[ad_1]

Public satisfaction with how the Financial institution of England is tackling inflation fell to the bottom on file as most Britons anticipate costs to proceed to rise steeply over the subsequent 5 years, in response to official knowledge revealed on Friday.

In Might, 28 per cent of the UK inhabitants was dissatisfied with how the central financial institution was dealing with inflation, its personal survey discovered. In April, UK client value progress soared to a 40-year excessive of 9 per cent, the very best among the many G7 nations.

With 25 per cent happy with the BoE’s efficiency, internet satisfaction dropped to minus 3 per cent, down from 6 per cent when the query was final requested in February, and the bottom since data started greater than 20 years in the past.

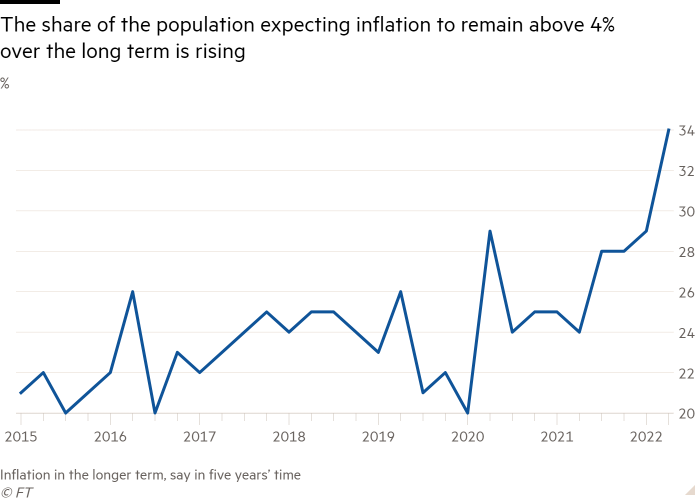

The BoE figures additionally confirmed that 59 per cent of the UK inhabitants anticipated inflation to stay above 2 per cent over the long run, with greater than one-third anticipating longer-term inflation to be above 4 per cent. That is the very best proportion since data started in 2009.

Adrian Lowery, monetary analyst at investing platform Bestinvest, stated the info meant that “folks don’t imagine the Financial institution of England will achieve its forecast of bringing inflation again right down to its 2 per cent goal in a few years”.

The findings additionally present an indicator of how entrenched inflation may change into, including to the case for an extra rate of interest rise on the BoE financial coverage assembly subsequent week. Markets anticipate the central financial institution to lift charges for the fifth consecutive time, by 25 foundation factors.

It’s because elevated inflation expectations amongst employees can gasoline larger wage calls for and due to this fact doubtlessly worsen the inflationary spiral, particularly in a decent labour market. Excessive inflation has already resulted in transport employees saying strikes and public sector unions threatening motion.

The BoE stated it was unable to remark as a result of it was in its “quiet interval” forward of the MPC choice. Final month, nonetheless, governor Andrew Bailey instructed MPs he was unable to cease inflation reaching double digits this 12 months. “To forecast 10 per cent inflation and to say there isn’t lots we are able to do about it’s an especially troublesome place to be,” he stated. “This can be a unhealthy scenario to be in.”

Separate figures revealed on Friday confirmed that the overwhelming majority of customers are apprehensive about the price of dwelling disaster, leading to spending cuts and better ranges of hysteria and decrease wellbeing.

Within the month to Might 22, 77 per cent of the UK inhabitants reported feeling very or considerably apprehensive concerning the rising prices of dwelling, in response to knowledge revealed by the Workplace for Nationwide Statistics on Friday.

The proportion rises to 90 per cent for folks with younger youngsters, with comparable shares reported amongst ethnic minorities and home renters.

Folks apprehensive about the price of dwelling disaster reported a lot larger ranges of hysteria and usually decrease wellbeing, together with decrease happiness, life satisfaction and feeling that life is worth it.

Practically two in three folks stated they had been chopping again on non-essentials and two in 5 stated they spent much less on meals, the ONS knowledge confirmed.

One other 40 per cent had lowered non-essential journeys and the vast majority of the inhabitants stated they had been utilizing much less gasoline and electrical energy at house.

This reinforces expectations of a brand new financial slowdown as forecast by the OECD, which this week slashed its UK progress forecast for 2023 to zero, the bottom within the G20 excluding Russia. Official knowledge to be launched on Monday are anticipated to point out that the economic system barely grew in April, after stagnating in February and March.

[ad_2]

Source link