[ad_1]

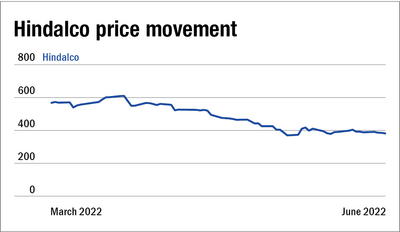

Indian aluminum main Hindalco Industries, which is part of the well-known Aditya Birla Group has fallen greater than 30 per cent over the last three months. From being near a 52-week excessive, it has come near its 52-week low.

Whereas the final volatility out there can be a cause, there are a few different the explanation why the shares took a toll.

Disappointing outcomes from Novelis

Whereas Hindalco’s total EBITDA (earnings earlier than curiosity tax depreciation and amortisation) elevated, its subsidiary Novelis posted an adjusted EBITDA of $431 million (Rs 3,247 crore) within the Q4FY22 in comparison with $505 million (Rs 3,705 crore) in Q4FY21, a 15 per cent year-over-year lower. Adjusted EBITDA per ton too decreased by 15 per cent yr over yr from $514 in Q4FY21 to $437 in Q4FY22. The online revenue of Novelis elevated by 21 per cent primarily on account of a fall in curiosity expense. The market was additionally a bit involved as Novelis has introduced a $3.4 billion capex which will likely be commissioned from FY26, which can even have an effect on the corporate’s free money flows.

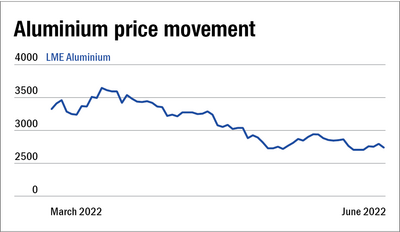

Falling aluminum costs

A serious cause for Hindalco’s constant improve in income and earnings through the yr was rising aluminum costs which resulted in the next realisation. But it surely looks like issues are coming to an finish in that angle as aluminum costs have been falling sharply within the final three months thereby returning to normalcy. The following quarter or Q4FY23 quarter might face the strain of a excessive base in Q4FY22. Falling aluminum costs might make it troublesome for the corporate to maintain the identical ranges of income and earnings.

Additionally learn:

Good instances within the inventory market

NTPC shares on a dream run

ONGC trumps Tata Metal and TCS

[ad_2]

Source link