[ad_1]

This text is an on-site model of our Europe Categorical e-newsletter. Join right here to get the e-newsletter despatched straight to your inbox each weekday and Saturday morning

Good morning and welcome to Europe Categorical.

The European Central Financial institution’s governing council’s assembly in Amsterdam is anticipated to take the primary steps in direction of ending its unfavourable rate of interest coverage and cease its bond buying programme. We’ll dive into 4 issues to look out for when Christine Lagarde speaks to the press this afternoon.

In the meantime, the bloc’s local weather agenda suffered a setback yesterday when the European parliament voted to weaken a number of the draft legal guidelines arising for talks with EU governments and the European Fee (although it maintained a full ban on CO₂-emitting vehicles as of 2035). We’ll hear from inner market commissioner Thierry Breton, who expressed disappointment on the improvement.

Finish of an period

Christine Lagarde will name time on the eurozone’s period of ultra-cheap cash later right now when the European Central Financial institution president is anticipated to stipulate plans to cease shopping for extra bonds and to begin elevating rates of interest subsequent month, writes Martin Arnold in Amsterdam.

A lot of the ECB’s 25 governing council members agree on the necessity to elevate borrowing prices after inflation hit a eurozone report of 8.1 per cent in Could — double the earlier all-time excessive and quadruple the central financial institution’s goal.

Nevertheless, deep divisions stay over how briskly and the way far it ought to elevate charges to convey inflation again underneath management. As ECB rate-setters meet in Amsterdam this week to debate its subsequent transfer, listed below are 4 issues to observe for:

-

Rates of interest:

With the ECB already lagging behind the US Federal Reserve and Financial institution of England, the important thing query for traders is whether or not it should elevate charges by 1 / 4 share level or a half when it meets once more on July 21. Lagarde is anticipated to go away the door open to a much bigger rise, whereas persevering with to sign a desire for beginning in a extra “gradual” method with 25 foundation factors.

No matter Lagarde says concerning the dimension of the ECB’s first price rise since 2011 might be carefully watched by traders, with any trace of a extra aggressive transfer risking a bond market sell-off. “If the ECB comes out extra hawkish than anticipated, this might spook market contributors,” stated Allianz economists.

-

Bond purchases:

Lagarde has already stated the ECB will cease its remaining €20bn-a-month asset purchases early subsequent month — fulfilling a key situation to begin elevating charges. Some ECB governing council members need it to cease shopping for extra bonds instantly, however they don’t seem to be positive it will occur.

One other key query is how lengthy the ECB will proceed reinvesting the proceeds of maturing bonds. The Fed has already stopped this — shrinking its stability sheet within the course of — however the ECB has stated it should proceed “for so long as vital to keep up beneficial liquidity situations and an ample diploma of financial lodging”. Frederik Ducrozet, head of macroeconomic analysis at Pictet Wealth Administration, stated this “can hardly be justified any extra”, elevating the query of how for much longer it should final.

-

New instrument:

The extra necessary query for traders is what the ECB will say about its plans for coping with the danger of a bond market panic as soon as it begins elevating charges. The distinction — or unfold — between what Germany and Italy every pay to borrow for 10 years has already risen to its highest since bond markets fell in the beginning of the pandemic in 2020.

Lagarde has stated “if vital we will design and deploy new devices to safe financial coverage transmission”, which is anticipated to imply shopping for the bonds of extremely indebted southern European international locations to sort out any sudden surge in borrowing prices that threatens to set off a debt disaster. A number of rate-setters help including the same dedication to the coverage assertion it publishes on Thursday with out giving extra element on the mechanics.

-

Forecasts:

There’s broad consensus amongst economists that the ECB will slash its progress forecasts and lift them for inflation over the subsequent three years. Underlining how badly it has underestimated current worth pressures, Berenberg chief economist Holger Schmieding predicted the ECB would elevate its 2022 inflation forecast by nearly 2 share factors for the second consecutive quarter, taking it as much as 7 per cent.

Traders will even be monitoring whether or not Lagarde places extra emphasis on the upside dangers to inflation or the draw back dangers to progress. The previous might be a hawkish sign that charges might have to rise greater than traders count on, whereas the latter will ship a extra dovish message.

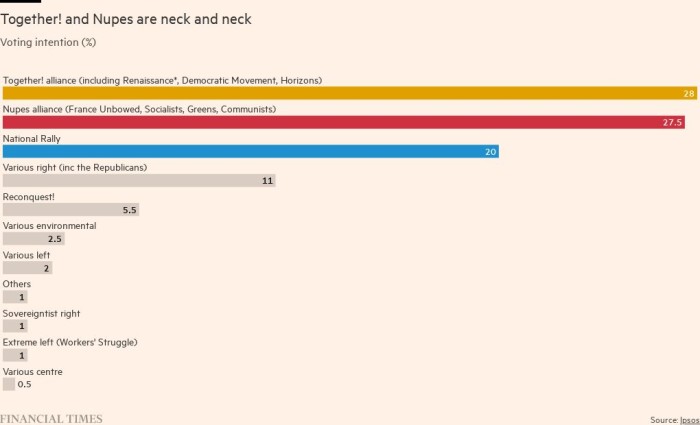

Chart du jour: Left-field problem

Emmanuel Macron’s former far-left challenger within the presidential elections, Jean-Luc Mélenchon, has taken benefit of public disillusionment with conventional politics to forge a leftwing alliance that might win a big share of seats on this month’s Nationwide Meeting elections and upset Macron’s legislative agenda.

Weakened hand

Trade commissioner Thierry Breton was among the many first to answer the frustration because the European parliament weakened its personal place forward of forthcoming negotiations on laws that goals to convey down the bloc’s carbon emissions by 55 per cent by 2030, writes Andy Bounds in Brussels.

The principle piece of laws the parliament seeks to water down is on extending a present system that makes heavy industrial polluters pay for his or her carbon emissions. The European Fee had proposed extending that system to cowl industrial and personal actual property, in a bid to speed up efforts to extend power effectivity in buildings.

However given the present pressures from rising inflation and report excessive power costs, the parliament yesterday voted to exclude housing from the emission buying and selling system (ETS).

MEPs additionally failed to succeed in settlement on the introduction of a carbon border tax — designed to cost importers to the EU for his or her emissions — and the institution of a social local weather fund supposed to minimise the consequences of carbon pricing on poorer households.

The French commissioner informed reporters he additionally had “some reservations” on the extension of the ETS to housing (keep in mind the gilets jaunes motion sparked by a climate-related gasoline tax?). However ultimately, Breton stated, he supported the fee’s proposal as a result of “the inexperienced deal is extraordinarily necessary”.

Whereas the parliament accredited a complete ban on inner combustion engines from 2035 onwards, Breton hinted at potential compromises down the highway, on condition that 600,000 jobs within the sector had been at stake. Additionally, Breton pointed to the truth that different components of the world would proceed to purchase combustion engines.

“Europe ought to proceed to supply some key parts for thermal engines you’ll promote exterior of Europe. This can be very necessary to assist the ecosystem to transition in a easy method,” he stated.

Breton additionally repeated his name on Europe to safe the important minerals to fabricate batteries, photo voltaic panels and wind generators, together with by mining them at house. He’ll produce a proposal after the summer time break. “It’s extra vital than ever.” In some instances, reminiscent of magnesium, the EU is nearly solely reliant on China. “We’d like 15 instances as a lot lithium by 2030,” he stated.

What to observe right now

-

ECB governing council meets in Amsterdam

-

Justice ministers and, individually, inner market ministers meet in Luxembourg

Notable, Quotable

-

Merkel backlash: Former German chancellor Angela Merkel has spoken publicly concerning the warfare in Ukraine for the primary time since she left workplace, defending her Russia stance in statements that prompted a fierce response from Ukrainian officers.

-

Regrets, however not sorry: Throughout his first journey to Kinshasa, Belgium’s King Philippe has expressed “deepest regrets for the injuries of the previous” however avoided a proper apology for his nation’s many years of brutal colonial rule in what’s now the Democratic Republic of Congo.

Really helpful newsletters for you

Britain after Brexit — Maintain updated with the most recent developments because the UK economic system adjusts to life exterior the EU. Join right here

Inside Politics — Observe what you might want to know in UK politics. Join right here

Are you having fun with Europe Categorical? Join right here to have it delivered straight to your inbox each workday at 7am CET and on Saturdays at midday CET. Do inform us what you suppose, we love to listen to from you: europe.categorical@ft.com. Sustain with the most recent European tales @FT Europe

[ad_2]

Source link