and Hint exercise.

- Manufacturing fell by 0.6% in April 2022, pushed by a fall in manufacturing of 1.0% on the month, as companies proceed to report the affect of worth will increase and provide chain shortages.

- Development additionally fell by 0.4% in April 2022, following sturdy development in March 2022 when there was vital restore and upkeep exercise following the storms skilled within the latter half of February 2022.

- That is the primary time that each one major sectors have contributed negatively to a month-to-month GDP estimate since January 2021.

UK Month-to-month GDP M/M (Apr) act: -0.3%, exp: 0.1%, prev: -0.1%

UK Month-to-month GDP 3M/3M (Apr) act: 0.2%, exp: 0.4%, prev: 0.8%

— Michael Hewson 🇬🇧 (@mhewson_CMC) June 13, 2022

The price-of-living disaster has dragged enterprise optimism to its lowest level in additional than a 12 months, accountancy agency BDO studies this morning.

BDO’s optimism index has fallen by 4.82 factors to 101.93, the second consecutive month of decline, as bosses fear about continued inflationary strain and provide chain disruption within the months forward.

BDO associate Kaley Crossthwaite stated:

“The truth that enterprise optimism is now on the identical stage it was greater than a 12 months in the past whereas the nation was nonetheless experiencing coronavirus restrictions paints a worrying image for the UK economic system.

“Weakened client spending energy is undoubtedly weighing closely on companies and can proceed to curtail development within the months forward.”

CBI warns UK authorities over Northern Eire protocol

Richard Partington

The CBI has warned the federal government that its risk to override the Northern Eire protocol is forcing firms to assume once more about investing in Britain and dragging down the economic system.

Tony Danker, the director basic of the CBI, stated reaching a deal was in the most effective pursuits of the British economic system as companies and households wrestle with the hovering price of dwelling and looming threat of recession.

“I don’t assume it’s time for grandstanding; I believe it’s time to do a deal. I’m firmly of the view the Europeans are being rigid. On the identical time, our measures – which can come on Monday – to take unilateral motion in response are unhelpful.”

The pinnacle of the foyer group, which represents 190,000 firms throughout the UK, stated renewed Brexit uncertainty triggered by the protocol dispute was hurting the British economic system, and main some firms to not put money into the UK.

Laws giving ministers energy to override elements of the Northern Eire Protocol is because of be printed within the Home of Commons on Monday afternoon.

Introduction: UK GDP report due, as CBI warns of recession dangers

Good morning, and welcome to our rolling protection of enterprise, the world economic system and the monetary markets.

We’re about to get a brand new healthcheck on the UK economic system this morning as April’s GDP report is launched.

The info, due at 7am BST, comes amid considerations that Britain may very well be heading in the direction of recession, as the price of dwelling disaster hits households and companies.

Analysts worry the report will present a weak economic system.

Alvin Tan of RBC Capital Markets units the scene:

The UK April GDP launch immediately will seize the direct output affect of the ending of the UK’s Covid test-and-trace programme. We expect that it will subtract round 0.6ppts from m/m GDP development in April.

Even permitting for some development in personal sector exercise, we nonetheless see month-to-month GDP development of -0.4%. We at present see GDP development flat for Q2 as a complete, however a larger-than-expected contraction in April can be tough to claw again in subsequent months given the June holidays.

And right here’s Michael Hewson of CMC Markets:

The most recent GDP numbers for April are anticipated to indicate a weak economic system, battered by the massive soar in power costs, with the index of companies forecast to develop by 0.1%, after declining -0.2% in March.

The headline month-to-month quantity, which confirmed a fall of -0.1% in March, will probably be fortunate if we present any development in any respect in April, whereas on a three-monthly foundation we will anticipate to see a decline from 0.8% to 0.4%.

The CBI, which represents British companies, is immediately calling for the federal government to get a grip on the economic system, warning that UK households will fall right into a recession this 12 months.

It has downgraded its GDP development forecasts to three.7% in 2022 (from 5.1% beforehand) and 1.0% in 2023 (from 3.0% beforehand).

It additionally fears family spending will shrink subsequent 12 months amid dented enterprise and client confidence.

Director basic Tony Danker stated the Prime Minister and Chancellor needed to take urgeng motion to assist development, together with supporting enterprise funding and tackling labour shortages in industries comparable to aviation.

Let me be clear – we’re anticipating the economic system to be just about stagnant. It received’t take a lot to tip us right into a recession. And even when we don’t, it’s going to really feel like one for too many individuals.

“Instances are robust for companies coping with rising prices, and for folks on decrease incomes involved about paying payments and placing meals on the desk.

Wider recession fears are additionally roiling markets, after the US inflation price hit a brand new 40-year excessive of 8.6% on Friday.

That despatched shares reeling in Europe and on Wall Road on the finish of final week, and Asia-Pacific markets have adopted – with Japan’s Nikkei sliding nearly 3%.

European inventory markets are set for additional losses immediately:

The agenda

- 7am BST: UK GDP report for April

- 7am BST: UK stability of commerce for April

- 11am BST: NIESR’s month-to-month GDP tracker for Could

- 1pm BST: India’s inflation price for Could

[ad_2]

Source link